In this edition of The TurboTenant Report, we will be focusing on the best places to buy an investment property in New Jersey. Three towns made our list: Montclair, Paterson, and East Orange. We curated data from studies on the best places to buy an investment property, median sale prices, and proprietary TurboTenant data. The TurboTenant Data includes stats on the average number of leads a rental property received, as well as the average number of days on the market. These two points will help an investor determine the strength of the rental market, as well as estimating potential vacancy rates.

Oh, New Jersey – if you’re not familiar with this cultural haven, you probably only associate the distinct Jersey accent and the Jersey Shore cast with this highly urbanized state. Jersey might be small, but it has a big personality. New Jersey has one of the highest population densities in the country as a large chunk of its population commutes to New York and Pennsylvania making its transportation system one of the busiest and most extensive in the world. New Jersey is also one of the most diverse states comprised of many ethnic groups giving the state its great character and food. Whether it’s visiting the resort town of Atlantic City, chowing on disco fries, or eating at an Italian bakery, locals love their state – don’t mess with them.

While Jersey native Bruce Springsteen was “Born to Run,” most residents like to stay in their home state while many transplants who work in NY opt for New Jersey living. Let’s take a look at the best places to buy an investment property in The Garden State.

New Jersey

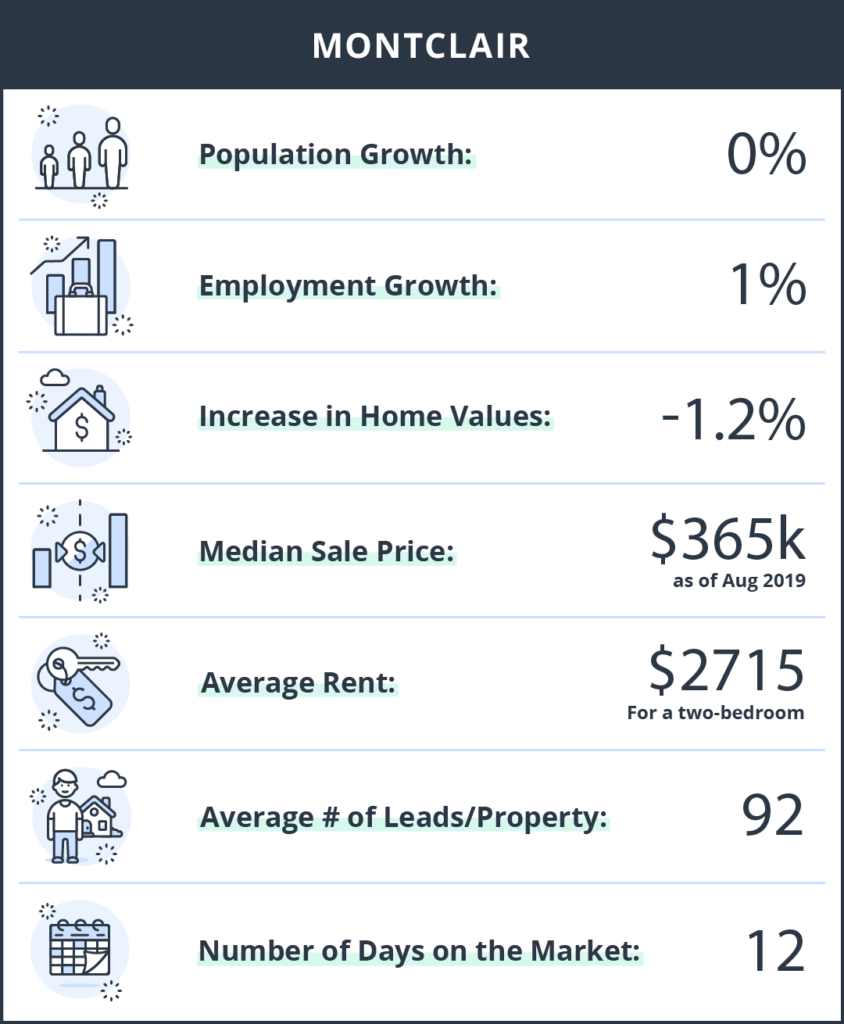

#3: Montclair

Montclair is an urban suburb, known for its vibrant art community, lively business districts, and home to Montclair State University. Less than an hour away from New York City, Montclair is in an excellent location with a far more affordable average rent than the Big Apple. This small, but progressive town is a model for sustainable communities as there are efficient recycling and home composting programs, several safe biking and walking trails, and even public charging stations for electric vehicles. Whether it’s admiring the beautiful architecture of Victorian mansions, walking through the Montclair Art Museum, or enjoying diverse cuisines – Montclair is a great place to live and own rental property. Excellent education brings families to this town while the University also supplies many renters – landlords can expect a large number of leads and less than two weeks on the rental market.

