Landlords looking to protect themselves from disputes and potential lawsuits should consider giving each tenant a rent receipt after every payment.

Depending on the number of tenants you have, the variety of your rental pricing, and your level of digitization, issuing receipts can present several challenges for landlords who just want to stay above the fray and track payments.

One critical issue is how different states legislate them. Some require a receipt for every payment type, while others stipulate that renters only receive a receipt for cash payments. It’s a complex mish-mash of legality that begs a straightforward question: Why not just give a digital rent receipt to every tenant and avoid trouble down the road?

In this article, we’ll explore what rent receipts are, how different cities and states legislate them, the importance of integrating payments with property management software, and more to help landlords streamline their processes.

Rent Receipts: An Overview

Traditionally, rent receipts follow a simple template. For each payment, the landlord typically writes out the amount paid, the date of the payment, the rental period covered, and the names of the landlord and tenant in a plain rent receipt book.

In essence, these flimsy pieces of paper serve as a record of payment. For both parties involved, tenants and landlords, this simple document can save each party significant frustration down the line.

For example, landlords who keep meticulous records ensure that any payment dispute with their tenants can be resolved by examining cold, hard facts in the form of straightforward and consistent receipts.

On the other hand, responsible tenants can point to their collection of receipts to prove they paid on time every month. It’s best for both parties to record payments sent and received to ensure a smooth business relationship.

State and Local Regulations

Some states and cities require rent receipts. However, it gets tricky when some cities within states require them while the state does not. For example, in Ohio, the state government does not explicitly state that landlords must provide them, but in Columbus, they’re required.

Ultimately, these requirements are a legal patchwork across the United States of America.

Consider this: Hawaii and New York mandate that every rent payment receives a receipt. Colorado enacted legislation requiring every cash rent payment to receive a receipt, and a number of states require them upon request.

With all the confusion this can cause landlords, especially out-of-state or remote landlords, providing a digital rent receipt ensures compliance in an ever-shifting legal landscape.

Regardless of legality, tracking rental payments for landlords and tenants alike is good practice.

The Digital Era of Renting

More industries are shifting to a digital-first approach, and renting is no different. Large-scale corporate-owned apartment complexes often utilize online portals that enable tenants to make payments online.

Online portals make rent collection easy and save landlords, property management companies, and tenants trips to the bank to withdraw or deposit cash or deal with money orders.

The critical benefit of digital payment systems is that printable PDF receipts are automatically generated and emailed to both parties. Systems like this are not only convenient, but they enable alternative payment methods, opening the door for credit card transactions.

Cash, money orders, and checks are cumbersome compared to credit and debit cards. And don’t get us started on the problems surrounding Zelle and Venmo.

Finally, some tenants want to pay with travel or cash-back cards to get something back for their monthly payment obligations. Without online portals, credit card payment options simply don’t exist. Happy tenants often result in happy landlords, so flexibility is encouraged.

Benefits of Digital Landlording

Unlike corporate giants, many smaller landlords lack the infrastructure to make rent collection convenient. So, at the beginning of the month, some landlords collect cash, money orders, and checks and then write receipts out by hand.

That’s not much of a problem for landlords with a door or two. However, as a landlord’s number of tenants grows, the challenge of rent collection becomes more significant. And for landlords who manage properties remotely, the process of collecting rent payments can represent a major time sick.

One good way to simplify rent collection while staying ahead of legislative changes is to digitize the entire property management puzzle by implementing property management software into your processes.

