Collect Rent Online

Collect Rent Online

Collect Rent Online

Collect Rent Online

Collect Rent Online

Make rent less stressful

for you and your tenants

Unlike Zelle, Venmo, or physical checks, our solution specifically meets the needs of landlords and real estate investors – and their tenants.

Online Rent Payments

Whether you have one or 1,000 doors, use TurboTenant’s intuitive toolset to streamline your entire process for free.

Build a listing in less than 10 minutes, then push it across the web to collect high-intent leads.

Gain insight into potential tenants’ rental, financial, criminal, and eviction history — for $0 on your end.

Build and adjust a lease on your own — specific to your state’s laws — in less than 15 minutes.

A Comprehensive Rent Collection Software

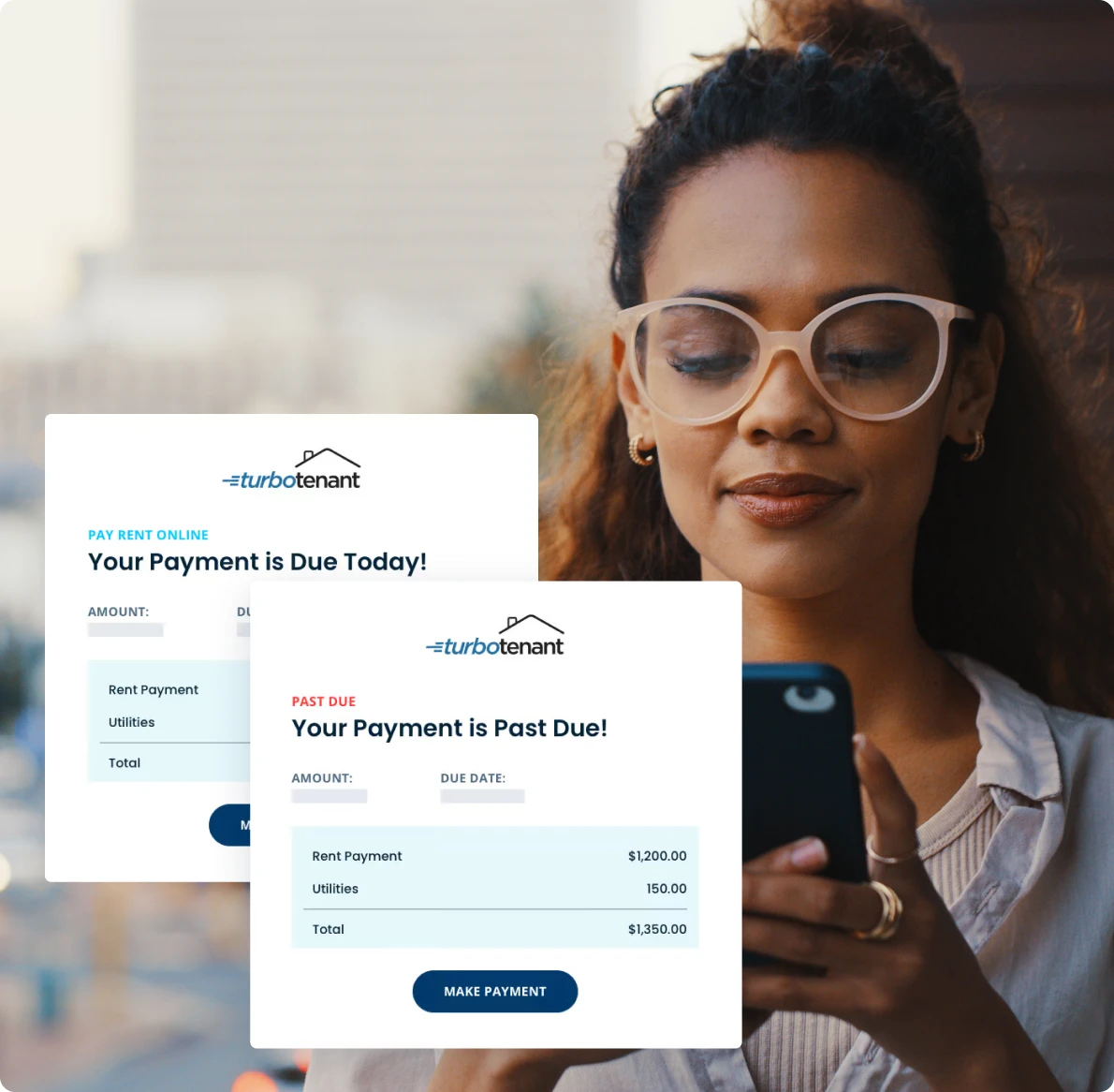

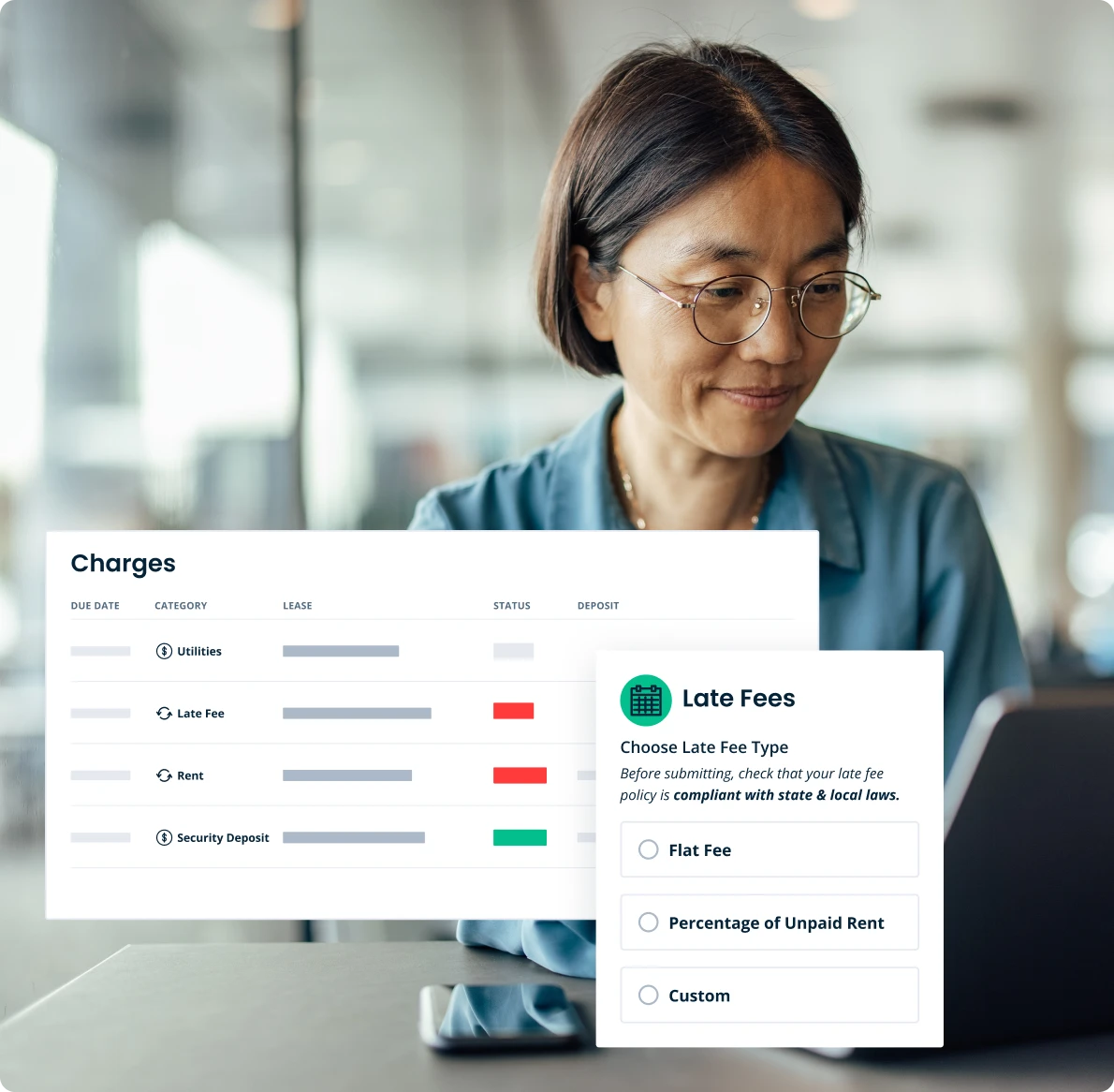

Recurring Charges and Automatic Reminders

Set up automatic late fees or turn on automatic payments for your tenants. With email reminders and automated technology, forgetful tenants are prompted to pay you on time. And if they don’t, we tell you.

