In this edition of The TurboTenant report, we will be focusing on the best places to buy an investment property in Michigan. Three towns made our list: Grand Rapids, Detroit, and Saginaw. We curated data from studies on the best places to buy an investment property, median sale prices, and proprietary TurboTenant data. The TurboTenant Data includes stats on the average number of leads a rental property received, as well as the average number of days on the market. These two points will help an investor determine the strength of the rental market, as well as estimating potential vacancy rates.

Michigan is the only state to consist of two peninsulas. The lower peninsula is shaped like a mitten, hence one of the nicknames “The Mitten State.” The lower and upper peninsula (often called the U.P.) is separated by the Strait of Mackinac. The state has the longest freshwater coastline in the world, and is bound by four out of the five Great Lakes as well as Lake Saint Claire. Fun fact: you are never more than six miles from a freshwater source when in Michigan. Although it’s the boating capital of the world, Michigan has year round fun to offer. The state boasts over 40 ski area where you can snowboard, downhill, or cross-country ski. If you would rather stay inside and watch a game, MI has got you covered in that area as well- Lions, Tigers, and Pistons oh my!

Let’s take a look at the best places to buy a rental investment property in The Great Lakes State.

#3: Saginaw, MI

Saginaw is located in Mid-Michigan on the lower peninsula. Saginaw was a thriving lumber town in the 19th century, however the economy took a hit in the latter half of the 20th century, and during the financial crisis starting in 2007. But the community has been working towards a comeback, and today its economy relies on clean energy and manufacturing exports. The city is one of the U.S. leaders in manufacturing job hires. The median sale price sits at $100k, which is a 24.7% increase year over year. The average rent price is coming in at $693, and landlords are averaging 28 leads per property and 10 days on the market.

