12 min read

Free Rental Inspection Checklist for Landlords (Printable PDF)

Download our free rental inspection landlord checklist for move-in, move-out, routine, and drive-by inspections to make your life easier!

Tenant turnover and missed rent payments can be among the most costly aspects of owning a rental property, not to mention the potential for eviction proceedings if the tenant continues to fail to pay rent.

The best way to cover yourself and your investment is to screen your tenants during the application process.

Requesting and analyzing a tenant credit report doesn’t have to be an overwhelming task. The process can be completed entirely online with property management software.

We’ll explain the entire process, from how to request a credit report legally to reading and interpreting the report, and accepting or rejecting applications.

A tenant credit check will give you insights into the financial history and health of your prospective tenant. Since the return on your investment is directly tied to your ability to collect rent from your tenant, this step should never be skipped, even if you have a great feeling about a tenant, or they have reported that they have never missed a rent payment, and make tons of money.

It doesn’t matter. Put a process in place for properly vetting tenants, and don’t make exceptions.

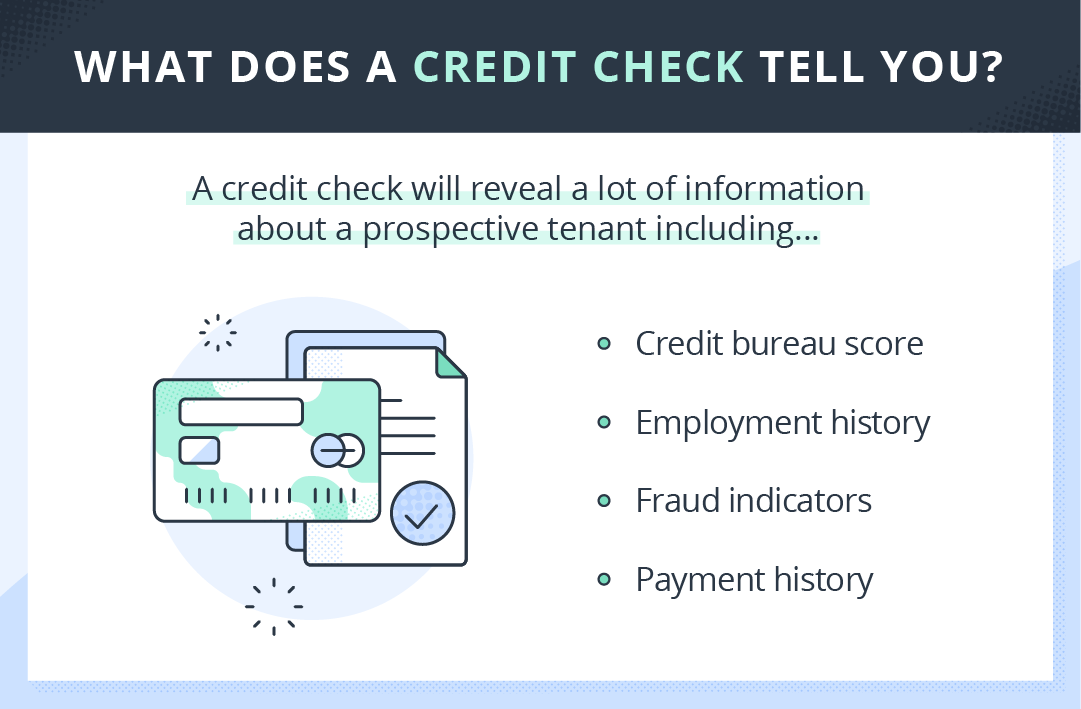

A tenant credit check reveals the applicant’s:

There are four categories of information covered in a credit check that remain consistent across all bureaus (although the report’s layout may vary).

The categories are:

Personally identifiable information: This includes the applicant’s name, Social Security number, date of birth, and employment details. Updates to this information come from details provided to lenders when the applicant applies for new credit.

Credit accounts: This section will include all the credit accounts lenders have reported on, such as credit cards, auto loans, mortgages, etc. It will state the date the account was opened, the credit limit, the balance, and the payment history. This information makes up the majority of the credit report.

