Did you know that almost 80% of renters’ first call during a maintenance issue is to their landlords? If you want to protect your monthly revenue, it pays to plan ahead – literally. Let’s examine how the average cost of rental appliance repairs, along with how much you should save to cover unexpected issues.

Get leads, screen tenants, create leases, manage maintenance requests, and collect rent — all in one place.

Let TurboTenant serve as your in-house maintenance team – handling requests and coordinating repairs with tenants.

How Much Should I Budget per Year for Repairs?

As a landlord, you should expect to have a minimum of one to two breakdowns per unit per year, so it’s important to have a budget for repairs and replacements in your rental property. While the exact amount can vary depending on factors such as the age and condition of the systems and appliances, as well as your specific property, a general guideline is to budget around 1%-2% of the property’s value for annual maintenance and repairs.

Here’s a step-by-step approach to help you calculate a rough estimate:

- Determine the value of your property: Start by assessing the current market value of your rental. You can use recent sales data or consult with a real estate professional to get an estimate.

- Calculate 1% to 2% of the property value: Multiply the property value by 0.01 (for 1%) and by 0.02 (for 2%) to get the estimated annual budget for repairs and replacements.

For example, if your property is valued at $200,000, the estimated annual maintenance and repair budget would be:

- 1%: $200,000 * 0.01 = $2,000

- 2%: $200,000 * 0.02 = $4,000

So, in this scenario, you should aim to set aside between $2,000 and $4,000 per year for maintenance and repairs.

Keep in mind that this is a general guideline, and the actual costs can vary. It’s also important to regularly assess the condition of your property, keep track of maintenance expenses, and adjust your budget accordingly. Additionally, having landlord insurance or warranties on your systems and appliances can help mitigate unexpected costs.

What Do Individual Repairs and Replacements Cost?

Armadillo Home conducted a case study reviewing breakdowns, repairs, and replacements for a landlord with 200 rental units:

- Breakdown severity ranged from $100 to $8,000.

- The average severity per breakdown was $1,157.27.

- The median breakdown severity was $850.

- The average repair cost per breakdown able to be repaired was $1,157.95.

- The average replacement per breakdown that needed to be replaced was $720.

- On the average repair or replacement, the landlord saved $451.17 on each breakdown using their Armadillo plan compared to those without an Armadillo plan.

The Severity of Average Breakdown

- Electrical: $1,000

- Plumbing: $1,353

- HVAC: $954.72

- Appliances: $1,142.50

The average costs of appliance repairs and replacements can vary depending on various factors such as the type of appliance, the specific issue, the location, and the service provider.

Cost-Saving Measures for Landlords With Multiple Rental Properties

Managing multiple rental properties can be challenging, especially when it comes to maintenance and repairs. Unforeseen expenses can quickly accumulate and affect your profitability. However, by implementing cost-saving measures and strategies, landlords can mitigate repair costs and achieve budgetary stability.

To that end, a home warranty is an excellent tool for landlords with multiple rental properties seeking budgetary stability. By investing in a home warranty plan, you can protect yourself from unforeseen repair costs and maintain a more predictable budget. Home warranties typically offer coverage for major appliances and systems, ensuring that repairs are handled promptly and professionally. With a home warranty, you pay a fixed premium, which helps you forecast and manage repair expenses effectively.

Case Study Data

- Breakdown severity ranged from $100 to $8,000.