Property Management Software Simplifies Rent Receipts

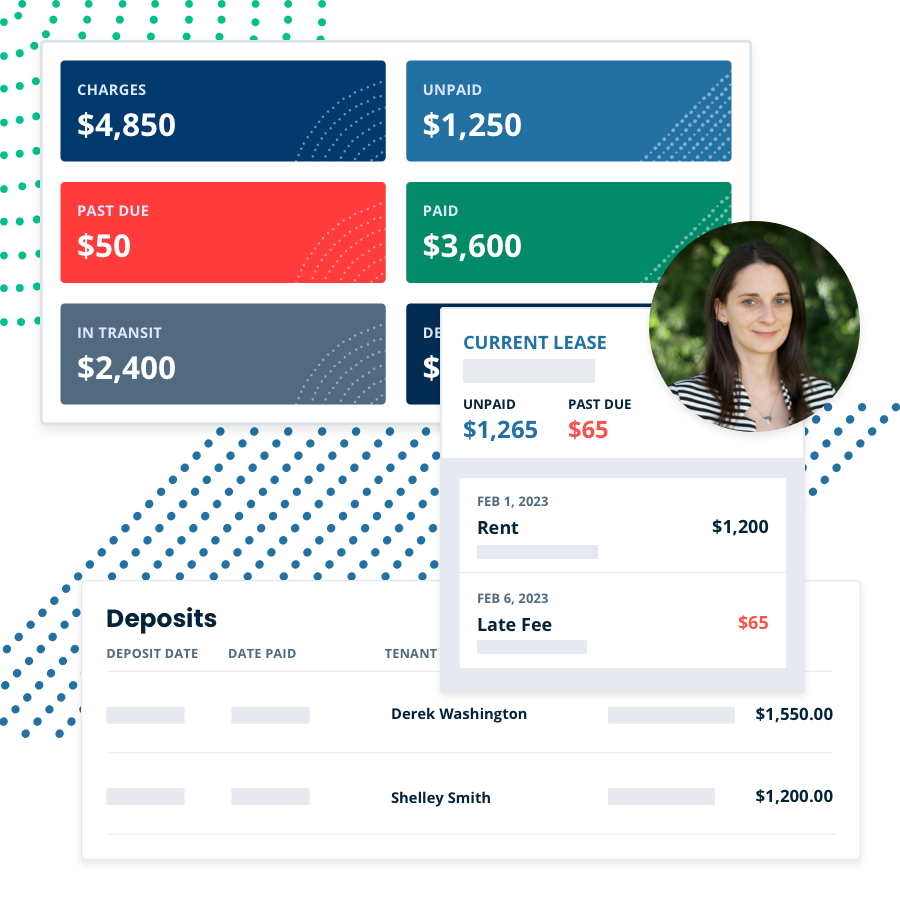

Landlords who want to streamline their property management processes can benefit from choosing web-based software that automatically delivers digital rent receipts for every payment received, whether the tenant pays with cash, debit, or credit card.

But remember, rent collection is just a tiny aspect of rental property management. Systems that can track rent payments and expenses and automatically import them into accounting software make the overall financial aspect of property management a much more efficient and seamless experience.

Instead of hand-filling out receipts for each tenant, collect rent money online and have it automatically deposited into your accounts. This will make your tenants’ lives easier while giving you fewer errands to run at the beginning of the month.

How To Transition to Digital Rent Receipts

One of the best, most effective ways for landlords to transition to digital receipts is to use TurboTenant to manage their rentals from a single online interface or app.

TurboTenant automatically generates rent receipts for payments received. But when it comes to rent collection, TurboTenant does much more than that. Our property management software can also remind your tenant to pay rent, automatically apply late fees, allow for autopay, and securely connect bank accounts for seamless payment transfers.

And when you need to fill a vacancy and get a qualified renter into your unit, TurboTenant simplifies the advertising, application, screening, and lease agreement process to help you quickly slash vacancy rates and fill your units with qualified tenants.

Who pays for this?

One common concern from landlords is that their systems don’t cost them money outside of a new rent receipt book every year or so, gas to drive to the bank, and time spent completing these tasks. Why would you want to introduce more costs to managing your property when there are already enough to consider?

But check this out: TurboTenant is free for landlords, including rent collection and receipts. Your tenant simply pays a small fee when they sent their payment.

While it’s a small fee for them, it’s a huge time saver for you.

Conclusion

As we’ve discussed, uncertain legal landscapes across the country make it difficult for landlords to know whether or not they are currently required to provide their tenants with rent receipts.

Knowing the laws for your state isn’t always enough. Some cities require landlords to provide them for each transaction, and others have no such requirements. It makes sense to default to providing receipts no matter your legal requirements.

Sign up for a free account today, automate your rent receipt collection for the better, and stop looking for receipt templates once and for all.

FAQ: Rent Receipts

How To Fill Out a Rent Receipt

You’ll want to include some critical information when filling out a rent receipt. Those include:

- The date the tenant submitted the payment

- Property information, including address or unit number

- Landlord information, including name and contact information

- The tenant’s full name

- The method of payment, whether it was made with cash, money order, etc.

- The timeframe the payment covers

What is a rent receipt?

A rent receipt is a document the landlord provides to confirm that the tenant paid their rent. It serves as proof of payment, helps landlords keep accurate records, and is the most critical tool for payment disputes.

Does a landlord have to give rent receipts?

The laws of the city or state of the property determine whether a landlord is legally required to provide a receipt. For landlords who want to stay ahead of changing laws, automatically providing rent receipts gives them one less thing to stress about.