Whether you’re a new landlord or a seasoned pro, you may be wondering, “What is a rent roll? Do I really need one?” Our experts compiled this guide to tell you everything you need to know.

Once you know the basics of a rent roll, it’s clear that this document is a must-have for any landlord serious about expanding their property’s income potential.

What Is a Rent Roll?

A rent roll is a record-keeping document that pulls data from multiple sources into one easy-to-read snapshot of monthly rental income from the residential or commercial properties you own. The document can be specific to one property or your entire portfolio if you own multiple properties.

This document keeps all your rental information in one easy-to-read, centralized place, saving you from scanning through multiple lease agreements each month. It also helps you maximize your rental income and increase the performance of your properties, making them a must-have for every landlord.

Because a rent roll should be a real-time view of your property, tenants, and rental income, you want to update it any time there are any changes at your property. For example, you should update the document as soon as a tenant moves out or you raise a tenant’s rent. It may be tempting to wait to edit it once a month, but you may miss important data, which can make it inaccurate and cause headaches later. Fortunately, this is easy if you use an online rent collection system.

Some people confuse a rent roll with a lease ledger. While they contain similar information, the main difference is the rent roll focuses on gross rental income and does not factor in any expenses you may have, like mortgage payments and utility bills. A lease ledger balances your gross income and your expenses to see your net income.

Both residential and commercial property landlords should have a rent roll. Commercial versions contain roughly the same information, although lease terms may be longer.

Who Uses a Rent Roll?

While you are the primary user of your rent roll, everyone from lenders, tax collectors, and potential buyers or investors may ask to see it. However, under no circumstances should tenants see this document as it holds private and secure information about your business.

How Landlords and Property Managers Use Rent Roll

As the landlord, you will use your rent roll regularly for various uses.

1: Manage Tenants

Once you’ve screened your tenants and they’ve signed a lease, add them to your rent roll. Because all lease information is in one place, you can quickly evaluate and make decisions regarding your tenants without having to skim all your lease documents. For example:

- Look ahead at lease end dates to proactively seek lease renewals or market soon-to-be-vacant apartments.

- Review security deposit amounts when a tenant moves out and you need to make repairs.

- Look for tenant turnover trends that may indicate a problem with the unit, your tenant screening process, or your management so you can address them quickly.

2: Track Your Rental Property’s Value

A rent roll functions as a snapshot of all income related to your rent, allowing you to see the value of your property easily.

- Track rental payments each month, especially prepaid and overdue rents, so you can easily see your current gross monthly and annual rental income.

- Compare your rental income month over month and year over year.

- Compare your monthly rent to the average rent in your area to determine if you need to negotiate a rent increase when tenants wish to renew their leases.

- Determine how much additional income you could make from raising the rents of your tenants or through improvements and renovations.

How Buyers and Investors Use Rent Roll

Besides you, buyers and investors are the most significant users of rent rolls. If you are looking to sell your rental property or add an investment partner, they will ask to see your rent roll, among other documents.

A potential buyer or investor is looking to invest in the property itself and the income that comes with the property through rent. Thus, they will be looking for a stable rent roll, which will reveal a stronger investment opportunity.

A potential buyer or investor will use the rent roll in a variety of ways.

1. Determine Financial Performance Formulas

There are a variety of calculations that potential investors use to determine whether your property is a sound investment. These include net operating income (NOI), internal rate of return (IRI), gross rent multiplier (GRM), and cap rate. For more information on what these terms mean as well as how to calculate the ROI on a property investment, visit here.

2. Verify Income

By comparing your rent roll to your profit and loss statements, a potential investor or buyer can feel more confident in both documents, making them more likely to purchase or invest.

3. Determine Whether You Have Been Charging Fair Market Rent

If the rent is too high, potential buyers or investors may be wary of investing due to a potential lowering of rates. If your rent is too low, they may see an opportunity to generate additional income by charging a higher rent, making the property more attractive. Learn how to accurately price your rental with our pricing guide.

4. Determine Tenant Stability

Buyers and investors want to see that your tenants are established renters (have been in the lease for at least three months) and responsible (pay their rent on time). Any tenant instability may be a sign of a poor investment.