- Population growth: -1.2%

- Employment growth: 0%

- Increase in home values: 24.7%

Median Sale Price: $100k

Average Rent: $693

Average Number of Leads per Property: 28

Number of days on the rental market: 10

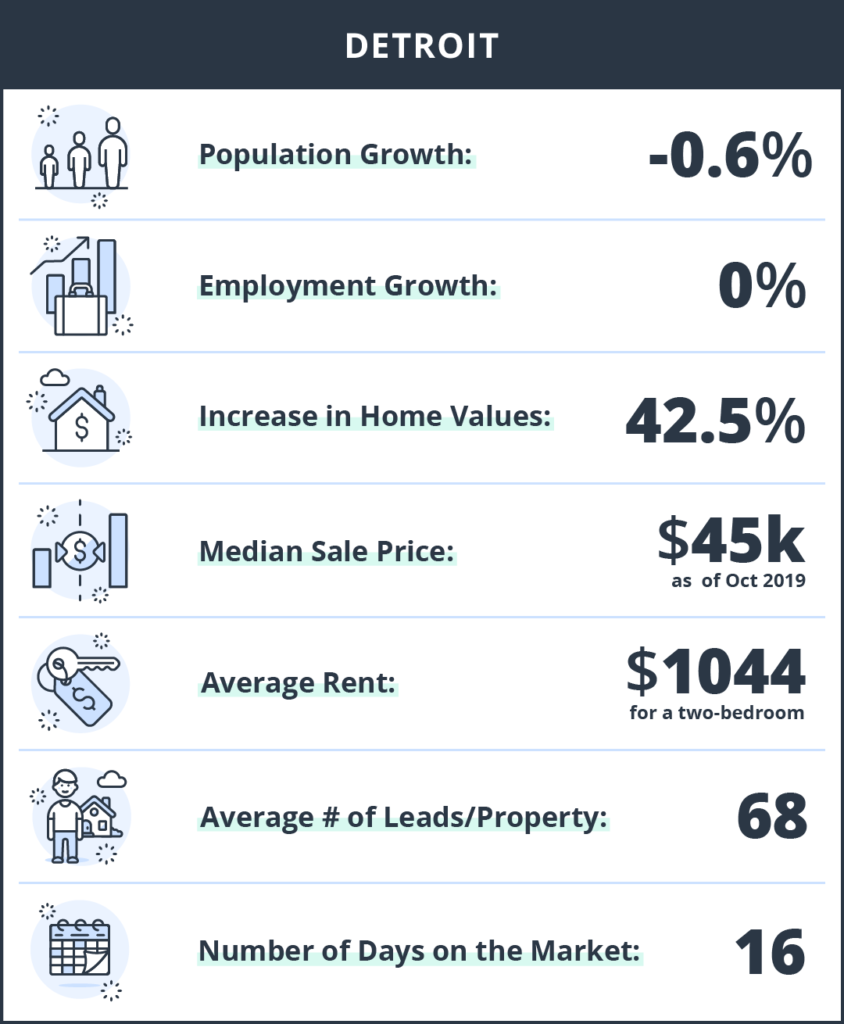

#2: Detroit, MI

“It’s go time Detroit” which is the city’s official motto. The Motor City is the largest city in MI, and the largest city that sits on an American/Canadian border. In an effort to combat decades long population declines, in recent years several revitalization initiatives were taken by Detroit citizens and new inhabitants. This includes renovations to the Michigan Central Station, urban gardening movements, and an LED street lighting system. Home prices have also seen a revitalization, reporting a 42.5% increase year over year, with a median sale price of $45k. The average rent is coming in at $1044, leads per property is a whooping 68, and the number of days on the market is 16 days. It’s investment go time Rock City!

- Population growth: -0.6%

- Employment growth: 0%

- Increase in home values: 42.5%

Median Sale Price: $45k

Average Rent: $1044

Average Number of Leads per Property: 68

Number of days on the rental market: 16

#1: Grand Rapids, MI

Grand Rapids is the second largest city in Michigan, and the largest city in West Michigan. It is located on the Grand River and 30 miles from Lake Michigan. Its deep history in furniture making has gotten it the nickname “Furniture City,” and it is still home to five of the world’s largest office furniture companies. Other economic drivers include healthcare, IT, automotive, aviation, and consumer goods manufacturing. GR is a trendsetter in the beer, food, art, and music scenes as well. Expedia dubbed it one of “America’s Super Cool Cities.” We think investing in GR is super cool. Positive numbers were reported across the board in population, employment and home values at 1.8%, 1%, and 7.5% respectively. The median sale price is $192k with a strong average rent reported at $1129. Landlords are sitting pretty in the lead department, with 72 on average and 20 days on the market.

- Population growth: 1.8%

- Employment growth: 1%

- Increase in home values: 7.5%

Median Sale Price: $192k

Average Rent: $1129

Average Number of Leads per Property: 72

Number of days on the rental market: 20

Once you’ve landed the perfect investment property in a good location, TurboTenant can help take your landlording into the digital world by streamlining the rental process with easy and free online rental applications as well as thorough tenant screening so you can find the best renter for your property.

About the TurboTenant Report

The TurboTenant Report analyzes data from active listings across all 50 states, as well as third party real estate, population and employment growth data. Our goal with the TurboReport is to empower seasoned and novice investors to make wise purchasing decisions when purchasing a rental investment property. For more information or custom data requests, please contact [email protected].

Methodology:

In order to determine the best cities to invest in each state, we curated data from a number of reputable sources as well as using TurboTenant proprietary data. Our main city selections were taken from a study that evaluated four main factors for each city: employment growth, population growth, increase in home values and rental yield. We combined that with TurboTenant data on the average rent price, the number of rental leads per property, as well as the average number of days the rental stays on the market.

We also included an honorable mention where applicable. They are pulled from this study on the best places to invest in every state. These were determined using Zillow’s Buyer-Seller Index and Zillow Home Value Forecast, and AreaVibes’ Livability Score. Other methods for determining honorable mentions include using TurboTenant proprietary data to determine which cities return the best rental investment R.O.I. using data points including days on market, the number of leads per property, and average rent price.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

Sources:

- TurboTenant Rental Data

- Fastest Growing States Population

- The Best and Worst Cities to Own Investment Property

- Real Estate data provided by Redfin, a national real estate brokerage.