- Population growth: 0%

- Employment growth: 1%

- Increase in home values: -1.2%

Median Sale Price: $365k

Average Rent: $2,715

Average Number of Leads per Property: 92

Number of days on the rental market: 12

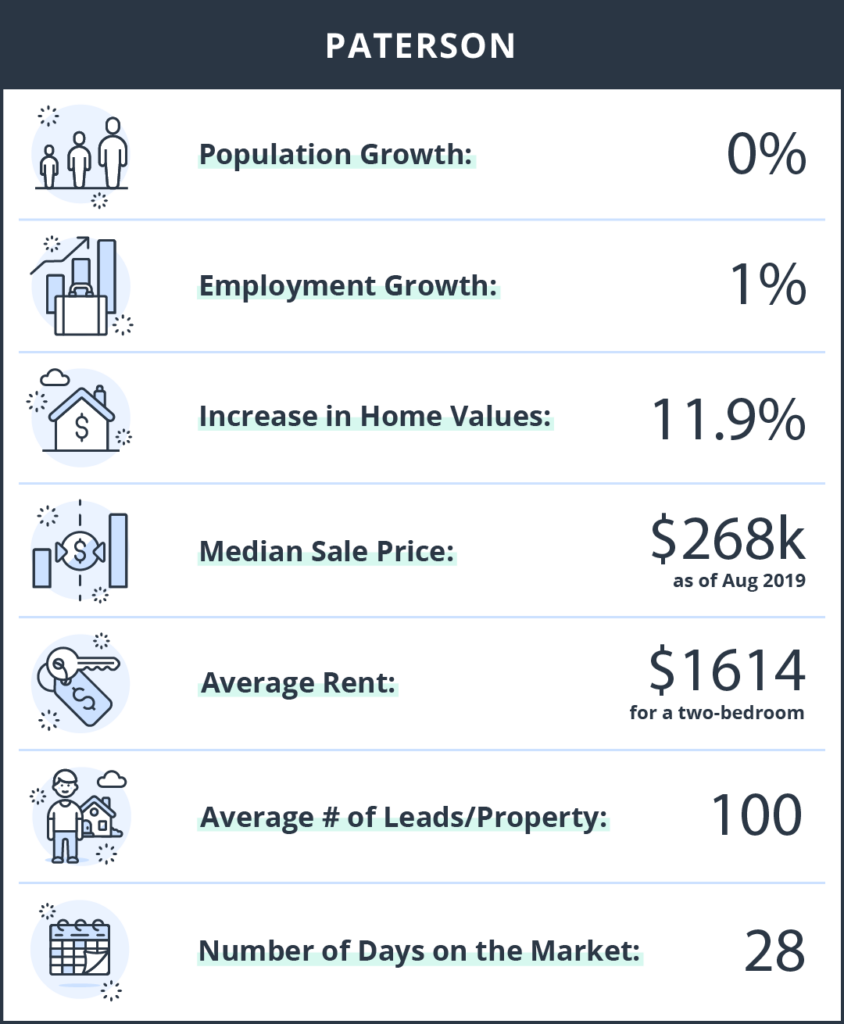

#2: Paterson

Famously named the Silk City for its production of silk fabrics in the early 19th and 20th centuries, Paterson was one of the first planned industrial centers in the United States founded by Alexander Hamilton. Located on the Passaic River in New Jersey, Paterson is less known for its manufacturing these days, and more for its diverse immigrant communities, Great Falls National Park, and its rich history. With a high increase in home values, landlords can expect to be able to increase rent as well as purchase rental property at a great price. Additionally, finding the right tenant for your property won’t be an issue as Paterson has an average of 100 leads per property! Take Hamilton’s advice – don’t throw away your shot to invest here.

