- Benefits of Renters Insurance for Landlords

- How to Require Renters Insurance

- Renters Insurance in Your TurboTenant Account

- Renters Insurance FAQ

Renters insurance is a protective tool for renters, but did you know that it can benefit landlords too? The reality is landlords are also provided added security when their tenants purchase renters insurance. With these added benefits being so great and only 37% of renters purchasing insurance, many landlords now require their tenants to buy insurance. Keep reading as we guide you through why and how to require renters insurance as a landlord.

Create a Custom Lease Agreement

Set up customizable lease agreements right in your TurboTenant account! Purchase a single lease agreement, or subscribe and receive unlimited lease agreements, plus electronic signatures and landlord forms.

Renters insurance is insurance paid for by a tenant renting a living space. It provides coverage for:

Accidents & Natural Disasters

Damage to the property caused by plumbing malfunctions, floods, fire, smoke, or objects hitting or falling on your property.

Malicious Actions

Insurance will cover the cost of a tenant’s personal items stolen from the property, vandalism, or civil commotion that damages the property.

Liability

If someone gets injured on the property, renters insurance can cover their medical bills and even the renter’s legal defense cost.

Additional Living Expenses

Renters insurance can cover living expenses such as hotel bills if something happens to the property, making it uninhabitable.

Benefits of Renters Insurance for Landlords

If you have never required renter’s insurance before, you might only know the basics of what it does. For renters, it protects their belongings and possessions from theft, damage, and more. At the same time, the benefits it provides for landlords is just as essential to mitigate stress, legal issues, and tenant conflicts:

1. Added Security for Both Landlords and Tenants

In most cases, landlords will not be responsible for their tenant’s lost property, and renters will be able to recover some of what was lost through their insurance. Without renters insurance, tenants may ask their landlord to cover their losses. Requiring renters insurance will comfort you both, knowing their items are covered.

2. Renters Insurance Can Reduce Out-of-Pocket Costs

Landlords carry their own insurance to cover their rental properties in case disaster strikes. However, many landlord insurances also come with a fairly high deductible, and filing claims often result in a higher premium for landlords. This gap in the coverage is where renters insurance can help. It will contribute to repairs following significant disasters that might take place on the property. Utilizing renters insurance can lend a helping hand, so landlords don’t have to file claims for everything, saving them money in the long run.

3. Reduces Legal Issues

Beyond disputes between the renter and landlord, if a guest or neighbor is injured on the property and tries to file a lawsuit, without renters insurance, the landlord could take the blame. Renters insurance will cover both legal fees and medical bills if a guest gets injured onsite.

4. Improve the Tenant Screening Process

Many renters are unfamiliar with the benefits renters insurance provides. Requiring renters insurance can help you find tenants willing to pay for insurance and avoid those who refuse to acquire it or can’t afford it.

5. Smoother Relationships with Tenants

Landlord and tenant communication is vital when it comes to running your rental business, and being upfront about requiring renters insurance will help you find a tenant whose values align with your own. Maintaining a strong relationship with tenants will alleviate any conflicts related to damages or liability, and a tenant with renters insurance will usually be far more willing to take responsibility for their items than tenants without insurance.

6. Pet Liability Coverage

Renters insurance can also provide pet liability coverage. This will help mitigate costs if the tenant’s pet injures someone or causes damage to the property. Having this additional protection can give landlords the peace of mind to allow tenants to own pets (although we still suggest asking for a pet resume to ensure the pet is a good fit).

How to Require Renters Insurance

Requiring renters insurance is easy. Your first step will be to check local and state guidelines to make sure it is legal for landlords to require renters insurance in your state. Once you have confirmed you can require insurance, you’ll need to include a renters insurance clause in the lease agreement.

It’s never a bad idea to check for proof of insurance from new renters and those renewing their lease. Sometimes, renters forget their policy has ended. Checking in can serve as a reminder to renew their policy, and confirming your tenants still have renters insurance will let you both rest easy knowing the property and their belongings are covered.

