Landlord insurance, also known as rental property insurance, is an insurance coverage policy that protects property owners who rent out their property. For example, a property owner (we’ll call her Denise) has bought a new home and decided to keep her first home as an investment, which she will rent out.

While Denise already has homeowners insurance for her soon-to-be rental, she will now need to purchase a landlord insurance policy instead. Why? Let’s break it down.

The Difference Between Homeowners Insurance and Landlord Insurance

Standard homeowners insurance policies cover the building and personal property damage, as well as liability, but it only covers these things when the dwelling is actively occupied by the property owner. So once Denise’s tenants move in, her homeowners insurance policy will no longer cover any property damage that occurs while tenants are occupying the rental. This doesn’t bode well for Denise or her investment.

Separate from homeowners insurance, landlord insurance is intended specifically for property owners who plan on renting out their property for an extended period of time. Landlord insurance policies cover everything a general homeowners insurance policy covers, plus many other perils property owners could experience in their time as a landlord. With a landlord insurance policy, Denise knows her rental (and bank account) will be taken care of if anything unfortunate were to happen.

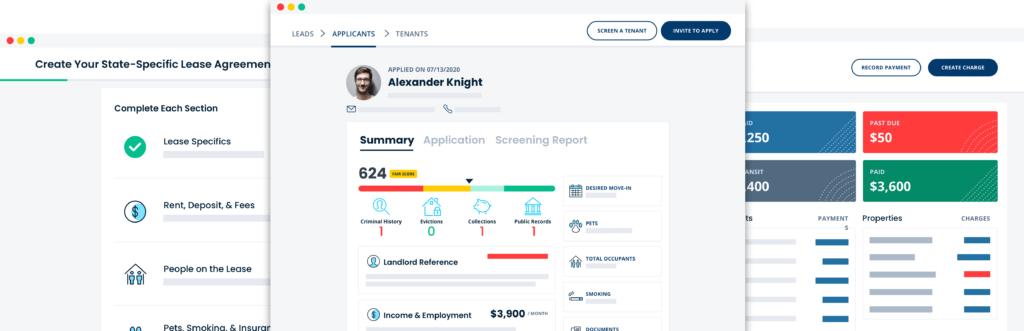

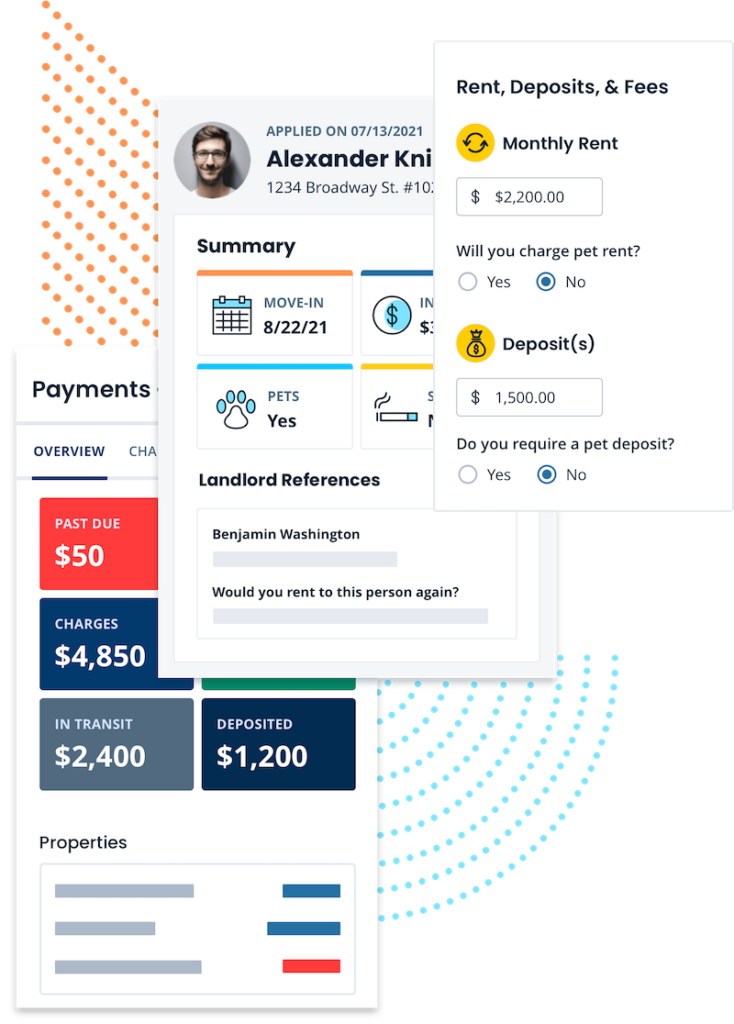

Streamline Your Rental Property Management

What does landlord insurance cover and not cover?

Landlord insurance coverage all depends on the type of policy you choose, but a good, comprehensive policy will include three key protections:

- Property damage – Covers any damage to the property caused by a natural disaster, vandalism, theft, irresponsible tenants, or anything else that could damage the physical structure of the property.

- Loss of rental income/rental income protection – Should something occur that causes your property to be uninhabitable, such as a natural disaster or severe mold, this coverage provides temporary rental income reimbursement that acts as a replacement for the rent a landlord would be receiving as usual if a tenant was occupying their property.

- Liability – Covers any medical or legal fees, such as lawsuits, bodily injury claims, and settlement costs, that could ensue if a tenant or a visitor were to get injured on the property.

For many policies, additional coverage or add ons are available, all of which will serve to protect your investment and yourself as a landlord. Some additional coverage options include:

- Flood insurance which covers general water or flood damage.

