Do you know who’s moving in? Without a thorough tenant screening report, you leave yourself open to financial harm. But when you use one of the best tenant screening services in 2024, you’ll get a clear, transparent, and unbiased picture of your interested parties.

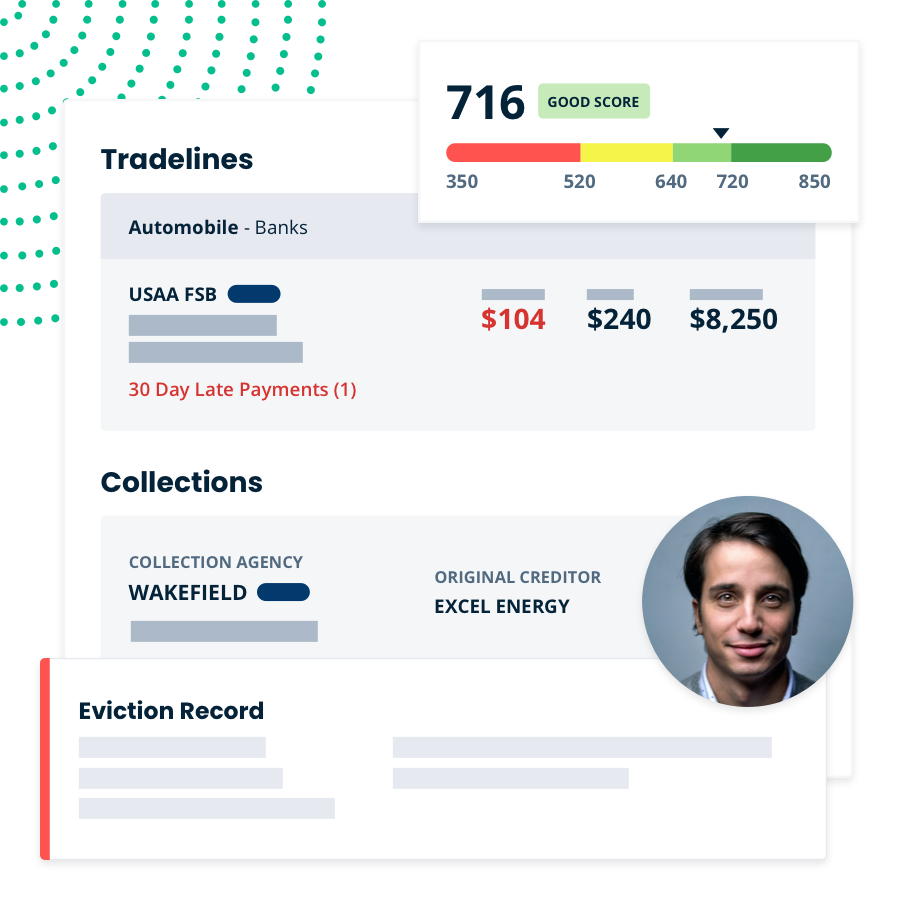

Of course, screening reports aren’t the end-all solution for predicting the future. Sometimes, tenants fall on hard times. But, a detailed summary (where permitted) of creditworthiness, eviction records, criminal histories, and income provides meaningful data to help you make sound decisions.

When you combine them into one comprehensive report, you can effortlessly select the tenants who are most likely to uphold their end of the bargain. To make your life easier, we examined the best background screening services for landlords.

But first, let’s break down the key components of exhaustive rental screening reports.

Critical Components of a Rental Screening Report

Like humans have multiple facets to their lives and personalities, tenant screening services do, too. The best reports analyze several factors of a renter’s life to create a general overview of that individual.

Here are the most important components.

Identity Verification

The first step is to know who you’re talking to. If there are discrepancies between who a renter says they are compared to what the report says, you’ll want to steer clear.

Credit Check

Knowing potential tenants’ credit scores and whether or not they pay their bills on time will give you a great idea of whether you can expect rent promptly every month. If they carry large amounts of debt, that may indicate they’re not financially fit to afford your place.

