For landlords in the Evergreen State, TurboTenant offers a comprehensive Washington lease agreement, meticulously reviewed by local legal professionals and property managers. This document ensures that all parties are protected under the umbrella of compliance as they partake in property rental agreements. Below, we delve into the structure and specifics of this key legal instrument.

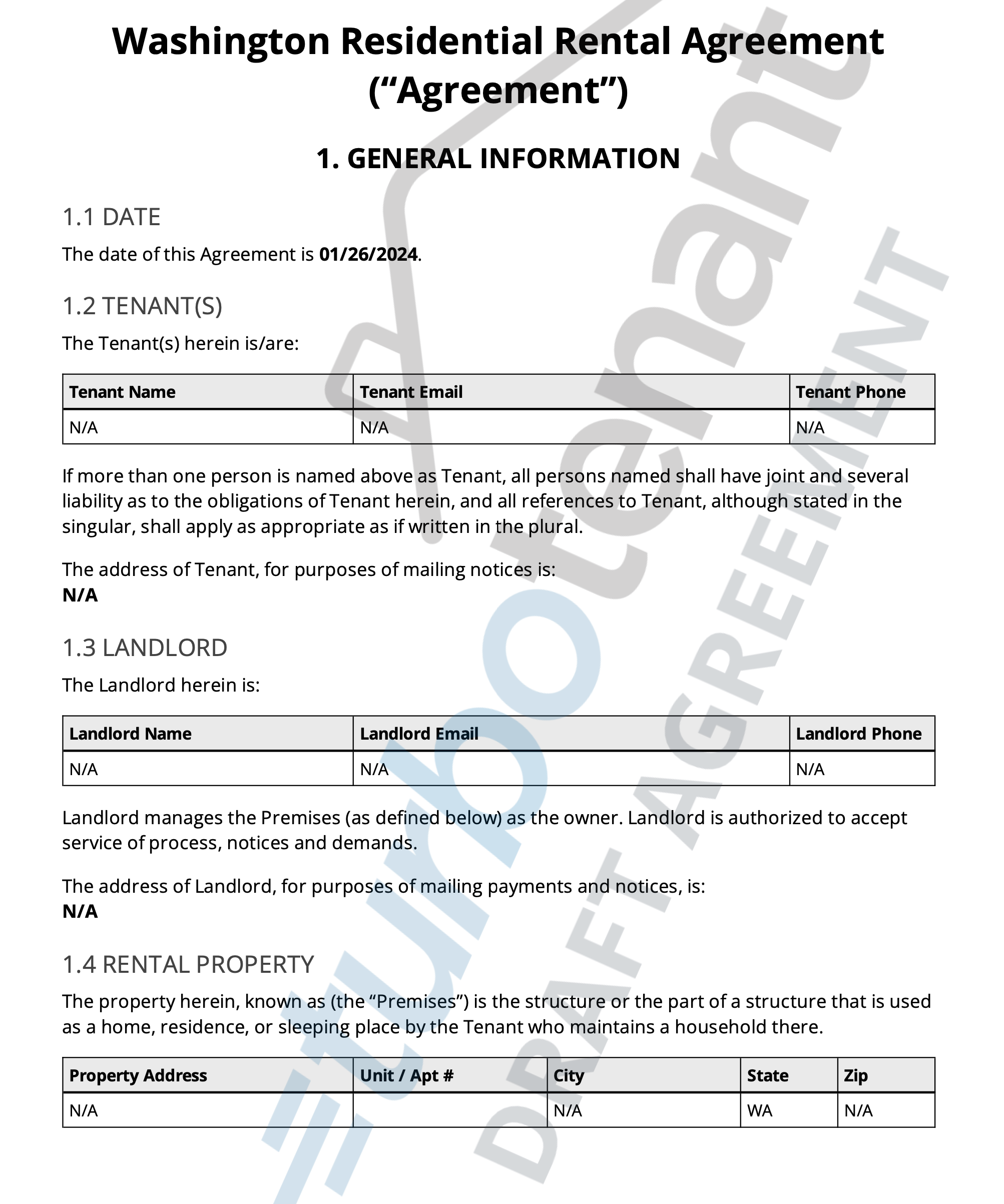

Section 1 – Personalized Lease Details

At the heart of the agreement lies Section 1, which is entirely customizable to fit the details of your distinct leasing scenario. This includes tenant names, rent specifications, and utility agreements—all inputted during the lease creation process with TurboTenant. The lease is designed for transparency and ease of understanding, with a summary table at the beginning of the document and subsequent details following suit. Notably:

- Additional Provisions: This subsection allows landlords to embed property-specific rules or necessary local clauses. It is advised that landlords consult with an attorney to review any additional terms to ensure legal compliance.

- Lost Key Clause: Tenants are responsible for the full cost of rekeying should they fail to return all keys at the end of their tenancy.

Section 2 – Washington Law Specifics

Section 2 is strictly crafted to echo the legal landscape of Washington State, but our Advanced Editor allows changes to be made with full disclosure that any edits may take you out of full compliance with state and/or local law and consultation with an attorney is advised. . Among the noteworthy clauses here are:

- Late Fees (Section 2.1): Rent is due on the first day of each month, and if not received by the 5th day, landlords may levy a $50 late fee—unless the 5th falls on a Sunday or holiday.

- Security Deposit Provisions (Section 2.4): In Washington, there is no statutory limit on security deposit amounts, which are typically one to two times the monthly rent. Deposits must be kept in a federally insured financial institution, and the landlord retains the interest unless agreed otherwise. The bank name and location must be described in the lease. Security deposits must be returned to tenants within 21 days of regaining possession of the property.

- Fair Housing (Section 2.11): The agreement adheres to both federal and state civil rights laws that prohibit discrimination in housing.

- Notice of Domestic Abuse Protections (Section 2.17): Tenants have an eviction defense if they can prove they are victims of domestic abuse and that the eviction is based on related conduct.

Section 3 – General Clauses for U.S. Landlords

The final segment includes clauses that are standard for lease agreements across the country, ensuring landlords are following best practices:

- Subletting (Section 3.1): Subleasing is not permitted without the landlord’s written consent.

- Alterations and Improvements (Section 3.2): Tenants must get written approval for any property changes and restore the property to its original state upon moving out unless otherwise agreed.

- Choice of Law (Section 3.11): The lease is governed by Washington law, and there is a mandate to consent to the jurisdiction of the county courts where the property is located.

- Law Abidance (Section 3.14): Tenants must comply with all laws and ordinances and avoid being disruptive to neighbors, with violations constituting grounds for lease termination.

FAQ

Can I include additional terms specific to my property in the lease agreement?

Yes, you can include additional terms through the Additional Provisions section of Section 1. These can encompass property-specific rules or clauses that are necessary due to local regulations. It is recommended to have these provisions reviewed by a legal professional to ensure they are compliant with the law.

What should I do if a tenant does not return their keys?

Tenants who fail to return their keys are responsible for the cost associated with rekeying the property. This cost is outlined in the lease agreement and can be deducted from the security deposit if necessary.

How much can I charge for a late fee in Washington?

A late fee of $50 can be charged if rent is not paid by the 5th day of the month. However, if the 5th is a Sunday or a holiday, the late fee cannot be imposed until the following business day.

Are there any restrictions on the amount I can charge for a security deposit in Washington?

Washington law does not specify a maximum amount for security deposits, but it is typical for deposits to range from one to two times the monthly rent. The lease agreement should clearly state the security deposit amount and the terms for its return.

How quickly must I return the security deposit after a tenant moves out?

Washington state law requires that landlords return the security deposit within 21 days of regaining possession of the property. This must include a detailed statement if there are any deductions for damages or unpaid rent.

TurboTenant’s Washington lease agreement is a vital resource for landlords looking to ensure legal protection and transparency throughout the rental process. With specific sections dedicated to state laws, personalized terms, and general landlord-tenant best practices, this document serves as a solid foundation for successful property management.

Washington Resources