Interested in turning your home into a source of passive income by becoming a landlord, but not sure where to do it — why not Georgia? With Georgia being the eighth most populous state in the U.S. with rising home values, it’s an excellent location to become a landlord.

Calculate ROI on Georgia Rental Property

Are you considering becoming a landlord in Georgia, but want to know how much you could potentially earn from a rental property? Enter your property’s information in our rental calculator to get started.

Preparing your Georgia rental property

The most successful rental properties in Georgia include amenities such as central HVAC, washer/dryer, dishwasher, walk-in closets, and upgraded flooring. Upgrading your property to include these luxury amenities can enable you to make hundreds of dollars more in rent every month. Another great feature is a functional and stylish outdoor space for pets and activities.

Best Practice: Look into other properties in your neighborhood to see how much they are being rented for. Then look into what amenities they offer to see how your rental property measures up. You can then adjust your rent price accordingly. You can also use a free rent estimate report to find out the pricing market of your surrounding area.

Review Georgia Landlord-Tenant and rental laws

To guarantee your success as a landlord in Georgia, make sure you get familiar with the Georgia landlord-tenant laws. This will help you when making decisions about security deposits, a notice of entry, and property maintenance. Also, they will help you establish who specific responsibilities fall on between you and the tenant.

Best Practice: Get familiar with the Georgia landlord rights, tenants’ rights, and the fair housing laws in your city to make sure that you are always in compliance.

Advertise your rental property

When you’re ready to start marketing your property it’s important to use both physical signs and online marketing. It’s easy to market your rental property for free across multiple websites by creating a property profile. Staging your rental property and taking well-lit photos can earn you a lot more applications.

Best Practice: Make sure your rental property is cleaned and staged for the photos you post online. Check out these and other real estate photography tips for the best possible results.

Find the perfect tenant

It’s okay to be a little picky when you are trying to discover the perfect tenant. Having the right person as a tenant will ensure you are paid on time and can make your life a lot easier. With the help of a tenant screening service, it’s easy to identify any major issues or past incidents a prospective tenant might have.

Best Practice: Merge the rental application and tenant screening process using a free online tool designed with landlords like you in mind.

Landlord check-ins & maintenance

In Georgia, there are no laws regarding notice of entry. However, it’s recommended that you provide 24-to-48-hour notice in writing that specifies the reason that you will be entering the rental property. It is also suggested that you only perform maintenance Monday through Friday between the hours of 9:00 AM to 5:00 PM. The exception to this is in the case of an emergency such as a fire or a big water leak. By following these recommendations it will help maintain a positive relationship between you and your tenant.

Best Practice: It is best to include maintenance and repair information in your lease so that your tenant and you are in agreement. Also, always double-check to make sure you’re complying with Georgia rental laws when creating your lease.

Bonus: Learn About Taxes on Rental Income in Georgia

In Georgia, residential rental income is taxed at a flat rate of 5%. However, operating expenses such as mortgage interest, property taxes, property insurance, structural improvements, and pest control can reduce your taxable rental property income.

Best Practice: Don’t get rid of receipts for services you paid for to maintain your rental property. They can be used to help with tax deductions come tax season.

Unlimited Everything.

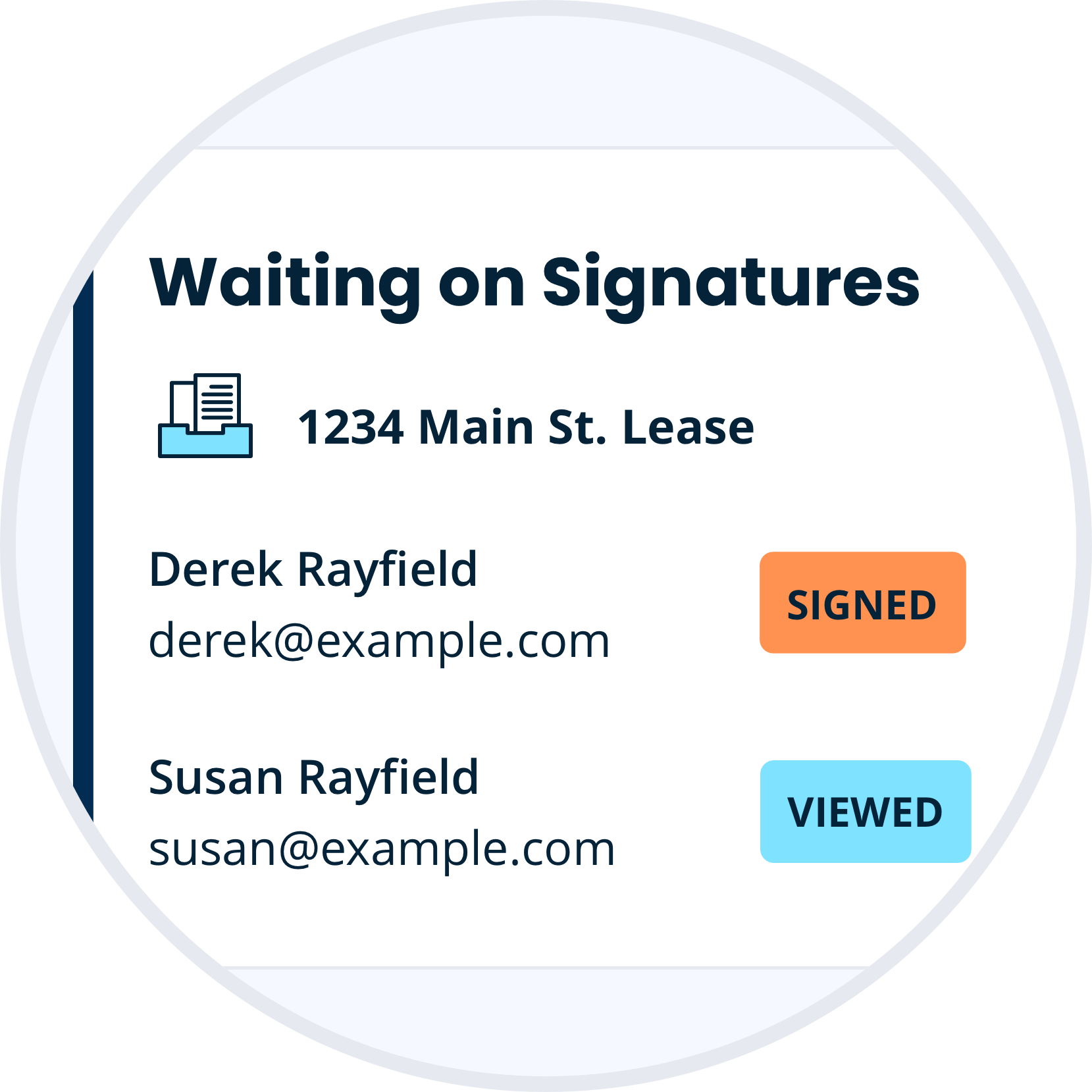

Create a single Georgia lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanBeing a landlord in Georgia doesn’t need to be hard thanks to the help of free landlord tools like TurboTenant. We allow you to advertise your property, screen prospective tenants, accept rental applications, create a lease, accept rent payments, and so much more. Join the growing Georgia economy and start increasing your money by becoming a landlord today!