Renters Insurance in Your TurboTenant Account

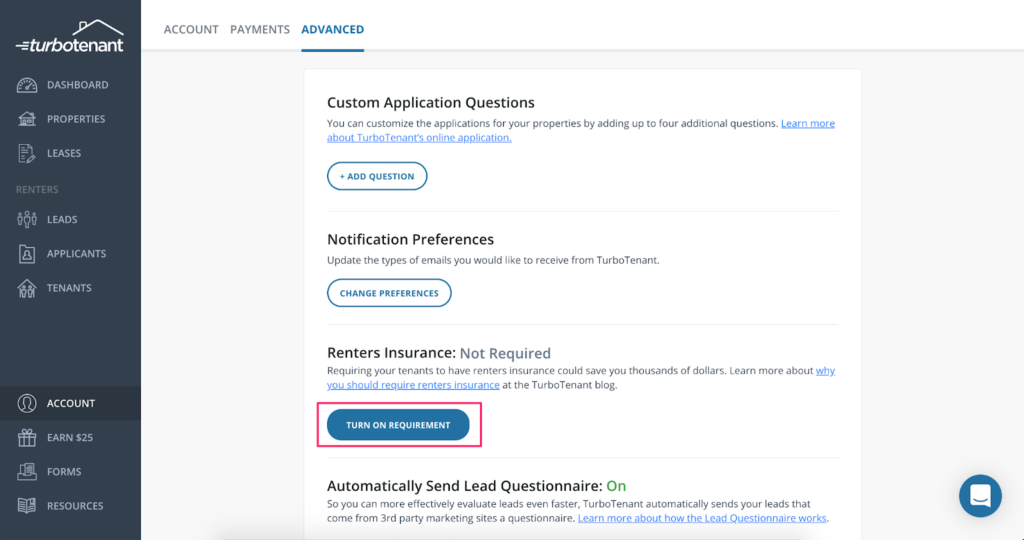

You can require renters insurance, add a clause to your lease agreement, and your tenant can even purchase a plan right from the comfort of your TurboTenant account. Under the advanced tab in your TurboTenant account settings, you can turn on the renters insurance requirement.

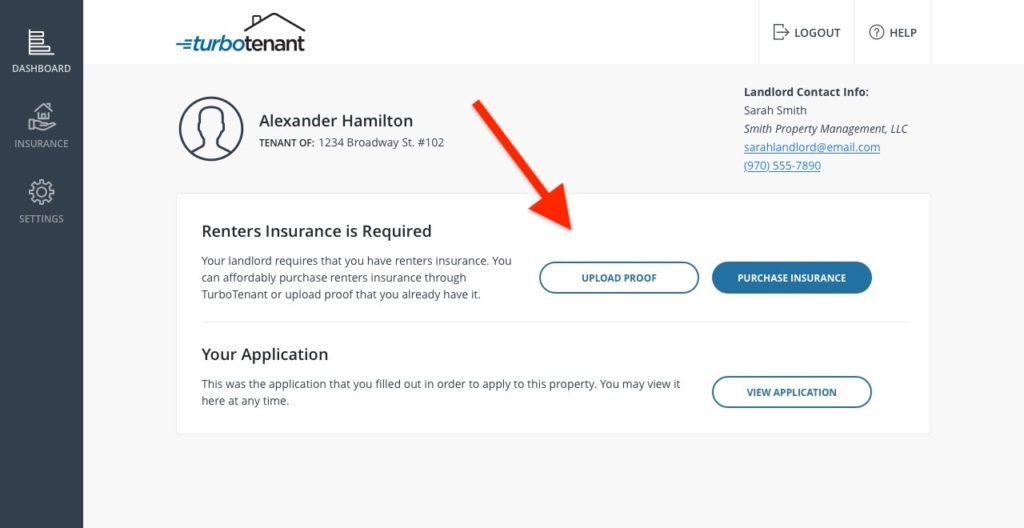

Once you accept a new tenant, TurboTenant will automatically send them an email letting them know that you require renters insurance as part of the lease agreement, and they will be asked to provide proof within their TurboTenant account. Here they will also be given the option to purchase a plan through TurboTenants partnership with SURE.

Once your tenant uploads their proof of policy, we will send you an email letting you know that your tenant is covered. We’ll also keep you both up to date on whether their policy changes, is canceled, or expires.

The bottom line is that renters insurance helps mitigate risks for renters and landlords alike. Plus, renters insurance is reasonably priced, with plans that start as low as $8/month (about the same as that overpriced cup of coffee). Which means your tenants can choose a plan that fits their needs without causing undue financial hardship, and you can sleep well knowing yours and your tenant’s property is covered.

FAQ

Why don’t renters purchase renters insurance?

While there are many reasons why renters choose to rent without insurance, the most common is that they are uneducated about what exactly renters insurance is and how it helps them. As a landlord, helping to inform potential tenants about what all renters insurance covers will go a long way in finding or creating a tenant willing to purchase renters insurance.

What does renters insurance cover?

Renters insurance can be purchased by anyone renting a home, apartment, condo, townhouse, or any other type of living space. It covers costs of legal liability, damage, or theft. Renters insurance can even cover damages or injuries caused by the tenant’s pet. It will also cover living expenses if something, like a fire, occurs and the property becomes uninhabitable.

Is requiring renters insurance legal?

In most states, it is entirely legal for landlords to require renters insurance. If you are a landlord, be sure to study your local and state law before requiring renters insurance for your tenants.

Why do some landlords require renters insurance?

Many landlords are starting to require renters insurance because they want their tenant’s items to be protected in case of damage or theft. Without renters insurance, landlords could be liable for the cost of items stolen or ruined in a disaster. Renters insurance can also help landlords avoid large deductibles in case of damage to the rental property if a fire or some other accident occurs.

How expensive is renters insurance?

Depending on the policy, renters insurance is very inexpensive. Renters can choose a policy that will work best for them in terms of coverage and pricing. With some policies starting as low as $8 per month, renters insurance can be very affordable for tenants.

DISCLAIMER: TurboTenant, Inc. does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.