Key Takeaways

- Maryland lease agreements must comply with specific state and local regulations.

- TurboTenant offers Maryland-specific lease templates, including for Baltimore and Montgomery County.

- Custom lease agreements allow landlords to detail unique rental terms and property rules.

- Maryland law caps late fees at 5% and requires security deposits not exceed twice the monthly rent.

- Security deposits must be returned with interest within 45 days, with proper receipts provided.

- Fair housing laws and habitability disclosures are mandatory inclusions in Maryland leases.

- Baltimore City and Montgomery County have additional unique lease requirements, such as floodplain disclosures and minimum lease terms.

- Non-refundable fees are prohibited in Montgomery County.

- County-specific regulations may dictate additional lease terms in Maryland counties like Prince George’s and Anne Arundel.

- General clauses include subletting restrictions, alteration permissions, and adherence to Maryland laws.

- Tenants must not engage in illegal activities or be nuisances, and only prevailing parties may recover legal fees in disputes.

Drafting a lease agreement in Maryland requires particular attention to state-specific regulations and practices that are essential for a legally binding and comprehensive document. TurboTenant’s Maryland Lease Agreement Generator and Templates are designed to help landlords craft agreements that conform to Maryland’s unique legal landscape, ensuring a smooth rental experience for both landlords and tenants. Due to specific, unique laws pertaining to Baltimore and Montgomery County, Maryland has 3 state specific leases to choose from.

