Table of Contents

- Calculate ROI on Rental Property in Pennsylvania

- 1. Preparing your Pennsylvania rental property

- 2. Get familiar with the Pennsylvania Landlord-Tenant laws

- 3. Market your rental property

- 4. Find the perfect tenant

- 5. Landlord Check-Ins & Maintenance

- Bonus: Learn About Taxes on Rental Income in Pennsylvania

Pennsylvania has the sixth largest economy in the U.S. and is an excellent place to have one or more rental properties. The average rent in top Pennsylvania cities ranges from roughly $950 on the low end up to $1,700 in larger cities like Philadelphia. Pennsylvania is home to some of the largest public and private companies such as Hershey’s, so the number of jobs and renters are increasing every day!

Calculate ROI on Rental Property in Pennsylvania

With the help of our rental property calculator you can find out how much your rental property in Pennsylvania can be making you today!

1. Preparing your Pennsylvania rental property

The rental properties that are performing the best in Pennsylvania include the most sought after amenities. This includes amenities such as a large open kitchen, spa like master bathroom, HVAC, walk-in closets, upgraded appliances, and much more. These top-of-the-line amenities are important enough to get renters to pay more if they are included in the rental property.

Best Practice: Decide the rental price that works best for your budget and look into nearby rental properties in that price range. If your rental property is nicer, you can increase the rent. If it could be improved compared to the nearby properties, make strategic upgrades to bring it up to par. An easy way to find out about the pricing market of properties in your neighborhood is with a free rent estimate report.

2. Get familiar with the Pennsylvania Landlord-Tenant laws

Fully understanding the Pennsylvania landlord-tenant laws will help you make the right choices when it comes to services on the rental property, security deposits, evictions, and determining who the burden falls on for specific circumstances.

Best Practice: Become an expert on Pennsylvania landlord rights, tenants’ rights, and the fair housing laws in your city to make sure that you are always in compliance.

3. Market your rental property

When you begin to market your rental property, make sure to utilize both physical signs to attract locally and online marketing to expand your reach to a larger market. Marketing your rental property online is free and made easy when you create a property profile. If you want to attract multiple applicants, then taking great photos is a must!

Best Practice: Make sure to clean your rental property until it’s spotless, then either stage it or empty it out. Great lighting is also essential. To learn all about these strategies and more look into real estate photography tips.

4. Find the perfect tenant

You should never leave finding the right tenant to chance. By using a screening service, you are able to quickly identify any red flags a potential tenant might have. This can help avoid situations where your rental property isn’t maintained, rent is missed, or even a possible eviction. Don’t settle for anything less than the perfect tenant!

Best Practice: Complete the rental application and tenant screening process at the same time using a free online tool designed with landlords like you in mind.

5. Landlord Check-Ins & Maintenance

In Pennsylvania, there are no laws regarding landlords’ right to entry. Due to this, landlords are technically allowed to enter the rental property whenever they want to, unless specified otherwise within the agreed-upon lease. The normal reasons for entry are maintenance and repairs or showing the rental property to prospective tenants or buyers.

However, it is common courtesy to provide at least a 24-hour notice of entry in writing. The typical reasonable times for entry are Monday through Friday between the hours of 9 AM – 5 PM. The only time a landlord should enter the property without notice is in the case of an emergency such as a major water leak or a fire.

Best Practice: Include maintenance and repair information as well as notice of entry information in your lease so that you and the tenant are on the same page, and there shouldn’t be any future issues. Make sure that you comply with Pennsylvania rental laws when setting them.

Bonus: Learn About Taxes on Rental Income in Pennsylvania

In Pennsylvania, rental income is taxed as personal income. Personal income in Pennsylvania is taxed at the rate of 3.07%. However, you can offset this cost to be even less by deducting operating expenses from your rental income. Operating expenses include mortgage interest, property taxes, property insurance, structural improvements, and pest control. By taking advantage of these deductions, you can maximize your profits.

Best Practice: Keep the receipts from any services or projects that would fall under operating expenses.

Unlimited Everything.