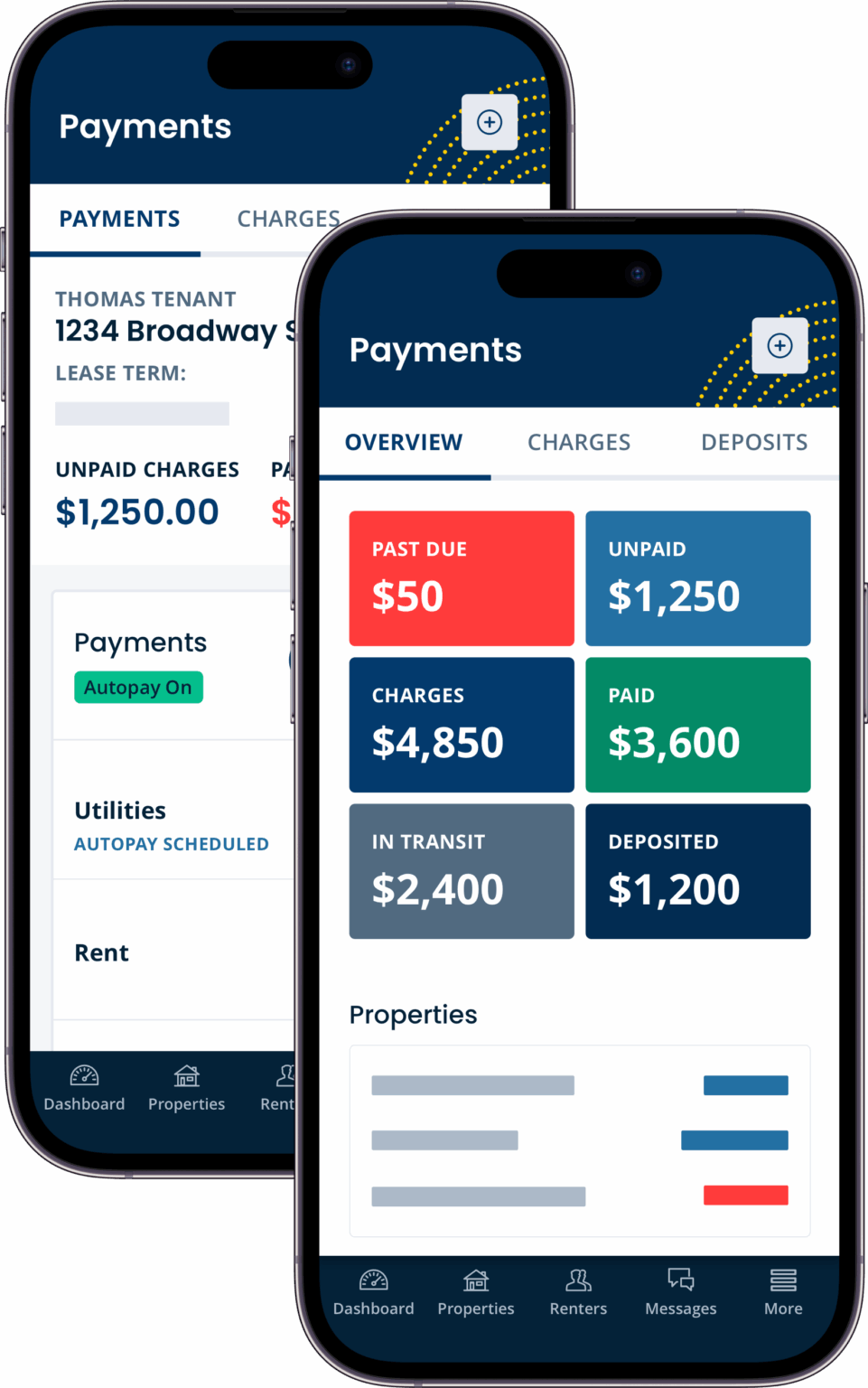

A Full View of Your Payments

Who owes you, and how much? How do your expenses stack against your rent payments this year? Find the answers in your comprehensive Payments Dashboard and integrated accounting software — built just for landlords!

Convenient and easy to use for both renters and landlords!

Marqus

1 Property Landlord

I like the automatic receipts, not having to deposit a check, and being able to track everything in one place.

Ryan

3 Property Landlord

The best things are that it’s free and it sends automatic rent reminders. It is simple, and tenants pay more timely!

Jacob

8 Property Landlord

Your Tenants Will Love It

When it comes to making payments, you want your tenants to be happy about how they pay you. And with us, they will be!

- Boost Credit Scores with On-Time Payments—Your tenants build their credit history with ease when they pay rent online. Learn about Rent Reporting.

- Pay with a Credit Card—Whether they want to earn points or are running short on cash that month, they’ll have options.

- Pay Easily from Any Device—There’s no need for them to drop off a check each month.

- Make Partial Payments—If you allow it, roommates can easily split rent or you can set up a payment plan with a tenant.

- Simple Onboarding Process—Tenants can easily pay using their bank (ACH) or credit/debit card.*

*Industry-standard convenience fees apply ($2 ACH, 3.49% credit/debit). Learn how you can waive ACH fees for your renters with Premium.

How do we compare?

Unlike Venmo or Zelle, TurboTenant is built for landlords, by landlords.

You’re running a business, not collecting money from friends.

Payment Limits »

Depending on your bank, Zelle can limit the amount of money your tenants can send to $1,000 per day or $5,000 per month. It puts a real damper on collecting a deposit and first month’s rent both at the same time.

High Fees »

Venmo charges small businesses, like landlords, a 1.9% fee for each transaction. You don’t need that cutting into your bottom line.

