Key Takeaways

- Customize New York State property leases with specific rent details and tenant information using TurboTenant.

- Include property-specific rules, local clauses, and policies like the Lost Key Policy in the lease.

- Align lease sections with New York State law on late fees, security deposits, repair notifications, and landlord entry.

- Comply with additional New York City laws on late fees, security deposits, maintenance, and landlord entry.

- Understand and integrate county-specific regulations affecting lease terms across New York, including rent control and stabilization.

- Incorporate tenant rights and housing quality standards relevant to each borough and county.

- Consult legal professionals to ensure lease agreements are fully compliant with New York landlord-tenant laws and local ordinances.

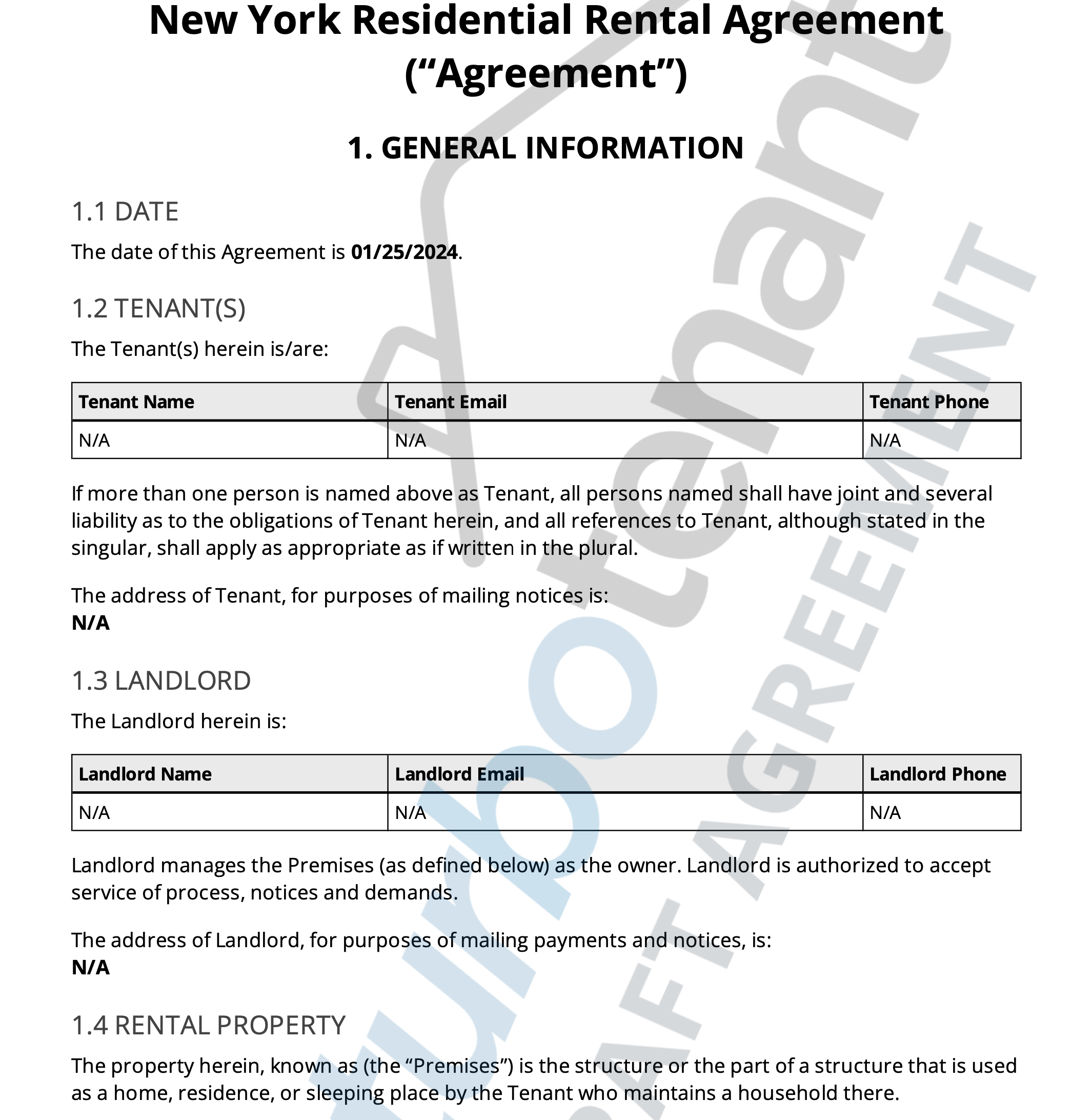

Custom Lease

In the lease creation process with TurboTenant, this is where you detail the unique features of your New York State property. From the rent details to who’s on the lease, this section ensures your lease agreement is specific to your property’s requirements.