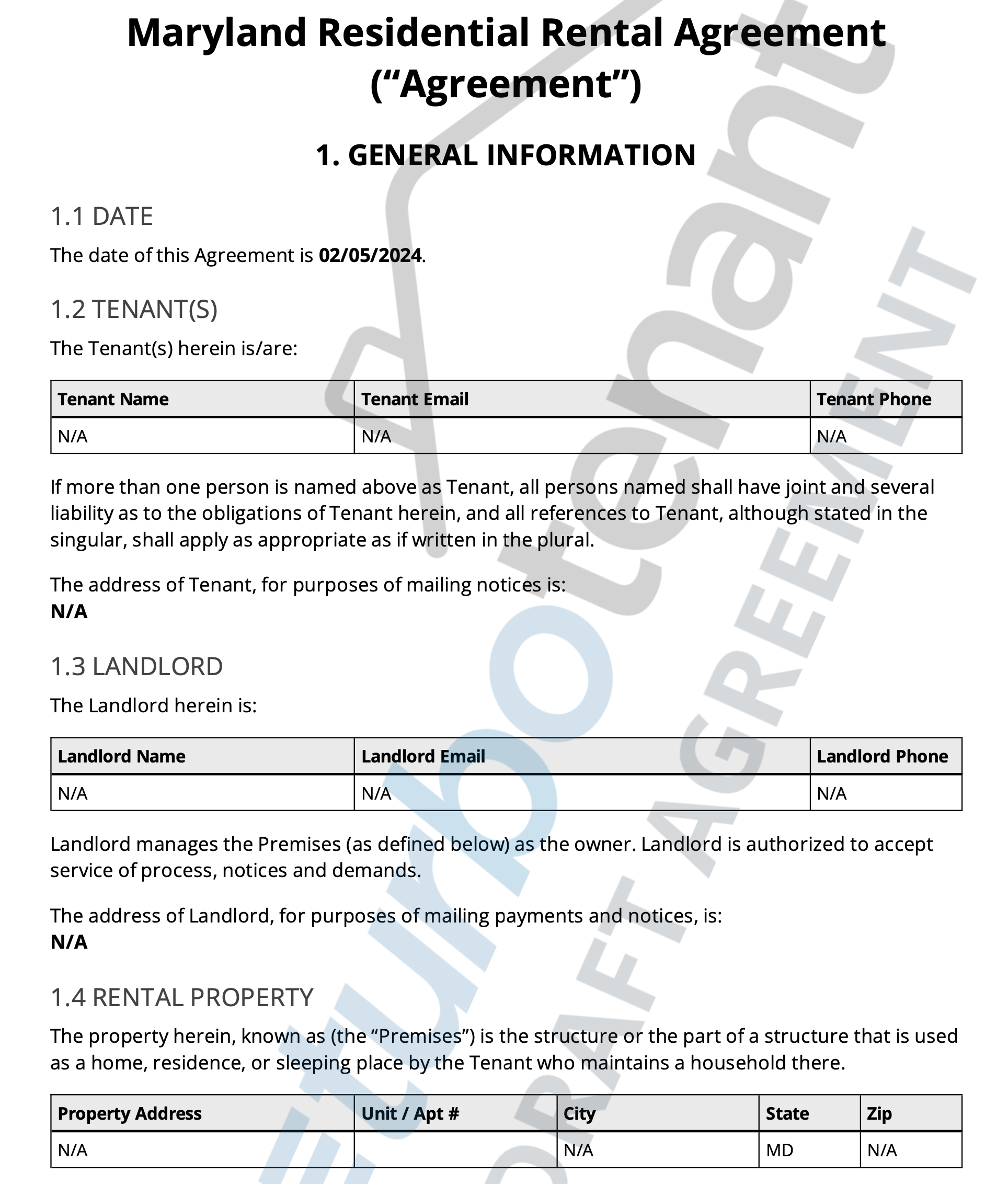

Custom Lease

The lease agreement starts with customizable details that are specific to your rental situation. This section is where you’ll include information about the parties involved in the lease, the rent amount, utility responsibilities, and any other particulars pertinent to your rental property. TurboTenant facilitates this process by providing a summary table at the beginning of the lease agreement for easy reference.

Key Customizable Elements

- Additional Provisions: Here, landlords can add any property-specific rules, necessary local clauses, or other unique stipulations they wish to enforce.

- Lost Key Policy: This clause requires tenants to bear the full cost of rekeying the property if they fail to return all keys upon moving out.

State-Specific Clauses

This section contains clauses that are specific to Maryland law to help landlords remain compliant with local regulations. These clauses should not be edited without first consulting with an attorney to make sure all changes remain compliant with state and/or local law. Notable Maryland Regulations

- Late Fees (Section 2.1): Maryland allows landlords to charge a late fee of 5% of the total unpaid rent amount if rent is not received by the 5th day of the month.

- Security Deposit Provisions (Section 2.4): Maryland law stipulates that landlords cannot require a security deposit more than twice the monthly rent. Deposits must be held in federally insured financial institutions, and landlords are required to return the security deposit with interest, less any rightful deductions, within 45 days after regaining possession of the premises. Receipts are required for all security deposits collected, and disclosure language of law is contained within this section.

- Fair Housing (Section 2.10): Maryland adheres to civil rights laws that prohibit housing discrimination. Landlords must conduct their rental practices according to all applicable fair housing laws and may need to research additional local ordinances for other protected classes.

- Habitability Disclosure (Section 2.15) is required by state law and is included in the lease.

Counties

Baltimore City Lease Agreement

This section contains clauses that are specific to the City of Baltimore, MD law to help landlords remain compliant with local regulations. These clauses should not be edited without first consulting with an attorney to make sure all changes remain compliant with state and/or local law. are non-editable within TurboTenant’s templates to ensure adherence to state laws.

- Late Fees (Section 2.1): Maryland allows landlords to charge a late fee of 5% of the total unpaid rent amount if rent is not received by the 10th day of the month.

- Security Deposit Provisions (Section 2.4): Maryland law stipulates that landlords cannot require a security deposit more than twice the monthly rent. Deposits must be held in federally insured financial institutions, and landlords are required to return the security deposit with interest, less any rightful deductions, within 45 days after regaining possession of the premises. Receipts are required for all security deposits collected, and disclosure language of law is contained within this section.

- Fair Housing (Section 2.10): Maryland adheres to civil rights laws that prohibit housing discrimination. Landlords must conduct their rental practices according to all applicable fair housing laws and may need to research additional local ordinances for other

- Habitability Disclosure (Section 2.15) is required by state law and is included in the lease.

- Shared Utilities (Section 2.16) disclosure is required under Baltimore ordinance, listing all shared water/wastewater utilities, how they are divided and the average monthly allocated cost for the preceding 12 mos.

- Floodplain Disclosure (Section 2.17) is required to be in the lease disclosing if the premises, motor vehicle parking area or separate storage facilities are within an area prone to flooding.

Montgomery County Lease Agreement

This section contains clauses that are specific to Montgomery County, MD law to help landlords remain compliant with local regulations. These clauses should not be edited without first consulting with an attorney to make sure all changes remain compliant with state and/or local law. are non-editable within TurboTenant’s templates to ensure adherence to state laws.

- Non-Refundable Fees, including pet deposits or move in fees, are not allowed in Montgomery County.

- Initial lease terms must be at least 2 years in length in Montgomery County, MD

- Landlord-Tenant handbook must be attached to the lease.