- Guaranteed income insurance covers partial or full rent payments if the tenant is unable to pay for one month – something many landlords experienced during the height of the pandemic.

- Property coverage covers your furnishings if you are renting out a furnished rental unit.

Keep in mind that the amount and type of additional coverage varies from insurance provider to insurance provider, so you will need to determine which provider is best for your landlord needs.

Now that you know what landlord insurance covers, let’s briefly review what it does not cover. First and foremost, landlord insurance excludes protection for a tenant’s personal belongings. Tenants will need to purchase a renter’s insurance policy for this, which surprisingly also benefits landlords! Additionally, landlord insurance doesn’t cover normal wear and tear, which is any damage that occurs as a natural result of the property being inhabited. This one might be obvious, but it doesn’t hurt to mention – landlord insurance does not cover properties in which the owner lives due to the fact that landlord insurance is specifically designed to cover “non-owner-occupied” properties.

Landlord insurance is a fantastic way to protect your investment - but your appliances might not be covered. Learn more about protecting your appliances and major systems with a home warranty plan!

What are the different types of landlord insurance?

As with any insurance, the coverage you receive will depend on the type of insurance policy you select. The different types of landlord insurance are labeled as “dwelling policies,” and they fall into three categories. You’ll discover that as the number associated with the policy increases, the types of coverage expand.

- Dwelling Policy 1 (DP-1): This is, of course, the most basic policy that covers common occurrences like fire, vandalism, windstorm, and hail. Because the coverage is so limited, this is also the cheapest option. It’s important to note that with this policy, claims that are covered will only be reimbursed for the actual cash value (ACV), which is the depreciated rebuild value of the dwelling.

- Dwelling Policy 2 (DP-2): This policy covers everything included in DP-1, plus burglary damage, freezing of pipes, falling objects, and loss of income. Essentially, it covers more substantial and less likely damage and incidences. But the biggest difference between DP-1 and DP-2 is that the latter policy pays out the replacement cost value (RCV), meaning the policy will pay to restore the dwelling to its original condition.

- Dwelling Policy 3 (DP-3): This is the most common and comprehensive type of policy that offers the broadest form of protection. While DP-1 and DP-2 only cover the specific incidences listed in the policy, DP-3 is an “all-risk” policy that covers any perils a landlord may run into.