4. Determine Whether Your Current Cash Flow Will Continue

Based on when the terms of your current leases are up, potential buyers or investors can see if the cash flow you are reporting on your rent roll and your profit and loss sheet will continue after they invest.

It’s not uncommon for investors or buyers to stipulate that you renew leases or find new tenants to replace those whose leases are expiring before they will proceed with a deal.

How Lenders Use Rent Roll

Most rental properties are self-sustaining through the rents you collect each month, but sometimes you may need to take out a loan to complete necessary repairs, renovations or other projects at your rental property. In that instance, a lender may ask to see your rent roll to determine your past, present, and future rental income so they can evaluate your eligibility for the loan.

How Tax Collectors Use Rent Roll

If you or your property management company are ever audited, the tax collector assigned to your case will probably ask for your rent roll to verify the income you report to the government. Not only does this document outline your income, but it also provides you with documentation of any potential taxes you may owe, such as the rental use tax.

How To Create a Rent Roll

Fortunately, rent rolls are relatively easy to create in any spreadsheet program or property management software.

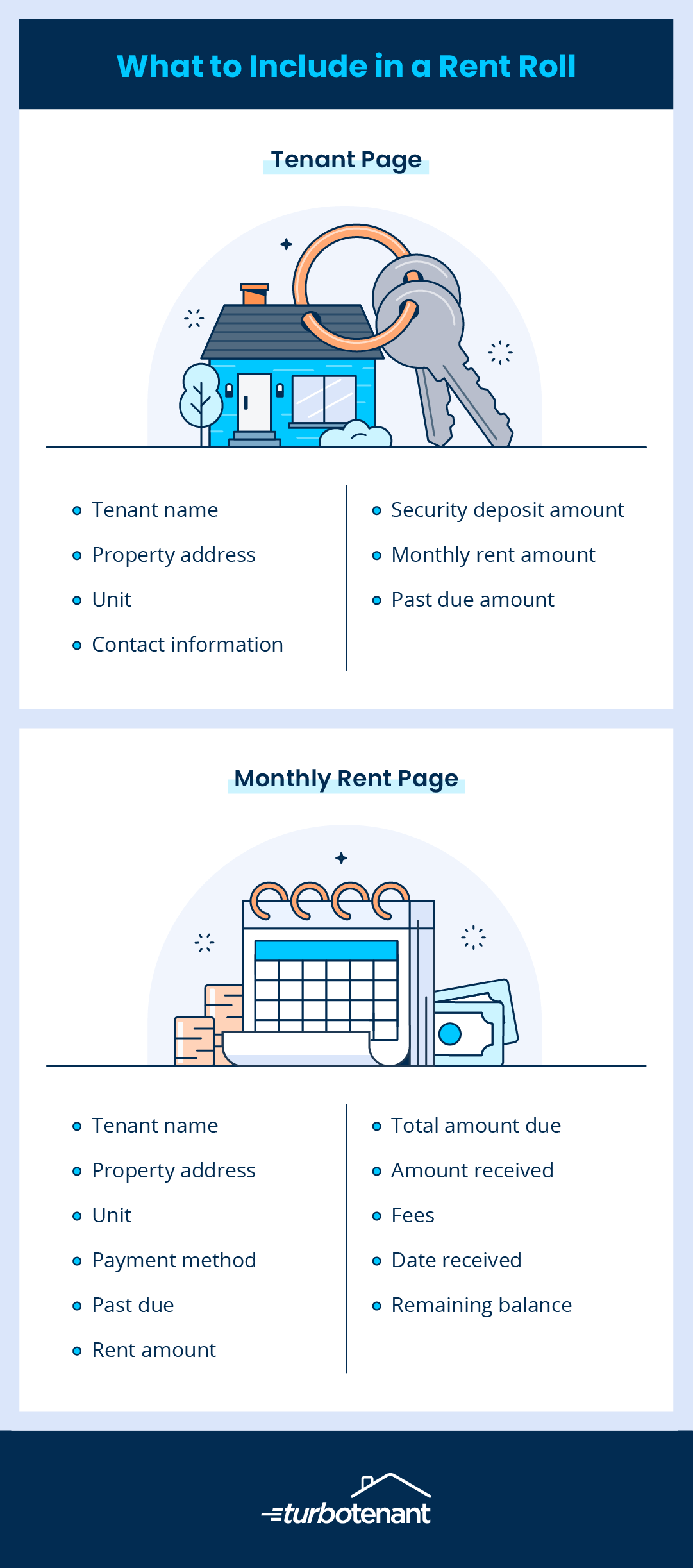

Components of a Rent Roll

While the specific components may vary based on your property and needs, a strong rent roll includes the following details:

- A tenant page listing:

- Tenant names

- Property address

- Unit

- Contact information

- Security deposit amount

- Monthly rent amount

- Past due amount

- A monthly rent page listing:

- Tenant name

- Property address

- Unit

- Payment method

- Past due

- Rent amount

- Fees

- Total amount due

- Amount received

- Date received

- Remaining balance

As you can see in the list, most of the information in the rent roll is information you already have, just condensed into one easy-to-reference document.

Where To Find Data for a Rent Roll

Rent rolls contain a lot of information, but fortunately, it comes from five key places, so everything you need is easy to track down.

- County tax assessor for property information

- MLS listing information for additional property information (if you recently purchased the property)

- Appraisal reports for detailed rental unit information

- Lease agreements for tenant information

- Profit and loss sheets for monthly and annual rental income totals

Once you’ve created the rent roll, you will only need to consult your lease agreements and your profit and loss sheets as you update it.

Rent Roll Template

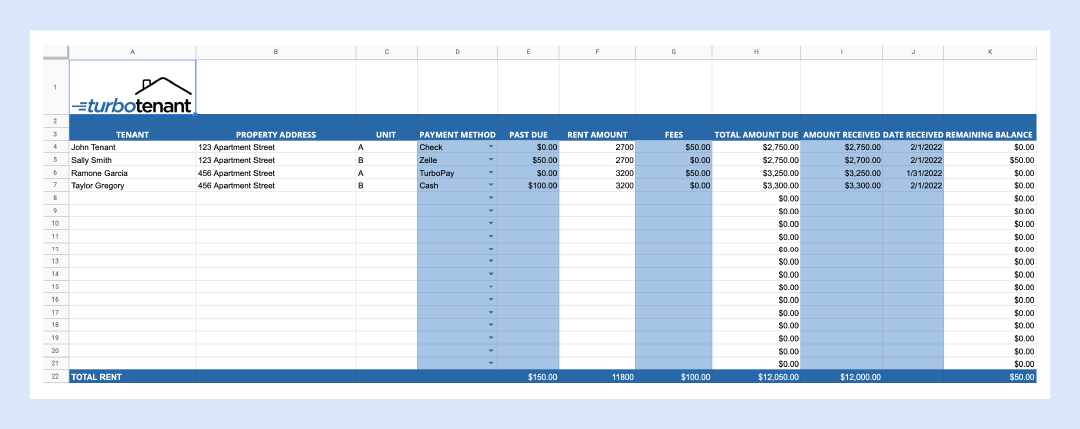

There are many different ways to format a rent roll, but the most important thing to keep in mind is that it should be easy to both update and understand.

You can create a rent roll using any spreadsheet software or property management program by labeling all the columns with the appropriate components.

For record-keeping purposes, make a new tab in your spreadsheet file for each month so comparisons are easy. Just make sure you update your monthly rent total and annual rent total as needed each month. It is often helpful to compare your rent rolls month over month and year over year to ensure strong management and income growth potential.

To get started, download our free monthly rent payment tracker so you can tailor the rent roll to each of your properties.

Rent Roll Example

The image below shows an example of a rent roll accurately filled out and updated. This is just one example; your format may vary slightly based on your rental property needs.

Monthly rent rolls are a powerful tool any landlord should have at their fingertips. It can help you make the most out of your rental property’s income potential and easily showcase your property’s value to an investor, buyer, or lender.

TurboTenant’s online tools, like the online rent collector and our rent estimate feature, makes setting and collecting monthly rental payments easy so you can focus on managing your property and keeping your tenants happy.