- Average breakdown severity: $1,157.27

- Average savings per breakdown during case study with Armadillo: $451.17

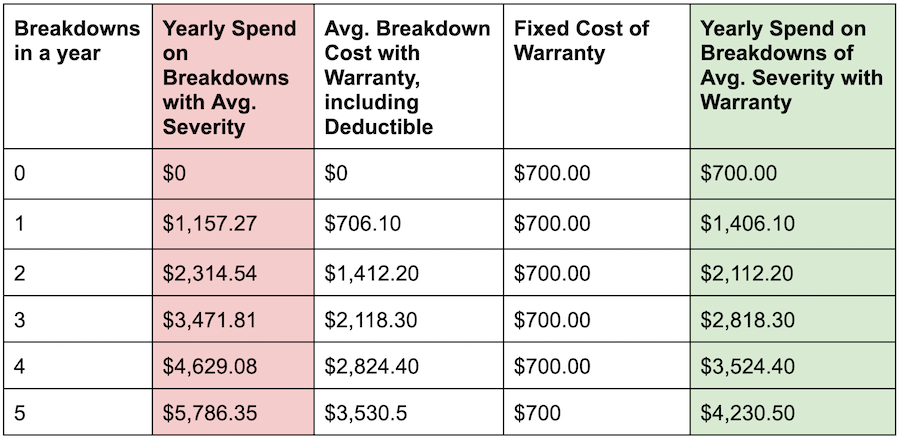

Case Study Data with Home Warranty Yearly Breakdowns | Single Rental Property

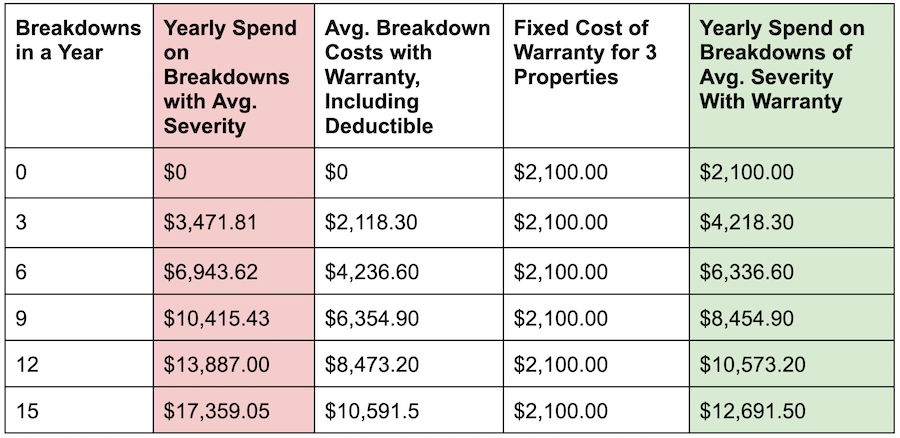

Yearly Breakdowns | 3 Rental Properties, 3 Warranties

Additionally, you should:

- Create an Emergency Fund: Establishing an emergency fund specifically designated for property repairs is a prudent financial practice. By setting aside a portion of your rental income each month, you can build a reserve that can be used to cover unexpected repair costs. This fund acts as a safety net, providing you with immediate access to funds when emergencies arise, reducing the strain on your budget, and providing stability. We recommend saving between three to six month’s worth of expenses to be safe.

- Conduct Regular Inspections and Maintenance: Prevention is often better than cure when it comes to property maintenance. By conducting regular inspections and addressing minor issues promptly, landlords can avoid larger and more expensive repairs down the line. Implementing a preventative maintenance plan can help identify potential problems early on and save money in the long run. This strategy ensures that you catch issues before they worsen and become costly to fix.

- Encourage Tenant Responsibility: Promoting tenant responsibility can help reduce repair expenses. Educate tenants about regular maintenance tasks, such as changing air filters, cleaning gutters, and reporting issues promptly. Providing clear guidelines and expectations in the rental agreement can ensure that tenants take an active role in maintaining the property, minimizing the likelihood of preventable damages.

For landlords managing multiple rental properties, implementing cost-saving measures and strategies is crucial to achieve budgetary stability and reduce repair expenses. By conducting regular inspections, creating an emergency fund, cultivating relationships with reliable contractors, encouraging tenant responsibility, and utilizing a home warranty, landlords can streamline their repair processes, minimize financial uncertainties, and maintain profitability. By adopting these strategies, landlords can protect their investments and ensure that their rental properties remain lucrative and well-maintained in the long term.

Looking for a home warranty to protect your investments? Armadillo Home offers an exclusive home warranty deal for TurboTenant landlords.