Costly Mistakes »

Ever worry that you’re sending money to the right person on Venmo? Mix-ups are common. And it’s especially risky when it’s a security deposit and first month’s rent ending up in a stranger’s account.

Difficult Tracking »

Come tax season, you don’t want rent payment line items alongside your friend paying you back for dinner.

No Receipts »

Your tenants just paid you a lot of money. They deserve to know you got it.

No Automation »

Tired of remembering to send late fee charges? Want to offer your tenants a way to put their payments on autopilot? Venmo and Paypal don’t offer these services — we do.

No Integrated Accounting »

Need accounting software that automatically syncs your transactions and rent payments? Ours is easy to set up directly in your account.

- No Daily Limits

- Free for Landlords

- Automatic Late Fees

- Autopay for Tenants

- Integrated Rental Accounting

- Rent Reporting

- Payments Dashboard

- Automated Monthly Payment Requests

- Extensive Records

- Automatic Receipts

- Complete Control

And that’s not all…

COURSE: 10 Expensive Tax Mistakes to Avoid

Learn professional tips to save on your taxes this year

It’s difficult to know exactly what to keep records of and what can qualify as a “deduction” when running your rental business. And while hiring an accountant is ideal, it isn’t always the most cost-effective option for everyday landlords.

Sign up for 10 Expensive Tax Mistakes to Avoid today to dodge expensive errors (and any trouble with the IRS) and be confident in your tax planning.

Craig M.

3-property landlord & TurboTenant user

More Than Collecting Rent Online

Manage the Entire Rental Process

Whether this is your only rental property or you’ve invested in more, you’ll have the systems in place to create a welcoming and professional rental experience for you and your tenants.

Integrated Rental Accounting: Access a landlord-specific accounting tool that syncs directly with your account.

Expense Tracking: Get a clear picture of money-in and money-out and make tax season easy.

Lease Agreements: Get a lawyer-prepared, state-specific lease agreement.

Document Management: Send, sign, and store important lease documents.

Maintenance Requests: Create a streamlined process so you have clear records

Rental Advertising: Have a vacancy? Post to dozens of sites to reach more renters!

Tenant Screening: Everything you need to know they’re a tenant you can trust.

Sean—Cedar Rapids, IA

1 Property Landlord

Download the app

Get a bird’s-eye view of your rental’s finances, right from the palm of your hand.

Join the 800,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

Online Rent Collection FAQs

How do landlords collect rent online from tenants?

Landlords can collect rent online by using property management software that supports digital payments. The best option is to sign up for a platform like TurboTenant, which accepts ACH transfers, credit cards, and debit cards. Tenants cover the processing fees, so landlords receive the full rent amount directly in their bank account—no deductions, no manual tracking.

Is online rent collection safe?

Yes, online rent collection is safe (almost always safer than accepting cash or paper checks). Most systems utilize bank-level encryption and secure verification tools, such as Plaid or Yodlee, to protect sensitive banking information. Rent payments go directly to the landlord’s account without risk of theft, forgery, or loss in the mail. Digital records also help resolve disputes quickly.

Can tenants pay rent automatically each month?

Yes, many online rent collection platforms let tenants set up automatic monthly payments. With autopay, tenants can “set it and forget it,” ensuring rent is paid on time without reminders. This helps landlords collect rent consistently and reduces late fees. Bonus: it builds good payment habits that can improve a tenant’s rental history and credit through rent reporting.

Who pays the fees for online rent payments?

Tenants typically pay all processing fees when using online rent collection tools. With TurboTenant, ACH payments are free for Premium users, while credit and debit card payments carry a 3.49% fee (paid by the tenant, not the landlord). This setup ensures landlords receive the full rent amount, fee-free, straight to their connected bank account.

Can landlords accept partial rent payments online?

Yes, landlords can accept partial rent payments online; however, not every platform supports this option. (TurboTenant does.)

To enable partial payments, just log in, go to the Leases tab, edit the lease, and toggle “Yes” under the partial payments section. Enabling this feature will make it easy for roommates to split rent or for tenants to pay in smaller increments.

How quickly do online rent payments arrive in a landlord’s bank account?

Online rent payments through TurboTenant arrive at different speeds depending on your plan and payment method. Free users typically receive ACH payments in 5–7 business days due to bank processing times. TurboTenant Premium users get faster, pre-funded payouts in 2–4 business days. Credit and debit card payments process even quicker, usually landing within 1–3 business days.

For more information, visit our “How Long Do Rent Payments Take to Process?” support page.

Can rent payments be tracked automatically?

Yes, rent payments can be tracked automatically if your software supports it. TurboTenant keeps a detailed log of every payment (amount, date, status) and syncs with your dashboard in real-time. It even integrates with accounting and bookkeeping tools, helping landlords stay organized, spot late payments, and simplify year-end financials.