Be sure that the tenant screening service you choose puts this information front and center.

Background Check

Background check for tenants differ depending on the service you choose and the state you live in. The best solutions (where allowed) review a person’s criminal history, eviction history, and sometimes employment history.

Knowing this information helps you evaluate an applicant’s trustworthiness and any potential risk factors.

Income Verification

Some potential tenants may fudge the numbers. By including income verification in your screening reports, you can ensure that the renters staying in your property have the financial means to pay rent on time.

Tenant Screening Services Backends

There are three primary tenant screening agencies, and you’re likely familiar with them: TransUnion®, Equifax®, and Experian®. These bureaus power tenant screening companies.

Each reporting agency has its own processes for conducting tenant screenings, but they generally cover the same aspects, including identity verification, credit checks, background checks, and more.

TransUnion

TransUnion is the most widely used tenant screening reporting agency in property management software solutions. In fact, it’s the tenant screening choice of TurboTenant and a large number of its competitors. Under the TransUnion umbrella is SmartMove®.

SmartMove provides a portal for entering tenant information, which is then used to pull up information from TransUnion. Compared to Equifax, the process is much simpler, and landlords can complete these tasks themselves without an intermediary. When it comes time to pay, you can elect to pay yourself or have the would-be tenant pay.

SmartMove offers three tiers of reports. In the most expensive option, at $44, you’ll see:

- TransUnion’s proprietary ResidentScore®

- Criminal background reports

- Credit reports

- Eviction related reports

- An Income Insights report

You can choose a less expensive option if you need less information, but more information is always better. Compared to the other two options discussed below, ResidentScore was designed for landlords and property managers to help them better gauge rental outcomes.

While SmartMove is easy to use, it’s just one piece of the puzzle. For landlords, tenant screening, marketing properties, collecting rent, and accounting are critical. If all your processes are set and you just need a tenant screening report, then SmartMove will work for you.

But, if you need a comprehensive set of tools to manage your properties, utilize a software solution to complete tenant screening, which is done by TransUnion anyway, and integrate it with all the other features you need, including tenant management, maintenance, and more.

Equifax

Landlords can’t directly go to Equifax to obtain a tenant screening report. Instead, they’ll use a tenant screening company to compile the renter’s information, and Equifax will search its TotalVerify™ data hub to provide a report on a potential tenant. Included in the data, you’ll find:

- Bankruptcies

- Evictions

- Address history

- National criminal records

- Recent criminal convictions

- Sex offender status

Tenant screening companies combine this data with a credit score to create an overall picture of a tenant. Equifax’s process can make it difficult for even large landlords to use their products, so you may want to find a more straightforward solution.

And again, you won’t get any additional property management features with an Equifax screening report unless you find a landlord software company that uses it.

Experian

Like Equifax, using Experian without a third party isn’t the easiest task. In fact, Experian teamed with Zillow to provide tenant screening reports that include:

- An Experian credit report

- Zillow’s residence history

- A Zillow background check (national criminal search, sex offender search, housing court records history)

- Income and employment verification

Zillow also offers a property management solution called Zillow Rental Manager. With it, landlords get more property management features than they would with just a simple tenant screening. But, it isn’t the most cost-effective option compared to tools like TurboTenant, especially as it relates to property listing costs.

For more information on TurboTenant vs Zillow Rental Manager, click here.

Top Tenant Screening Services in 2024

As you can see, the best tenant screening services use agencies to obtain their data. You’ll get great reports no matter which service you use. But, for the most part, you’ll access data from these services via an intermediary. Choosing a great partner to get your reports from while helping you with other critical tasks is the best way to maximize your time and money.

That’s where property management software comes in. It makes screening tenants much more accessible. Rather than tenant screening occupying a silo in the overall landscape of your landlording tasks, you can tie them all together in easy-to-use solutions that integrate all the most critical aspects of management under a single roof.

