Ready to start earning passive income as a landlord in Montana? The Treasure State presents many opportunities for aspiring landlords to take the next step. Despite its sheer size, rental vacancy rates are low thanks to nearly 36% of Montana’s residents being renters. The average rent in Montana’s top cities ranges from $1,100 through $1,800 — so you can expect to bring in a significant amount of money each month with a premium property.

Calculate ROI for your Montana Rental Property

Have a property in Montana that you’re considering renting? Enter your property’s information into our rental property calculator for an estimated ROI!

1. Preparing Your Montana Rental Property

To get your Montana rental property ready for tenants, make sure that it features popular amenities like luxury plank or hardwood floors, covered parking, in-unit washer and dryer, and depending on where you live, extra storage space for snowboards, skis and other outdoor equipment. Thanks to Big Sky Country’s stunning scenery, a great view or location can also assist in raising your rental’s worth — and is a great reason to invest in bigger windows or updated outdoor areas where the views can be enjoyed.

Best Practice: Scope out the competition and make sure that your amenities match or surpass similar properties to ensure that your rental is as attractive as possible to renters. You can also get a free rent estimate report to learn about the pricing market of the other properties around you.

2. Learn Montana Landlord-Tenant and Rental Laws

To be the best possible landlord, you’ll need to study and learn Montana’s landlord-tenant laws. This will help you to create an airtight lease agreement that sets the expectations for both you and your tenants. In Montana, repairs necessary for the health and safety of a tenant must be made in 14 days or the tenant may terminate the lease at the end of 30 days. Stating this in your lease agreement provides you both with the information needed to respond appropriately to any necessary repairs.

Best Practice: Familiarize yourself with all landlord responsibilities surrounding repairs, maintenance, and more for your rental property to properly set your expectations.

3. Advertise Your Rental Property

Montana is a big place. Listing your rental online is a great way to reach more potential tenants, and it doesn’t have to break the bank. In fact, you can market your rental property for free across multiple websites by creating a property profile with TurboTenant. When creating a listing, make sure that you use high-quality images that make your space look warm and inviting.

4. Choose the Perfect Tenant With a Montana Rental Application

You don’t have to rent your property to just anybody. Finding the perfect tenant will ensure that you’re paid on time each month and that your property is well-cared for. Screening your tenants for common red flags is the best way to decide who the best renter for your property is.

Best Practice: Combine the Montana rental application and tenant screening process using a free online tool designed with landlords like you in mind.

5. Landlord Check-Ins & Maintenance

Do you know the rules and regulations regarding your responsibilities as a landlord? In emergency situations, like a heater going out in freezing temperatures, landlords only have three working days to make repairs after receiving a written notice. Including this valuable information in your lease agreement, along with when you plan on making any check-ins or maintenance calls, will set both you and your tenant up for success.

Best Practice: Detail each and every item that you are responsible for maintaining as well as what the tenant should do if they are in need of repairs in your lease agreement.

Bonus: Learn About Taxes on Rental Income in Montana

Montana’s average property tax rate is 0.83%, well below the national average of 1.07%. Any income earned from rental properties is also taxable, but you can reduce that taxable income by subtracting incurred expenses for maintenance and even tasks you completed to make the property ready for new tenants.

Best Practice: Get a preview of your Montana income tax with an online calculator.

Unlimited Everything.

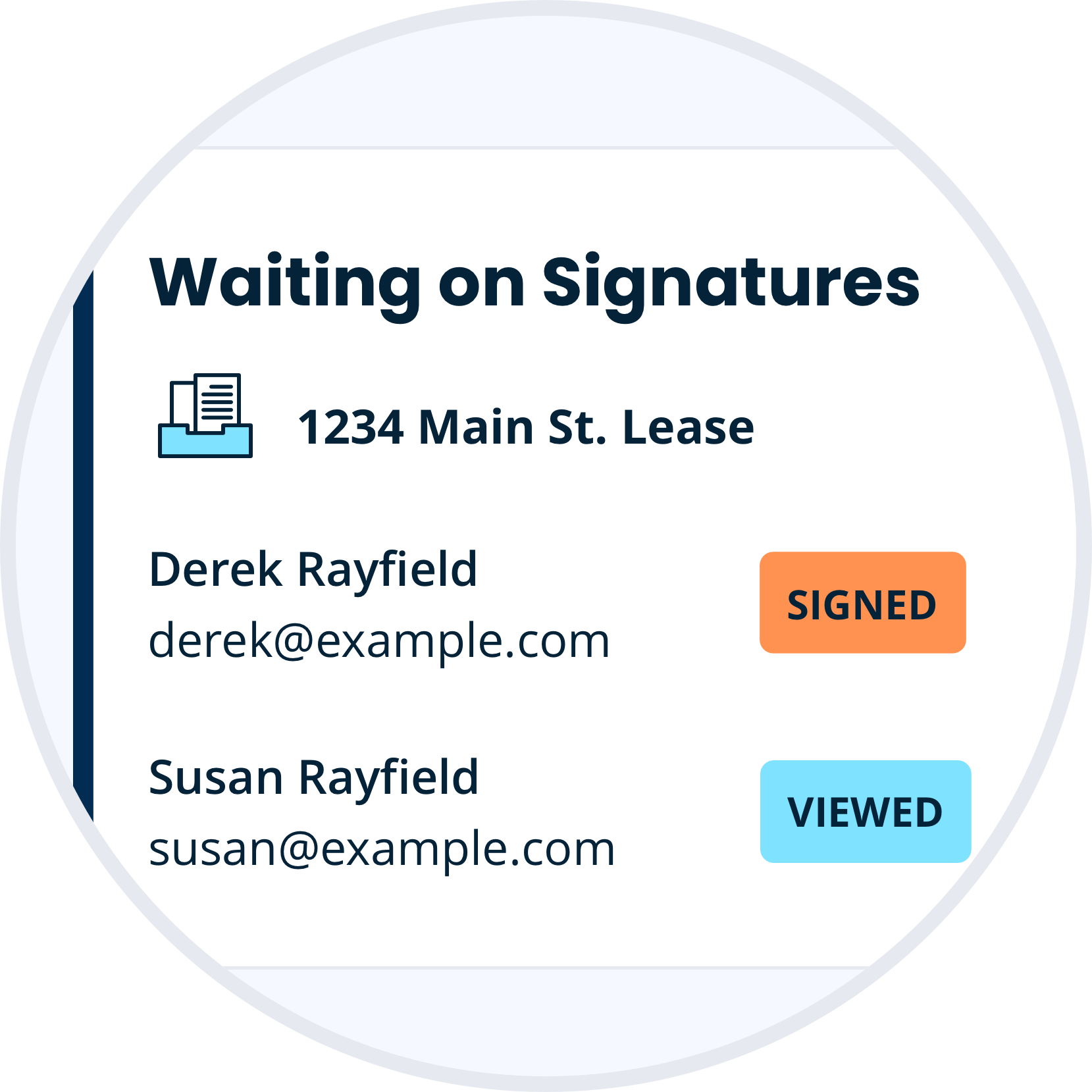

Create a single Montana lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanMontana is a landlord friendly state. Even better, with free landlord tools like TurboTenant, you can advertise, rent, and manage your property from your phone, and without having to pay another company to handle it. With Montana’s labor force expected to grow exponentially in the next five years, need for rental properties can only be expected to rise. Start earning as a landlord today!