If you are a renter or landlord new to online payments, you might be wondering – can you pay rent with a credit card? The simple answer is, yes, through secure online rent payment platforms tenants can pay rent with a credit card. With an increasing amount of back-rent owed throughout the U.S. due to the current economic crisis, renters and landlords are both struggling.

While there are a variety of ways to pay and collect rent, paying with a credit card can be a practical solution for renters who need more time at the beginning of the month, or who might want to keep paying rent as best they can so they can avoid a build-up of rent, late fees, and interest. Keep reading below to find out how to pay and collect rent with a credit card as well as the benefits of doing so.

Collect Rent Online → Report Rent for Free

Now, not only do landlords enjoy the convenience of collecting rent online, but by doing so, your tenants can build credit by reporting rent payments to TransUnion for free. Learn more about Rent Payments & Rent Reporting.

Benefits of Paying Rent With a Credit Card

Paying rent with a credit card has many advantages, mainly, it allows for flexibility. If renters don’t have enough cash in the bank to make their rent payments when they are due, using a credit card can buy them time to avoid missing rent. Additionally, there are personal benefits for renters when they pay with a credit card which include the following:

- Earning Rewards: Credit cards typically come with different types of rewards for account holders. Some incentives include cashback, travel rewards, and 0% APR, meaning there will be no interest on balances or transfers for a certain period of time. For example, if you pay rent with a credit card with cashback rewards, you can receive a percentage back over time which often makes up for processing fees and, in the long run, can be a great benefit.

- You Can Build Your Credit Score: If you are just starting to build your credit score, remember, you won’t have an official score until six months of consistent payments and data. However, once you continually make rent payments on time along with other payments, your score will grow. Through TurboTenant, renters have the additional option of Rent Reporting where they can report their on-time rent payments to TransUnion for free to help build credit history.

- Gives You More Time: Because credit cards don’t have to be paid off until you get your monthly statement through the credit card company, paying your rent with a credit card can help alleviate financial stress. Everyone’s pay schedule is different and some people may not receive their paychecks until later in the month while rent is typically due at the beginning of the month.

While paying the rent with a credit card can be a great return on investment for renters, it’s important to note the only drawback with credit card payments, is that they usually come with an online processing fee of around 3.49%. However, if you are using a credit card with rewards, you can easily gain the processing fee back through cashback or travel rewards.

How to Pay Rent with a Credit Card

Communicating with your landlord during difficult times will enable you to have open and honest conversations so you both can figure out a solution where you can pay rent on time by either coming up with a rent payment plan or negotiating other options. Renters can easily pay their rent with a credit card through online rent collection accounts their landlords set up through property management software – this is a safe and effective way to pay rent online that works for both sides.

When you’re paying rent with a credit card, it is vital you keep up with credit card bills as best you can so you don’t hurt your credit score or incur interest on the amount owed. Luckily, paying rent the first of the month when bills are typically due at the end of the next month allows you time to pay yourself back. Additionally, people’s paychecks will come at different times so if yours won’t come in until mid-month or even later, you can still pay your rent on time with a credit card and avoid late fees.

Some other easy things you can do if you are using a credit card to pay rent are to, first, avoid charging other expenses on your credit card and, second, to set reminders for when rent and your credit card payments are due. If you are worried about a processing fee, consider connecting your bank account for an ACH transfer that will not include a fee.

