Ohio is a great state to become a landlord in by turning your house into a money-making rental property. As one of America’s industrial capitals, Ohio’s booming economy helps to create high rental demand. Coupled with many renowned universities and a great tourism industry, you’re sure to have an abundance of potential renters to choose from. The average rent in Ohio’s top cities ranges from a low of $730 to a high of $1,100 in cities like Columbus. Below are the steps outlining how to become a landlord in Ohio so you can start making passive income today.

Calculate ROI on Rental Property in Ohio

Interested in how much money your Ohio rental property can earn you? Enter your property’s information into our rental calculator to get started!

1. Preparing your Ohio rental property

Some of the best Ohio rental properties include amenities such as a fireplace, hot tub, HVAC, new kitchen appliances, an open kitchen floor plan, and a washer and dryer. These highly sought-after amenities are able to boost your property’s value and result in making more money from rent. Roughly 72% of renters have pets, so pet-friendly rentals are an added bonus.

Best Practice: By getting a free rent estimate report, you can find out what your neighborhood’s pricing market looks like to help establish your budget. Then you can look more into other rental properties to find out what amenities they are offering so you can see if your rental property is priced accordingly.

2. Become an Expert on Ohio Landlord-Tenant laws

Becoming an expert on the Ohio landlord-tenant laws is essential if you want to avoid legal complications and even save money. This will help you understand which responsibilities fall on you and which fall on the tenant. It will also help with decisions on property maintenance, security deposits, and a lot more.

Best Practice: Get to know the Ohio landlord rights, tenants’ rights, and the fair housing laws in your city to make sure that you’re always in compliance.

3. Promote your rental property

When promoting your rental property make sure you use both physical signs and online advertising. You can create a property profile that will allow you to market your rental property for free across multiple online locations. Ensure all of your photos are high quality to help attract more potential tenants.

4. Find the perfect tenant

When looking for your new tenant don’t just settle for anyone. Finding the perfect tenant can be made a lot quicker with the help of a tenant screening service. This will make any red flags obvious and help you understand the kind of renter a person will most likely be. Knowing this will help provide peace of mind and hopefully save you from any huge headaches in the future.

Best Practice: Bring together the rental application and tenant screening process using a free online tool designed with landlords like you in mind.

5. Landlord Check-Ins & Maintenance

Unless there is an emergency, landlords in Ohio must give at least 24 hours notice to be able to enter the rental property. The main reasons a landlord should enter a rental property are to perform repairs or alterations, inspections, or to show the property to prospective tenants, purchasers, or contractors. Although it’s not required, a landlord should provide notice of entry in writing.

Best Practice: Include maintenance and repair information in your lease so that your tenant and you are in agreeance. Also, check to make sure you’re complying with Ohio rental laws when creating your lease.

Bonus: Learn About Taxes on Rental Income in Ohio

Rental income is taxed as ordinary income in Ohio so the percent you will be taxed is based on whichever tax bracket you fall into. However, your operating expenses such as mortgage interest, property taxes, maintenance, and other expenses can be deducted from your taxable income to reduce how much you owe in taxes.

Best Practice: Keep all of the receipts from services you provide to the property to help verify your operating expenses.

Unlimited Everything.

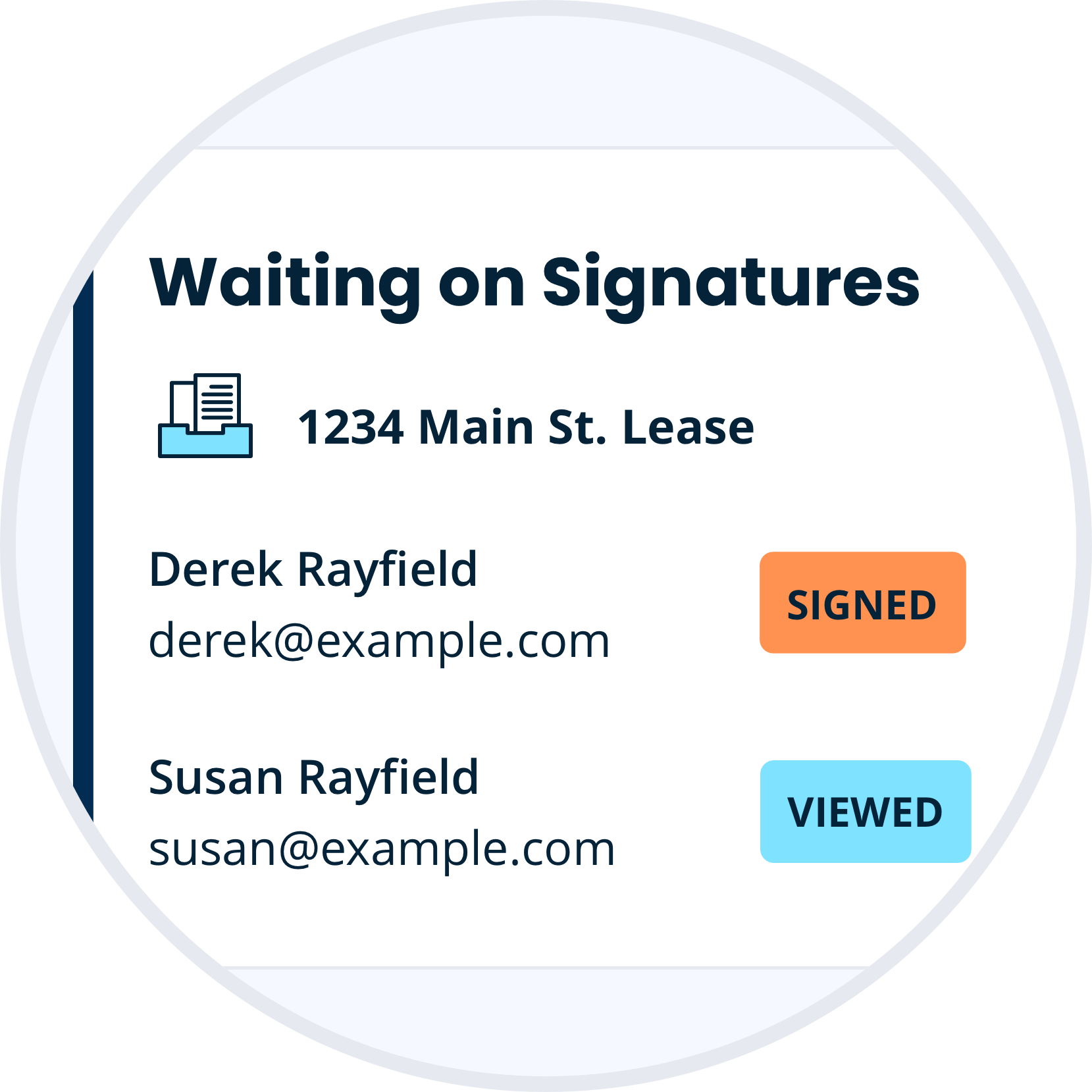

Create a single Ohio lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanTurboTenant can help make becoming a landlord in Ohio a breeze. With free landlord tools you will be able to promote your rental property, run screening reports on prospective tenants, receive payments and even communicate with tenants all from your home in one easy place. Ohio’s economy and rental industry are thriving — don’t miss your opportunity to begin making passive income by becoming a landlord today!