Illinois, the Land of Lincoln, is one of the best places in the U.S. to become a landlord. With a strong industry in agriculture and natural resources, Illinois has continued to attract people which shows in the increasing rental market. The average rent in Illinois’s top cities runs from $715 to $1,950 in cities like Chicago.

Calculate ROI on Rental Property in Illinois

Enter your property’s information into our rental calculator to learn how much money your rental property could earn you!

1. Preparing your Illinois rental property

Some of the most sought-after Illinois rental properties feature updated appliances, HVAC, open floor plans, natural lighting, and smart safety upgrades. These popular amenities are able to increase the value of a house and result in you making more profit off of the rental property. Upgrading your property will also attract more interested renters which will help get you the best possible tenants.

Best Practice: Look into other Illinois rental properties in your area that are renting for your desired price. Does your property feature similar or better amenities? If not, perform the upgrades that fit into your budget to increase the value of your rental property.

2. Review Illinois landlord-tenant and rental laws

Ensure that everything goes smooth by familiarizing yourself with Illinois landlord-tenant laws. These will help you abide by all state and local laws as well as know your rights as a landlord. It’s important to know which responsibilities fall on you and which to the rental property tenants.

Best Practice: Research Illinois landlord rights, tenants’ rights, and the fair housing laws in your city to make sure that you are always in compliance.

3. Advertise your rental property

There is no better way to advertise your rental property than online. By creating an attractive rental property profile with stunning photos and a good description you will be able to reach people all over the world looking to rent in Illinois. Taking advantage of physical signs in your local area can also help bring in additional traffic to view your rental property.

Best Practice: Having good lighting and a clean photo can be the difference between having interested potential renters immediately and having a vacant rental property whilst you wait for a renter who is interested. Following these real estate photography tips can help make sure you get the best results.

4. Find the perfect tenant

Don’t just randomly choose someone to rent your property. Finding the right tenant will make sure that you get your rent payments on time and your rental property is well maintained. Finding the perfect tenant is easy with the help of a tenant screening service to quickly find any red flags.

Best Practice: Make the rental application and tenant screening process one by using a free online tool designed with landlords like you in mind.

5. Landlord check-ins & maintenance

Illinois requires that landlords give tenants at least a 24-hour notice before entering a rental property. Additionally, the times for entry must fall between Monday to Friday and between the hours of 8 AM to 6 PM. The main reasons that a landlord would enter the rental property would be to either make repairs or to give prospective tenants or future owners a tour of the property.

Best Practice: Outline maintenance and repairs that you will cover in the lease to make it clear for tenants. Make sure that you comply with Illinois rental laws when setting them.

Bonus: Learn About Taxes on Rental Income in Illinois

Rental income falls under the passive income category which means it is taxed at the same rate as your personal income. In Illinois, there is a flat income tax set at 4.95%. However, your operating expenses like mortgage interest, property taxes, structural improvements, and pest control can reduce your taxable rental property income.

There is no set rate for property tax in Illinois, however, most property is taxed at 33% of its fair market value. This results in an average property tax rate of 2.16%.

Best Practice: Keep the receipts from all the maintenance or property upgrades done on the rental property.

Unlimited Everything.

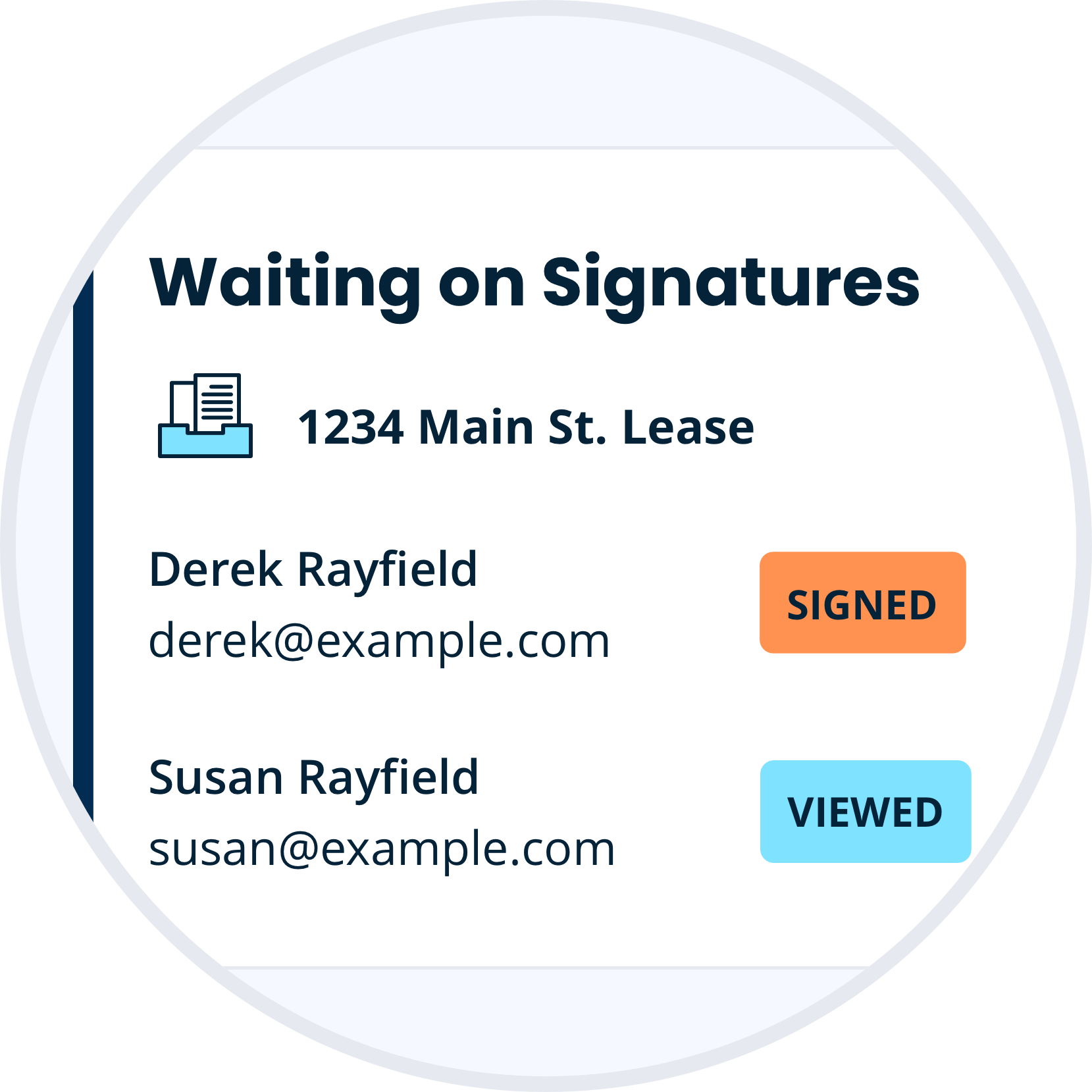

Create a single Illinois lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanThere has never been a better time than now to become a landlord in Illinois. Using the free landlord tools provided by TurboTenant, you’ll be able to remove management costs, accept applications, screen tenants, accept rent payments, and even communicate with your tenants all in one convenient place. We’re here to help you every step of the way on your journey to becoming a landlord and joining the booming Illinois rental industry!