- Additional Provisions: Here, landlords can add any property-specific rules, necessary local clauses, or other unique stipulations they wish to enforce.

- Lost Key Policy: This policy holds tenants financially responsible for the cost associated with lost keys, safeguarding you from unnecessary expenses.

State Laws

This crucial section of your lease is fixed to align with New York State law and includes:

- Late Fees: Defines the timeline for rent due dates and the fees applicable if payments are late.

- Security Deposit Guidelines: Details the limitations on security deposits and the prohibition on collecting the last month’s rent upfront.

- Notification of Repairs: Outlines the tenant’s obligation to report necessary repairs to the landlord.

- Entry and Privacy: Specifies the conditions under which a landlord may access the property, respecting tenant privacy.

New York City

To ensure your lease is compliant with New York City laws, this section includes:

- Late Fees and Security Deposits: Contains specific clauses for New York City regarding permissible charges and security deposit handling.

- Maintenance and Building Repairs: Sets out the expectations for tenant communication regarding repairs and the landlord’s timely response and action.

- Landlord Entry: Outlines the rights and protocols for landlord entry into the premises, ensuring tenant privacy is maintained.

Counties

Navigating the complexities of lease agreements in New York requires an understanding of both state and local laws. Here’s a concise look at how county-specific regulations might influence lease terms across New York:

New York County (Manhattan)

- Adherence to state law and additional Manhattan-specific regulations.

- Inclusion of clauses for rent control and rent stabilization is necessary.

Kings County (Brooklyn)

- Rental laws that cater to rent-stabilized apartments.

- Tenant rights stipulations must be integrated into lease agreements.

Queens County

- Lease agreements may include special disclosures and requirements.

- Housing preservation and development regulations impact leasing terms.

Bronx County

- Clauses pertaining to rent stabilization and housing quality standards.

- Tenant protections are distinct to the borough.

Richmond County (Staten Island)

- Compliance with state laws and potential local lease stipulations.

Nassau County

- Regulations affecting safety, occupancy, and habitability in lease terms.

Suffolk County

- Additional requirements for rental permits and maintenance standards.

Westchester County

- Rent stabilization provisions in municipalities like New Rochelle and Yonkers.

Erie County

- Local housing codes and tenant protections in areas like Buffalo.

Albany County

- Lease terms generally follow state law with consideration for local ordinances.

For landlords and property managers, particularly those utilizing TurboTenant’s services, it’s essential to be well-versed in both state and local ordinances when drafting lease agreements. Legal consultation is recommended to ensure full compliance with New York’s landlord-tenant laws and the unique requirements of each county or city.

FAQ

Can I charge more than one month’s rent for a security deposit in New York?

No, in New York, the law restricts security deposits to a maximum of one month’s rent.

What is the maximum late fee I can charge tenants in New York?

You can charge a late fee of $50 or 5% of the monthly unpaid rent, whichever is less, if the rent is not paid by the 5th of the month.

Do I need to keep security deposits in a separate bank account in New York?

Yes, landlords of properties with 1–5 units must keep security deposits in a separate bank account. For properties with 6 or more units, the deposits must be kept in an FDIC-insured interest-bearing account.

Are there any specific rules for returning security deposits in New York City?

Yes, landlords must return the security deposit within 14 days after lease termination, along with an itemized statement of any deductions. The deposit must be kept in a separate interest-bearing account, and the interest earned, minus a 1% administrative fee, should be returned to the tenant.

Can I collect the last month’s rent upfront in New York City?

No, collecting the last month’s rent upfront is prohibited in New York City.

Is there a specific way I need to handle security deposits and interest in New York City?

Yes, for properties with six or more units, security deposits must be kept in a separate FDIC interest-bearing escrow account in New York. Interest earned, minus a 1% administrative fee, can be offered to be returned at the end of the lease term, annually, or credited against rent.