- Population growth: 0%

- Employment growth: 1%

- Increase in home values: 11.9%

Median Sale Price: $268k

Average Rent: $1,614

Average Number of Leads per Property: 100

Number of days on the rental market: 28

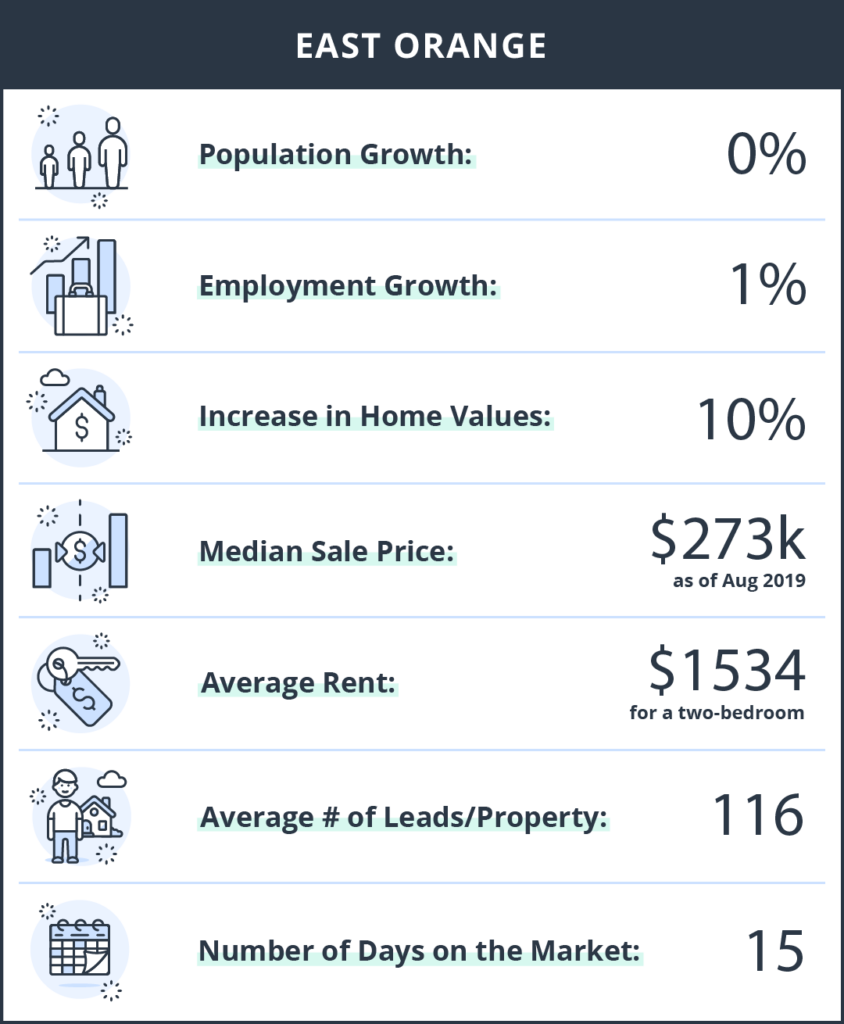

#1: East Orange

The Crossroads of New Jersey, AKA East Orange, is conveniently located only 30 minutes from New York City – this small four square mile town holds around 65,000 residents. Unlike many East Coast towns, it has spacious homes, and wide streets lined with beautiful trees – its transportation is a great asset including a direct daily service to midtown Manhattan. This town offers great amenities in and around it such as the renowned Paper Mill Play House, the Newark Museum, and many restaurants. Renters should skip the pricey housing in NYC and hop on over to East Orange – this is a gold mine for property investors as the median sale price is only $237k with an average of 116 leads per property. With these numbers, it will be a breeze to fill rentals with the best tenants; don’t miss out on orange-ing a killer rental property here!

- Population growth: 0%

- Employment growth: 1%

- Increase in home values: 10%

Median Sale Price: $273k

Average Rent: $1,534

Average Number of Leads per Property: 116

Number of days on the rental market: 15

Once you’ve landed the perfect investment property in a good location, TurboTenant can help take your landlording into the digital world by streamlining the rental process with easy and free online rental applications as well as thorough tenant screening so you can find the best renter for your property.

About the TurboTenant Report

The TurboTenant Report analyzes data from active listings across all 50 states, as well as third party real estate, population and employment growth data. Our goal with the TurboReport is to empower seasoned and novice investors to make wise purchasing decisions when purchasing a rental investment property. For more information or custom data requests, please contact [email protected].

Methodology:

In order to determine the best cities to invest in each state, we curated data from a number of reputable sources as well as using TurboTenant proprietary data. Our main city selections were taken from a study that evaluated four main factors for each city: employment growth, population growth, increase in home values and rental yield. We combined that with TurboTenant data on the average rent price, the number of rental leads per property, as well as the average number of days the rental stays on the market.

We also included an honorable mention where applicable. They are pulled from this study on the best places to invest in every state. These were determined using Zillow’s Buyer-Seller Index and Zillow Home Value Forecast, and AreaVibes’ Livability Score. Other methods for determining honorable mentions include using TurboTenant proprietary data to determine which cities return the best rental investment R.O.I. using data points including days on market, the number of leads per property, and average rent price.

DISCLAIMER: TurboTenant, Inc does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

Sources:

- TurboTenant Rental Data

- Fastest Growing States Population

- The Best and Worst Cities to Own Investment Property

- Real Estate data provided by Redfin, a national real estate brokerage