Credit inquiries: When applying for a loan, lenders will run a “hard” credit check, and these inquiries will be reflected in this section. You’ll see the number of “hard” inquiries accumulated by the applicant in the last two years. Having too many hard inquiries can negatively impact a credit score. A landlord credit check is a “soft” inquiry, which does not negatively affect an applicant’s credit.

Public records and collections: Credit bureaus will report bankruptcies in this section, as well as any accounts that have been sent to collections due to non-payment.

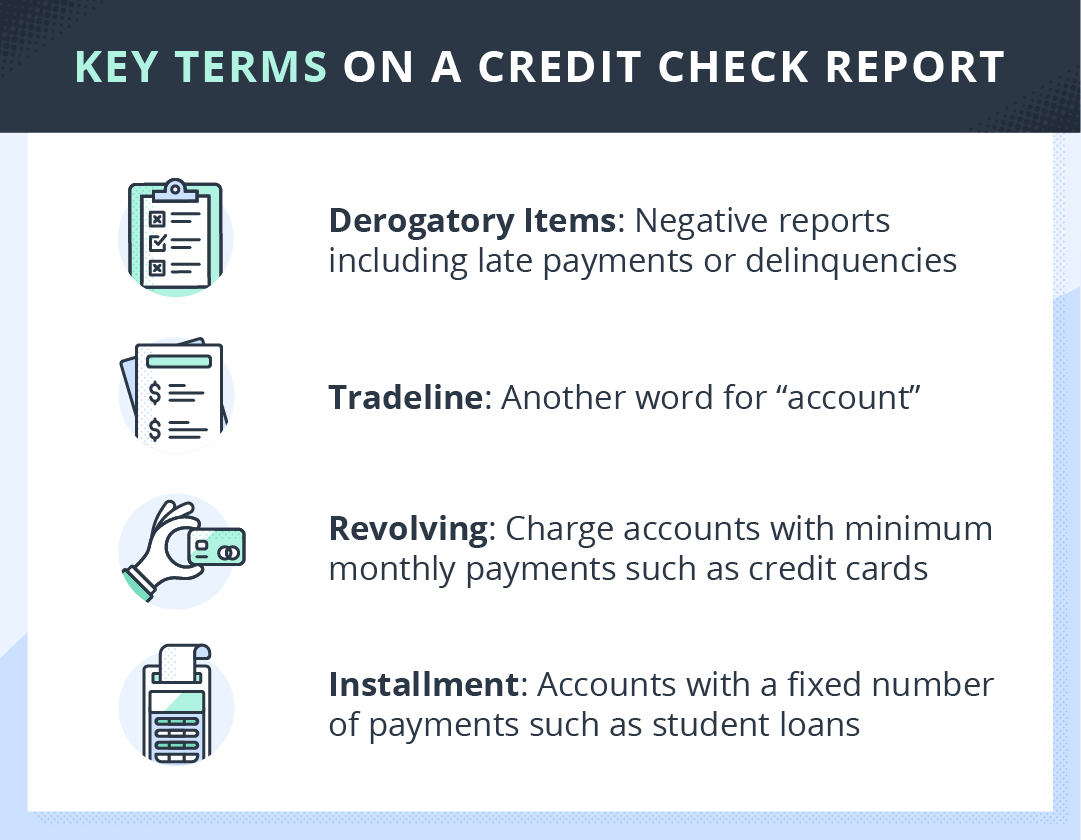

To help you read and interpret a tenant credit check, it’s crucial to understand the following key terms:

Banks, loan companies, utility companies, healthcare providers, and property managers all submit financial data to credit reporting bureaus.

While each agency will report on the same buckets of information, the main differences will sometimes be the level of detail and depth of that information. Often, landlords pay more for access to more detailed information.

Consumers can easily pull a credit report on themselves; the cost varies between credit bureaus. However, to obtain a credit report on someone else, you must first obtain written authorization.

Before this process moved entirely online, it would involve multiple consent forms, mailing or faxing the documents, and then waiting for everything to be processed. That used to result in a significant amount of lost revenue.

Luckily, online tenant screening services have improved the process. Now, the easiest way to access a tenant screening report is to work with a company that specifically pulls reports for landlords and property managers digitally.

