Are you looking for a great source of passive income? Then becoming a landlord in New York could be the best option for you. With around half of New York’s population being renters, you will have an abundance of tenants looking to pay you rent. The average rent in New York ranges from $600 on the low end to as high as $3,000 in places like New York City.

Calculate ROI on Rental Property in New York

Interested in how much money a New York rental property can earn you? Enter your property’s information into our rental property calculator to get started!

1. Preparing your New York rental property

If you are looking to maximize your profit from your rental property then having the most up-to-date amenities is a must. Some of the most important amenities to renters in New York include central AC, private outdoor space, pet friendly housing, washer and dryer, and a dishwasher. These amenities will help your property become more desirable and help attract future potential tenants.

Best Practice: After determining your ideal price range, look into other rental properties in your area to see how you compare. Using a free rent estimate report can make finding your neighborhood’s pricing market easy. This can help you decide if you are priced correctly, need to lower your price, or could increase your asking price.

2. Research the New York Landlord-Tenant laws

Knowing your rights is always important and that is also true as a landlord. Make sure you do thorough research on the New York Landlord-Tenant laws. These laws will help you understand what your duties and responsibilities are as a landlord and what falls on the renter.

Best Practice: Acquaint yourself with New York landlord rights, tenants’ rights, and the fair housing laws in your city to make sure that you are always in compliance.

3. Market your rental property

Although physical signs are important, marketing your rental property online is the best way to maximize your reach for potential tenants. By creating an amazing looking profile with high-quality photos, a clear list of amenities, and a great description of the rental property you’re sure to catch many renters’ attention.

Best Practice: Ensure that the rental property is the cleanest it’s ever been and staged or cleared out before you take photos. Another pro real estate photography tip is to take the picture with good lighting because a great photo can say a thousand words.

4. Find the perfect tenant

You put a lot of time and effort into preparing your rental property to be ready so that shouldn’t stop at the tenant selection process. Nothing is worse than a tenant who is late on payments or doesn’t maintain the property. Using a tenant screening service you can find any possible red flags early on. This can help you narrow the options down to the perfect tenant.

Best Practice: Merge the rental application and tenant screening process using a free online tool designed with landlords like you in mind.

5. Landlord Check-Ins & Maintenance

Random check-ins from a landlord are not allowed in New York. Landlords are required to give a 24-hour written notice in advance to be able to enter the rental property for an inspection or for maintenance. Additionally, reasonable times to enter the property are between 9:00 AM – 5:00 PM.

The exceptions to having to give notice in advance to enter the property are in the case of an emergency such as a fire or water leak or if the tenant invites the landlord to enter.

Best Practice: By including maintenance and repair information in your lease it ensures both you, the landlord, and the tenants are all on the same page so issues can be avoided in the future. Make sure that you comply with New York rental laws when creating your lease.

Bonus: Learn About Taxes on Rental Income in New York

Rental income in New York is treated as ordinary income and taxed accordingly. However, your operating expenses can act as a deduction from rental income. Operating expenses can include mortgage interest, property taxes, utilities, and costs of cleaning and maintaining the property.

Best Practice: Make sure you keep receipts as proof for all expenses that fall under operating expenses so you can deduct them when it’s tax season.

Unlimited Everything.

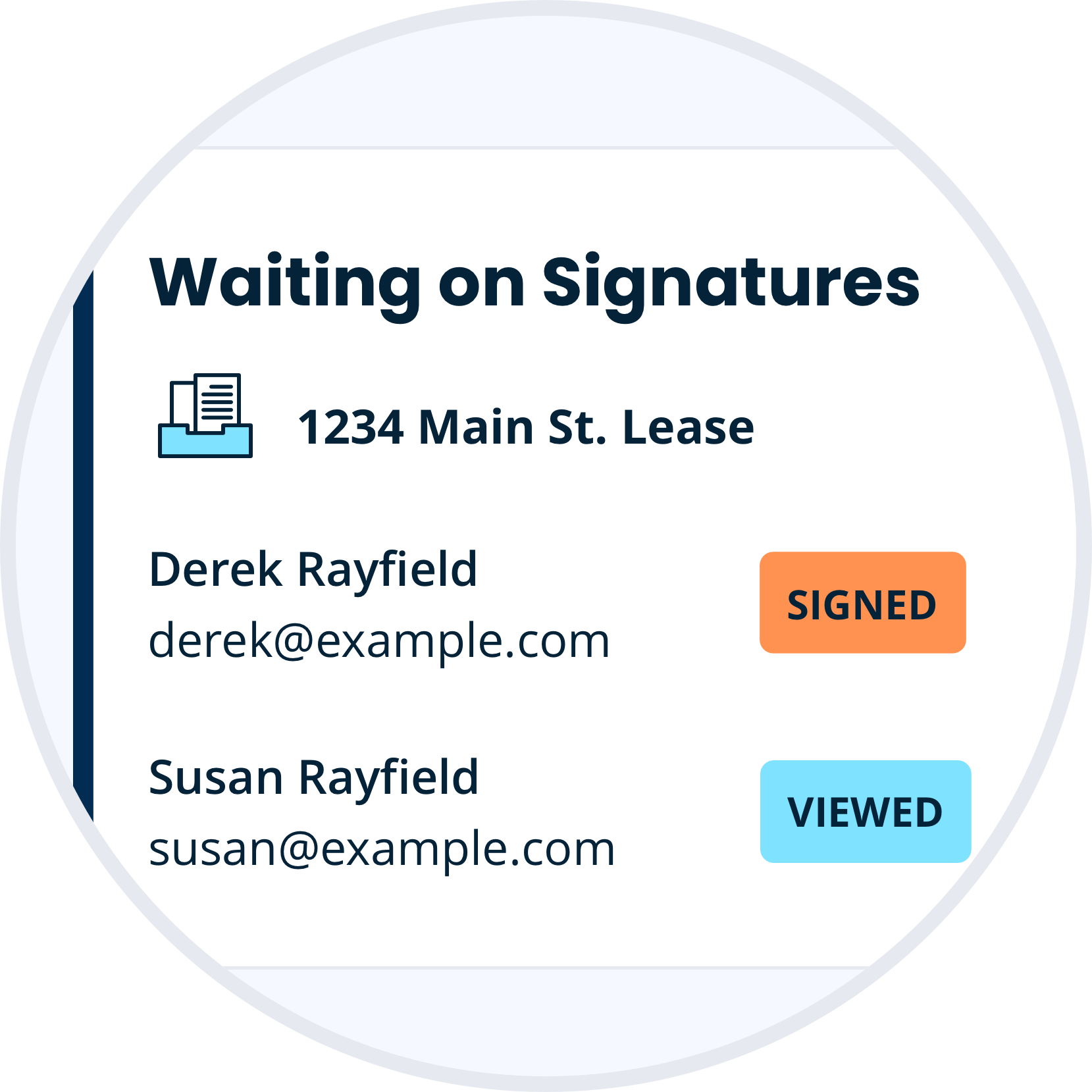

Create a single New York lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanWith the help of free landlord tools like TurboTenant, being a landlord in New York can be made easy. These tools allow you to market your rental, run tenant screening reports, accept applications, receive payments, and communicate with tenants online. New York’s rental industry is flourishing — become a landlord so you too can start making passive income.