Landlords: Collecting Rent with a Credit Card

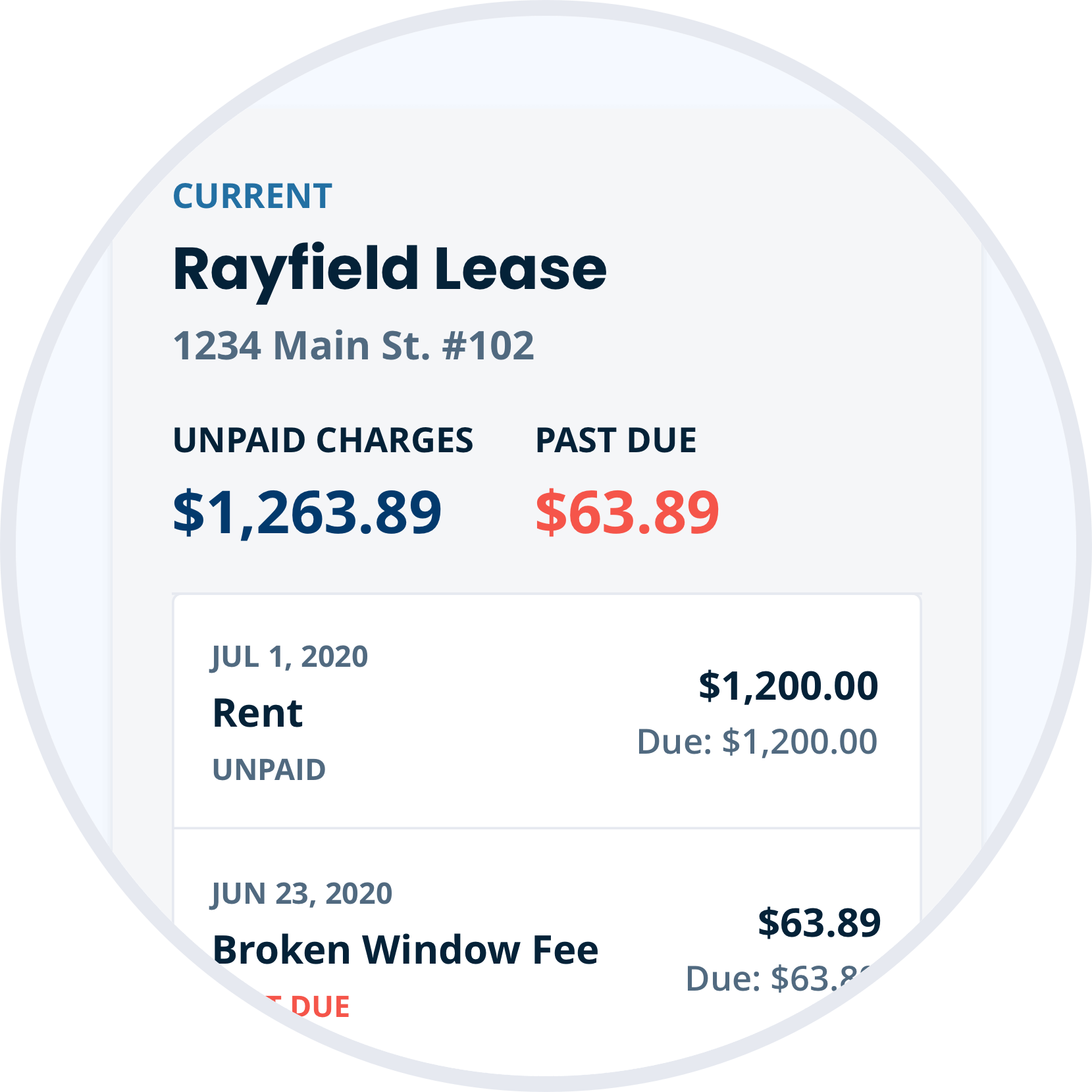

As we mentioned above, landlords need to communicate with renters before rent is due to avoid missed payments which can be detrimental to both renters and landlords. If you’re wondering how to collect rent online as a landlord, read our full guide here. Collecting rent online has many benefits and with the world dynamic moving to more contactless transactions, it is also a necessity. You can easily set up online rent payments through your TurboTenant account in less than five minutes for free. Tenants have the option of setting up an ACH account or paying rent with a debit or credit card with a 3.49% processing fee.

The Pros and Cons of Accepting Credit Cards for Rent Payments

The more types of rent payments you accept, the more likely it is that your tenant will have an easy way to pay you each month. However, there are additional factors to consider when deciding if you’ll accept credit card payments:

Pros

- Convenience: if your online rent payment collector allows for automatic payments, a credit card is one of the most convenient ways for your renter to pay rent. Most also won’t have to worry about overdrawing their account.

- Improved credit score: paying rent on time with a credit card (and then paying that credit card off regularly) helps your tenant build up their credit score – which means they’ll be more likely to pay you on time!

Cons

- Risk of fraud: credit cards can be stolen, which is always a risk to consider when thinking about accepting this type of payment. But using a verified, reputable payment processor will mitigate that risk.

Being flexible is crucial – landlords should consider halting late fees and interest for rent payments while also considering partial credit or partial cash payments if there is a valid reason from the tenant. If a tenant comes to you to negotiate rent, there are a variety of different payment plans or alternate options to consider. Regardless of what you choose to do, make sure you keep your lease agreement up-to-date on rent payment plans and methods so both parties are held accountable.

What is the Best Credit Card to Use for Rent?

When it comes to credit cards, you should always do your research to learn what will work best for your lifestyle and financial situation. Cards that give you cashback are extremely popular and can be useful in times when money can be short. Travel rewards, on the other hand, are great for those who are spending money on flights and other travel expenses. Take a look at this helpful list for first-time credit cards if you are new to the process. Remember, building credit takes time and it’s important to take credit card payments seriously as it can impact your rental process, loans, and other future investments you hope to make.

Overall, paying rent with a credit card has many benefits for renters, if used wisely. If you are struggling to make rent payments using cash or checks, talk to your landlord about collecting rent online so you can pay with a credit card to not only buy yourself more time in the month but also boost your credit score and collect rewards.

FAQ

Is it safe to pay rent with a credit card?

Yes, it is safe to pay with a credit card as long as you are going through a secure site where your information is encrypted. TurboTenant uses industry leaders Stripe and Plaid to process and transfer rent payments safely.

Should I pay rent with a credit card or debit card?

With a debit or a credit card, a processing fee is usually collected. Obviously, it is up to your financial situation to see if you have enough funds in your checking account to pay your rent – debit cards will instantly draw cash from your accounts while credit card bills won’t be due until the end of the period.

Does paying rent with a credit card impact my credit score?

Paying for rent with a credit card is like any other credit card purchase – as long as you stay within your allowed limit and pay your credit card bills on time, your credit score can be positively impacted. If you are late on credit card payments, however, this can affect your score negatively.