- Late Fees (Section 2.1): Maryland allows landlords to charge a late fee of 5% of the total unpaid rent amount if rent is not received by the 10th day of the month.

- Security Deposit Provisions (Section 2.4): Maryland law stipulates that landlords cannot require a security deposit more than twice the monthly rent. Deposits must be held in federally insured financial institutions, and landlords are required to return the security deposit with interest, less any rightful deductions, within 45 days after regaining possession of the premises. Receipts are required for all security deposits collected, and disclosure language of law is contained within this section.

- Fair Housing (Section 2.10): Maryland adheres to civil rights laws that prohibit housing discrimination. Landlords must conduct their rental practices according to all applicable fair housing laws and may need to research additional local ordinances for other

- Habitability Disclosure (Section 2.15) is required by state law and is included in the lease.

- Window Guard Disclosure (Section 2.16) requires advisement of tenant’s right to have window guards installed for all units above ground floor, upon request.

- Shared Utilities (Section 2.17) disclosure is required under Baltimore ordinance, listing all shared water/wastewater utilities, how they are divided and the average monthly allocated cost for the preceding 12 mos.

Prince George’s County

- Unique requirements for rental property licensing and inspections.

- Landlords must adhere to county-defined property standards.

Baltimore County

- Generally follows Maryland state laws.

- The city of Baltimore has distinct laws regarding security deposits, notice periods for tenants, and rent control for selected properties.

Anne Arundel County

- Local housing codes and tenant protections in the city of Annapolis and Anne Arundel County may dictate lease specifics.

Howard County

- Lease clauses may be influenced by housing quality standards and rental property licensing.

- Tenant protections are also a consideration in lease terms.

Frederick County

- Local housing codes can affect lease agreements, adding layers on top of state regulations.

Harford County

- Lease agreements might include clauses based on property maintenance and safety standards defined by local ordinances.

To ensure lease agreements are compliant with both Maryland state and county-specific laws, landlords should consult with legal professionals familiar with the nuances of Maryland’s landlord-tenant laws and the intricacies of county-level ordinances. This due diligence will safeguard the legality of the lease and the rights of all parties involved in the leasing agreement.

General Clauses

The general clauses in Section 3 are common to most lease agreements and align with best practices in landlord-tenant relations, as advised by experienced landlords.

Key General Clauses

- Subletting (Section 3.1): Tenants are not permitted to sublease the property without the landlord’s written consent.

- Altering or Improving the Property (Section 3.2): Tenants must obtain written permission before making any alterations or improvements to the property, ensuring it is returned in the same condition as when they moved in.

- Choice of Law (Section 3.11): The lease agreement is governed by Maryland laws, and parties must consent to the use of county courts where the property is situated.

Additional Considerations

- Follow the Law (Section 3.14): Tenants are obligated not to violate any laws or ordinances while on the property and must refrain from being a nuisance to neighbors.

- Attorney/Collection Fees (Section 3.17) Only the prevailing party in a legal enforcement or collection shall be entitled to recover legal fees and costs awarded by a court. (For Baltimore and Montgomery County leases).

FAQ

What constitutes a valid late fee in Maryland?

A valid late fee in Maryland is 5% of the total unpaid rent amount and can be charged if rent is not received by the 3rd day of the month, as stated in Section 2.1.

How should security deposits be handled in Maryland?

In Maryland, landlords cannot ask for more than twice the monthly rent as a security deposit. They must return the deposit plus applicable interest, minus any justified deductions, within 45 days after gaining possession of the property, as detailed in Section 2.4.

Is it necessary to follow fair housing laws in Maryland?

Yes, it is crucial to comply with fair housing laws that prohibit discrimination in Maryland. Landlords should familiarize themselves with these laws and any additional local ordinances, as outlined in Section 2.11.

Can tenants make changes to the rental property?

Tenants must obtain the landlord’s written permission before making any alterations or improvements to the rental property. This ensures the property remains in its original condition, as per Section 3.2.

TurboTenant Maryland Lease Agreements

TurboTenant’s Lease Agreement Generator and Templates for Maryland provide landlords with a streamlined process for creating lease agreements that are compliant with Maryland’s specific legal requirements. These tools assist landlords in drafting detailed agreements that protect their rights and ensure a legally sound leasing process. For custom lease provisions or additional guidance, consulting with a legal professional is always recommended to ensure your lease agreement aligns with Maryland law and best practices.

Maryland Resources