There has never been a better time to start making money from your rental property. Florida is the perfect place to become a landlord. The average rent in Florida’s top cities ranges from roughly $850 on the low end up to $2,500 and more in places like Miami Beach. The average time for homes on the market is around 18 days. With more people moving to retire in Florida, 33.75% of residents in the Sunshine State are tenants.

Calculate ROI on Florida Rental Property

Want to find out how much money your property in Florida can make you? Enter your property’s information into our rental property calculator to get started!

1. Preparing your Florida rental property

The best Florida rental properties feature amenities such as an open kitchen floor plan, new kitchen appliances, an outdoor pool, upgraded floors, and an updated bathroom. By having these desirable items a property can be rented for a great deal more. What are the most important amenities in the Sunshine State? Undoubtedly a working air conditioner, fans, or other cooling systems to help escape the sun on those brutally hot days.

Best Practice: Look into other available properties in your area to see how much they are going for. Then dig a little deeper to find what amenities they offer so you can either increase the price of your rent if your property is nicer or find out what you’re missing so you can make improvements to become more desirable. Get a free rent estimate report to see how the pricing market is in your neighborhood.

2. Review Florida landlord-tenant and rental laws

To ensure you succeed as a landlord in Florida, make sure you learn as much as you can about the Florida landlord-tenant laws. These will help you know whether responsibilities fall on you or your renter as well as ensure you are following both state and local laws. They will also help you make decisions when it comes to property maintenance, security deposits, and much more!

Best Practice: Familiarize yourself with Florida landlord rights, tenants’ rights, and the fair housing laws in your city to make sure that you are always in compliance.

3. Advertise your rental property

When the time comes to market and promote your property, it’s best to take a two-pronged approach and advertise both with physical signs and online. By creating a property profile you will be able to market your rental property for free across multiple websites. Using high-quality or professional photos for your listing can have a huge impact.

4. Find the perfect tenant

Having a bad tenant can turn life as a landlord into a nightmare. Luckily for you, tenant screening services can make finding the perfect tenant easy! This will allow you to check renter information — like do they pay rent on time or have they ever been evicted. Knowing this will ensure you get paid every month and your property will be maintained.

Best Practice: Combine the rental application and tenant screening process using a free online tool designed with landlords like you in mind.

Once you’ve found the perfect tenant, make them feel at home with our Welcome Home guide. It’s free, and it’s a great resource to centralize critical information about how to pay rent, steps to take in an emergency, lawn care, and more.

5. Landlord check-ins & maintenance

In Florida, landlords are allowed to enter the rental property from time to time if they are inspecting the property, making repairs, providing services that were agreed upon, or showing off the unit to prospective tenants. As a landlord, you must provide notice within a reasonable amount of time before entry.

In the case of repairs, you are required to provide a 12 hours notice in writing before entering the property, however, most landlords will give the tenants at least a 24 hours notice out of courtesy. Maintenance and repairs can only be completed between the hours of 7:30 AM – 8:00 PM.

Best Practice: Make sure you include maintenance and repair information in your lease so that your tenant and you are on the same page. Also, check to make sure you’re complying with Florida rental laws when creating your lease.

Bonus: Learn About Taxes on Rental Income in Florida

Although Florida has no state-level income tax, it does charge a state sales tax at a rate of 6% on all rental income. However, your operating expenses like mortgage interest, property taxes, property insurance, structural improvements, and yard maintenance can reduce your taxable rental property income.

Rental property taxes in Florida differ by county so it’s important to find out how much you will be paying so you can factor that into your rent price to avoid taking a loss. Haven’t purchased your rental property yet? Find out which counties charge the lowest property taxes to help maximize your profits!

Best Practice: Keep receipts for all of the services you pay for to maintain your rental property to help with tax deductions come tax season.