TurboTenant

TurboTenant is an all-in-one property management solution. You or your tenant will pay for a screening report regardless, so why not utilize a service that can also manage the following aspects of your business in addition to providing TransUnion’s excellent tenant screening reports?

- Property Marketing

- Rental Applications

- Lease Agreements

- Rent Collections

- Showing Scheduling

- Accounting

- Maintenance Management

Rather than running tenant screening reports individually, combine all your management tasks for the most time savings. Move interested parties from applicant to screening, and if they pass, generate and sign the lease from the same window.

The best part is that all the critical features you need to run an efficient and profitable rental business are free for landlords. You won’t need to sign up for a free trial or enter a credit card. Just sign up and try it out.

Note: Screening reports cost $55 for free subscribers, who can choose to pass that cost on to their tenants. Premium users’ reports cost $45, and they include Income Insights to see how their reported income compares to TransUnion’s information.

AppFolio

Unlike TurboTenant, AppFolio uses Experian to run its tenant screening reports. But like TurboTenant, it offers many property management features that do more than just provide screening reports.

You’ll find features like rent collection, accounting, and maintenance, but the big difference between the two is price. AppFolio includes a 50-unit minimum and a $298 minimum monthly spend, which comes out to more than $3,500 per year. For some landlords, this price may be prohibitive.

On the other hand, if you find yourself with that many doors, their tenant screening options are inexpensive. For $20, the tenant screening report will show you:

- Credit

- Rental payment history

- Nationwide eviction history

- Rental history verification

- Criminal history

Landlords also get an income verification screening for $12 as an add-on. The total, per report, is $13 less than TurboTenant. However, when you factor in the $298 minimum monthly spend compared to TurboTenant’s $119 per year Premium option, you’ll save significantly by going with TurboTenant.

RentPrep

RentPrep is primarily a tenant screening service, though it’s a Roofstock company like Stessa.

RentPrep lists three pricing tiers for their reports. In their full report, priced at $40 each, landlords have access to the following:

- A full credit report

- TransUnion’s ResidentScore

- Rental background check

- SSN verification

- Nationwide criminal and sex offender search

- Nationwide evictions

- Bankruptcies

Then, you can add on checks like judgment and liens or income verification for an added cost.

The lower tier does not include the full credit report, ResidentScore, or criminal/eviction histories. In short, RentPrep can be a good option if you just need a tenant screening solution, but unless you choose to also use Stessa, you’ll miss out on a number of key features.

The Importance of Background Check Software for Tenants and Landlords

Background check software contributes to the tenant screening process by helping landlords assess the risk associated with potential tenants. Through its automated system, it ensures legal compliance with fair housing laws, streamlines the screening process, and reduces the potential for human errors.

Leveraging this technology allows landlords to identify applicants who align with their specific rental criteria, creating a more reliable tenant base. Plus, it instills a sense of security by helping maintain a safe living environment for all residents through thorough vetting.

The software’s ability to support efficient decision-making enables landlords to fill vacant units with qualified tenants promptly. Its automated system helps ensure a consistent and unbiased screening process, aligning landlords with legal requirements.

Ultimately, background check software enhances the overall success and risk management of property management and rental endeavors, contributing to a secure, compliant, and financially sustainable rental enterprise.

TurboTenant: A One-Stop Solution for Tenant Screening

Of the best tenant screening services available, TurboTenant stands out. It facilitates an in-depth evaluation of prospective tenants to safeguard your property and financial future saving you headaches down the road.

The rental screening report equips landlords with vital information, including credit history, eviction records, criminal background checks, fraud indicators, and even Income Insights (if you choose Premium) to get a detailed financial and criminal view of potential tenants before they move a single piece of furniture in.

It’s a fantastic way to mitigate the risk of unreliable renters while supporting legal compliance with fair housing laws. Plus, with it’s property management features, you can do far more than run reports. Sign up for a free account today and try it out. No credit card or trials to deal with, ever.