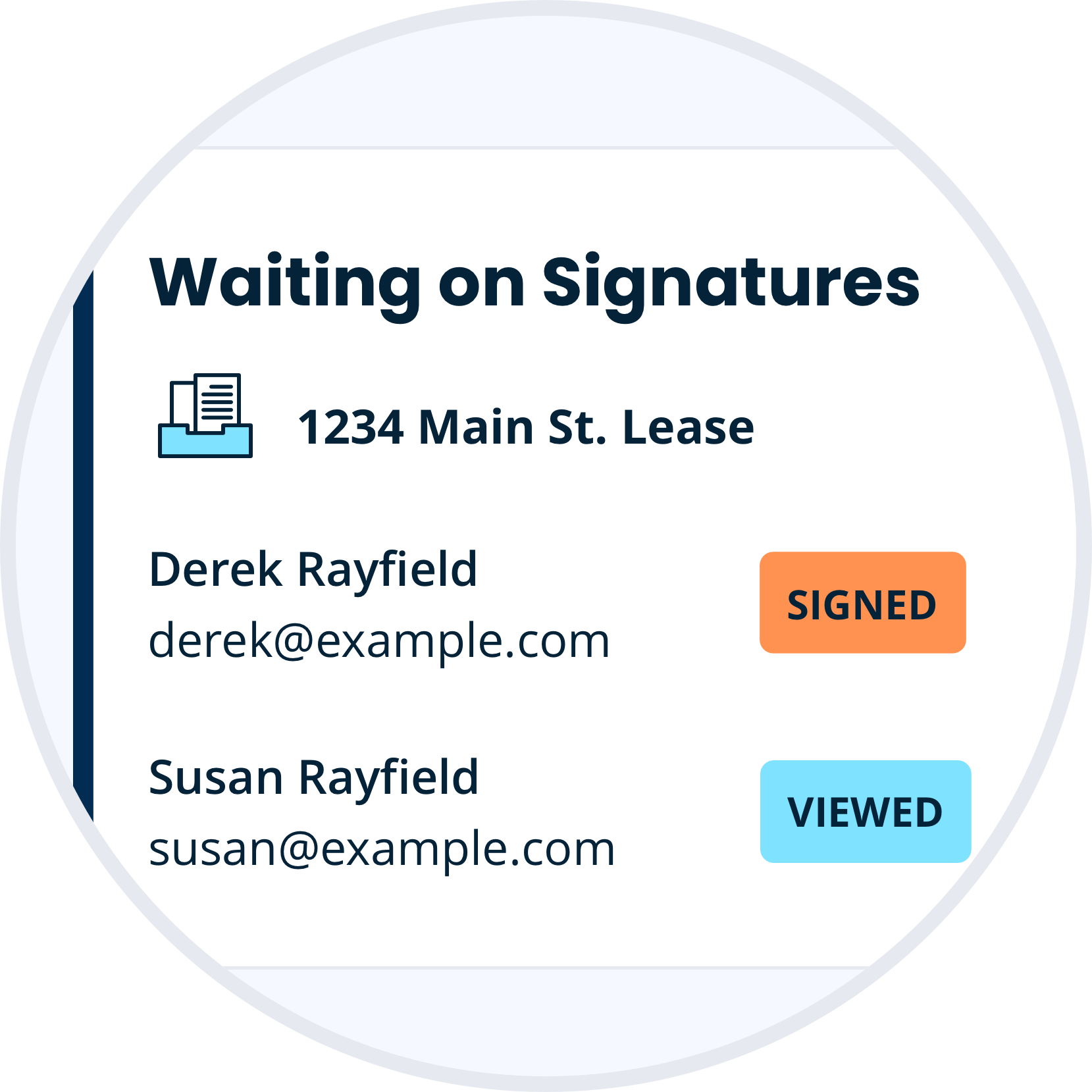

Create a single Pennsylvania lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanWith Pennsylvania having an incredible growing economy and low taxes, it makes for an ideal location for you to own rental properties. Using TurboTenant’s free landlord tools you can easily market your rental property, accept applications, run tenant screening reports, receive payments, and communicate with tenants. Don’t miss out on this amazing opportunity to join the profitable rental industry in Pennsylvania!