For example, TurboTenant partners with Rent Butter to simplify the tenant screening process, from electronically acquiring consent from the prospective tenant to instantly delivering a comprehensive credit, background, and eviction report directly to your inbox.

Before running a tenant credit check, be transparent with your prospective tenant. Let them know that you require every applicant to undergo this process. If at that point they object or make excuses so you won’t look into their background, that should be a big red flag.

Do not stray from your process, or you could risk violating the Fair Housing Act.

Additionally, the success of your investment relies on your tenant’s ability to pay rent and pay it on time, so make sure to analyze their financial means well.

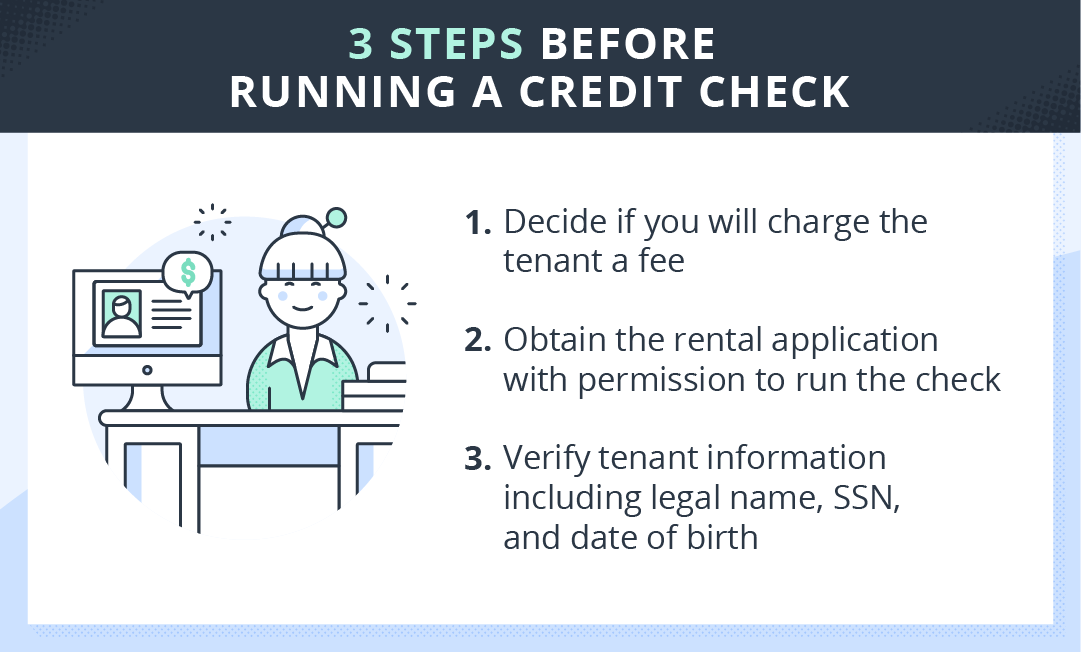

Most property managers and landlords will make the tenant cover the cost of the tenant credit check. This is entirely a personal preference. The cost can range from $35 to $65.

You might be allowed to add an additional processing fee on top of the screening cost. However, be mindful of your local and state laws regarding application fees, which are becoming increasingly regulated.

Charging a fee also helps to weed out applicants who aren’t serious about living in your property.

TurboTenant’s tenant screening services pass all application fees to the tenant, but you can cover them yourself in competitive markets.

Before screening, ask your prospective tenant to fill out a rental application. This document provides the necessary information to vet the tenant and complete a comprehensive tenant background check.

Once you accept the application and move them into the tenant screening phase of the process, you must first receive written permission to pull a tenant credit check.

Most online tenant screening services will facilitate this process for you.

To run a credit check on a prospective tenant, you will need some basic information, along with their written consent, as mentioned above. We suggest using a secure online tenant screening system.