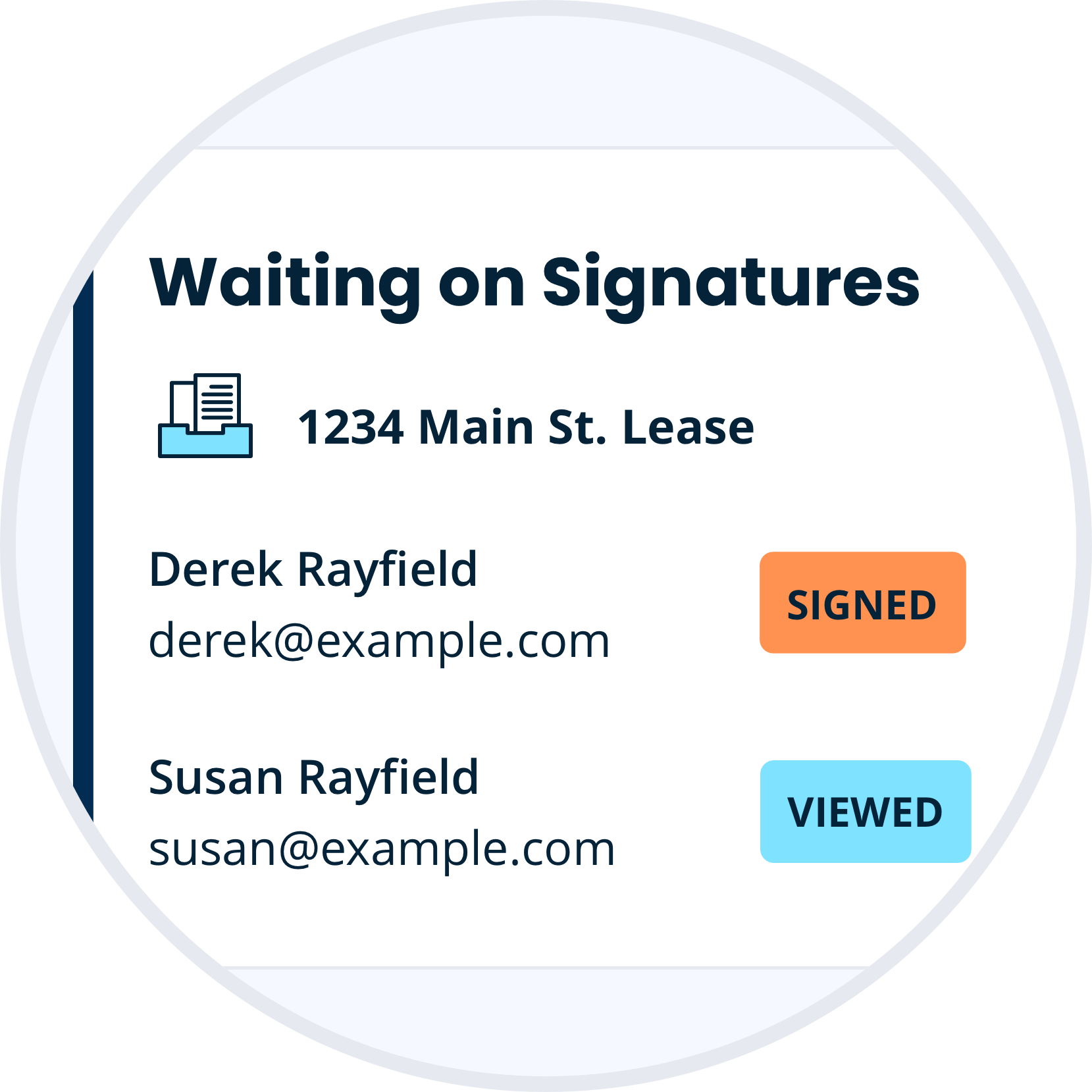

Unlimited Everything.

Create a single Florida lease agreement, or subscribe and receive unlimited lease agreements, landlord forms pack, and e-signs for a simple annual fee. Be confident with all the legal forms and tools you need as a professional landlord.

Discover Our Unlimited PlanBeing a landlord has never been easier thanks to the help of free landlord tools like TurboTenant. We’ll help you market your property, accept applications, screen tenants to find the right renter, create a lease, accept rent payments, and so much more. Florida’s rental industry is thriving so why not join in and start making passive income today!