The Benefits of Landlord Insurance

The benefit of landlord insurance boils down to one thing – fewer out-of-pocket costs for landlords. But, let’s break down the benefits so you can see exactly why you need landlord insurance:

- Liability protection protects landlords from legal or medical fees in the case that a tenant or their guest is injured on the landlord’s property. Tenants can sue for a pay-out or for coverage of medical expenses related to everything from physical injury and death to financial difficulty and emotional harm. With liability coverage, any possible expenses related to legal or medical fees will be covered, protecting you from out-of-pocket costs.

- Rental income protection may be the top benefit provided by landlord insurance. In the case that something happens to your property that makes it uninhabitable, such as fire, mold, or tornado damage, this element of protection will cover the financial loss that you would endure during the time you are unable to rent out the dwelling. Usually, the coverage will only extend up to a defined period of time such as 12 months, but that’s 12 months you could have not been paid rent. When purchasing a policy, always check to make sure your policy includes rental income protection if you desire it.

- Certain tenant damage coverage can cover two types of damage caused by the tenant: accidental and malicious or intentional damage. In both cases of coverage, the insurance provider will help cover the costs of repair or replacement for the damaged item(s). Once again, when purchasing a policy, always check to make your chosen policy covers both types of certain tenant damage.

How much does landlord insurance cost?

It’s the big question – how much does landlord insurance cost? Landlord insurance costs vary due to several factors: the location and size of the rental, the cost to repair damage, and the level of coverage. To put it simply, the more comprehensive the coverage, the more expensive the policy will be.

However, this doesn’t mean we can’t get a cost estimate. According to the Insurance Information Institute, landlord insurance costs about 25% more than a typical homeowners insurance policy. If the average premium for home insurance is around $1,200, we can calculate that a landlord insurance policy premium could cost you roughly $1,500. Once again, it will all depend on the type of coverage and the insurance company you go with.

Many of you know insurance is a highly competitive business, and there are several great companies out there to choose from. Through our research, we found that out of all the top insurance providers, Steadily offers the most comprehensive landlord insurance policies for a wide range of properties like single-family homes, condos, and townhomes.

Landlord Insurance FAQ

Is landlord rental insurance worth it?

The short answer is yes. Seeing that homeowners insurance does not cover any property damage that occurs while tenants are occupying the rental, landlords need a different type of coverage that accounts for the risks associated with a rental business.

Is landlord insurance tax deductible?

Luckily, yes! Landlords are permitted to make a tax deduction for the entire landlord insurance premium for your rental. This is because insurance is considered a normal business expense by the IRS. Learn how to properly track your expenses today!

What is the difference between renter’s insurance and landlord insurance?

Renter’s insurance and landlord insurance differs in what the policy covers and who pays for it. Renter’s insurance is always paid for by the renter and covers their personal belongings, renter liability, and temporary living expenses. Landlord insurance is paid for by the landlord and covers the actual dwelling, owner liability, and loss of income. It’s crucial to know that renter’s insurance will not cover any damage to the actual rental property, thus landlord insurance is necessary.

Should a landlord have both homeowners insurance and landlord insurance?

Generally, no, landlords do not need both homeowners insurance and landlords insurance at the same time due to the fact that homeowners insurance is only intended for properties inhabited by their owner.

Do I need landlord insurance if I’m only renting out my room?

A homeowners insurance policy may offer coverage if you’re only renting out a room in the property you own and reside in. But, this can depend on the number of renters and the length of their stay. Homeowners insurance coverage of scenarios like this will vary by insurer and policy, so always check with your agent before renting out a room in your place.

Whether lightning strikes your rental and causes electrical issues or black mold is discovered in your rental’s walls leading to a full renovation, as a landlord you’ll want to know you are financially protected. And to be fully protected, landlord insurance is a must.

We hope this guide has helped you come to a conclusion on if landlord insurance is right for you and your rental business. Ready to leave your landlord worries behind? Sign up now for landlord insurance with Steadily.