Most will allow you to invite the tenant to complete a form with the information below and permit you to review the tenant screening report. Here’s a list of some of the information about the applicant that will need to be provided:

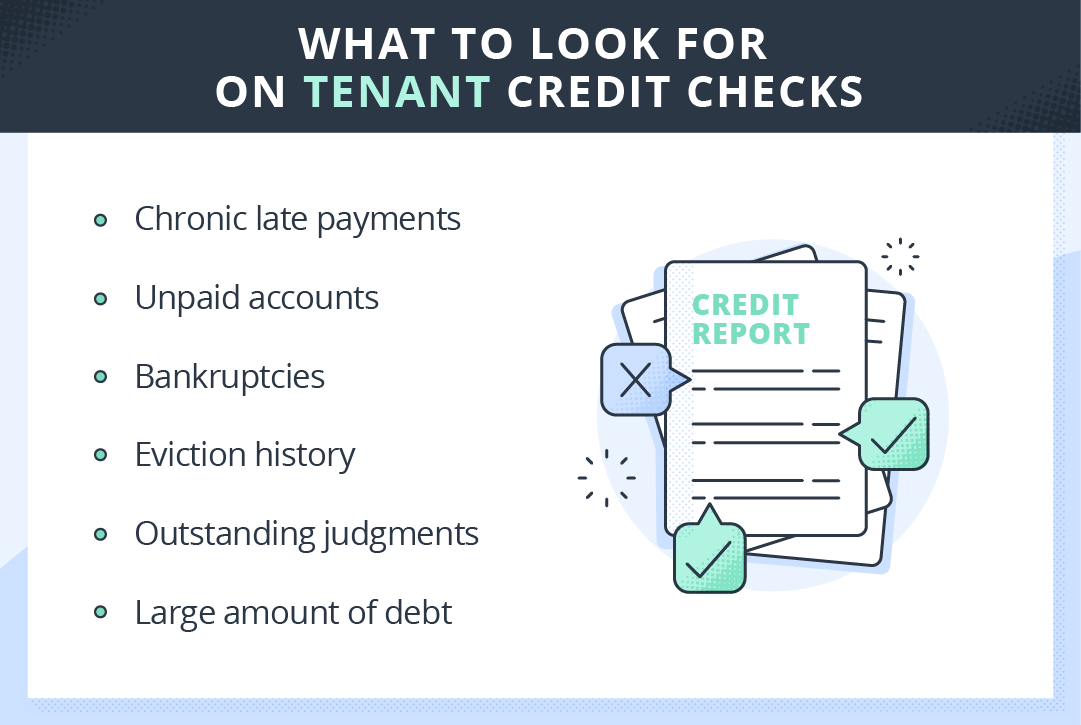

Once you receive the tenant credit check back, it’s time to review and analyze the results. Remember, you’re looking at the financial health of your prospective tenant; the ROI of your investment depends on their ability to pay.

The data from their screening report helps you evaluate that.

You will receive a credit score, as well as a list of all items that affect that credit score. Here are a few items to look for that negatively affect a score or could potentially be red flags:

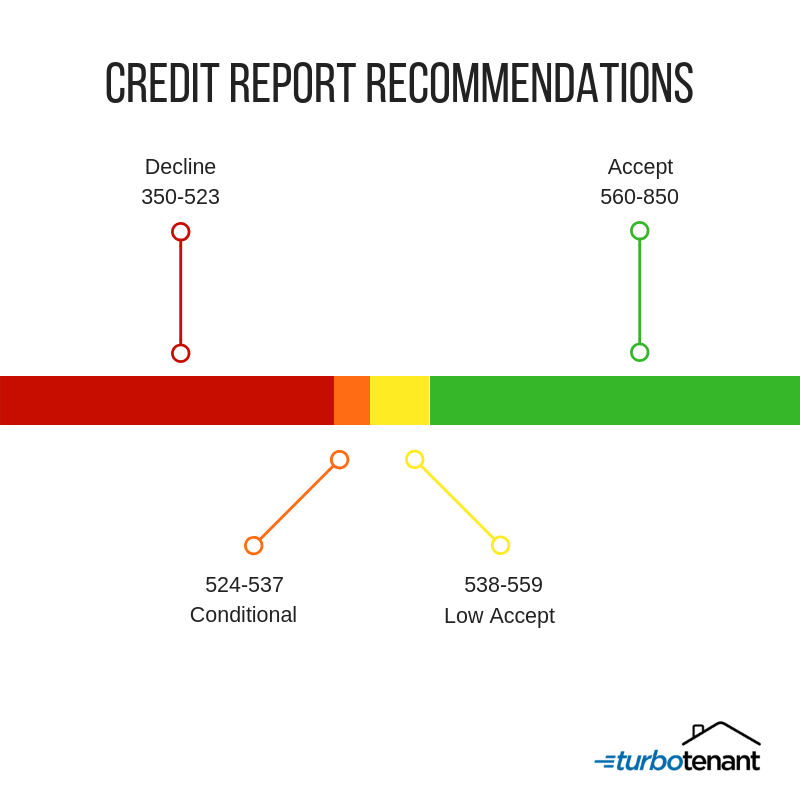

It is up to the landlord to decide what credit score range they are comfortable with a tenant having. Below is a range of credit scores, along with recommendations on whether to accept, decline, or proceed on a conditional basis.

It’s also important to look beyond the credit score before deciding on a tenant. Some qualitative factors are important to consider. Does the applicant communicate well? If the location permits, spend time with them and build rapport. You should also request references from past landlords.

Ask their previous landlord how they were as a tenant, did they ever have any issues or complaints?

Using a combination of quantitative and qualitative factors can help you narrow your search down to one great tenant.

There will be some circumstances where a great applicant has a credit score that falls below your acceptable range. It may be worth discussing with them if you still wish to move forward.

Good people fall on hard times. If the explanation warrants further consideration, you can always accept them on a conditional basis and set milestones for them to meet regarding increasing their credit.

An easy way for your tenant to achieve this is by opting into Rent Reporting—a service provided by TurboTenant that reports the tenant’s on-time rent payments to help build good credit.

Not only will Rent Reporting benefit the tenant, but it will benefit the landlord as it incentivizes on-time rent payments.

If you plan to reject a tenant based on their credit score, you must do so in a legally compliant manner, which we will discuss below.

If you reject a tenant based on the information you obtained in their credit report, you must follow the rules laid out in the Fair Credit Reporting Act and send them an adverse action letter notifying them that they have been rejected based on that information.

You must also provide them with the address of the reporting agency. They’ll be able to obtain their credit report and review what may have caused the rejection. Consumers are allowed one free credit report from each agency every 12 months.

Sometimes, landlords choose to rent to tenants with bad credit. There are steps you can take to secure your property if you decide to move forward with a tenant who has bad credit.

You can require a co-signer or guarantor who must fill out an application and run a credit report on them as well.

Additionally, you can put credit improvement milestones in place and run an additional credit report in a few months to check the process. You may be able to charge a larger security deposit, but this will depend on local and state laws regarding security deposits.

Here are a few tips to help you run a tenant credit check smoothly.

Running a tenant credit check isn’t optional when vetting prospective tenants. This process is a crucial step that should be accompanied by a solid rental application. These reports can indicate a tenant’s ability to consistently pay rent, which is vital to the success of your investment.

If you would like more information regarding tenant credit checks, tenant screening, or any other aspect of the landlording process, visit TurboTenant so we can assist you.

DISCLAIMER: TurboTenant does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to review all applicable local, state, and federal laws and consult with legal counsel if any questions arise.

The length of time it will take to run a tenant credit check will depend on which agency or service you use. Often times you can receive a report back instantly or within a couple of hours if using an online service.

The cost to run a credit check will depend on which service you use and if you also include a background check and an eviction report. Through TurboTenant, a tenant screening report is $55 and includes a background, credit, and eviction history check.

Landlords will usually run a consumer credit check using a third-party service to gain permission to obtain the report.

12 min read

Download our free rental inspection landlord checklist for move-in, move-out, routine, and drive-by inspections to make your life easier!

13 min read

If you’ve tried to rent your property online, you know what a pain that can be. For DIY landlords, it’s often the toughest...

9 min read

Regardless of the number of rental units you manage, collecting rent using traditional methods is always a headache. Cash payments can get...

Join the 800,000+ independent landlords who rely on TurboTenant to create welcoming rental experiences.

No tricks or trials to worry about. So what’s the harm? Try it today!

TurboTenant, Inc., © 2025

Created in Sunny Colorado

Comprehensive Tenant Screening Reports

In less than 5 minutes, request a credit check, criminal background check, and eviction report to quickly find your perfect tenant.