Collecting rent is one of the most important recurring tasks a landlord handles, and it can also be one of the easiest. When it comes to rent payments, there are a variety of options landlords can implement – from traditional checks to online rent payments. As a landlord, you’ll need to decide which rent collection method is best for your rental business.

Luckily, the digital age has transformed the landlord experience by streamlining the process online, saving both time and money. Receiving the best ROI on your rental properties should always be at the forefront of your mind, which means having a seamless way to collect rent.

On TurboTenant’s platform, we now give renters the option to set up Autopay so that the rent is paid in full every month. We also allow landlords to automatically charge Late Fees by setting the amount and defining when a charge is officially late.

Below, we’ve compiled a comprehensive pros-and-cons guide covering both online and traditional rent payment options.

Online Rent Payments

In the past few years, mail theft doubled, according to a report from the United States Postal Service. Thankfully, property management software has made it easy and safe to collect rent online.

Younger generations, who make up a larger portion of the renting population, often prefer the convenience of online rent collection and may be unfamiliar with checks. At the end of 2021, 41% of renters reported paid their rent with a money transfer via an ACH, digital wallet, or rent payments platform. Plus, online rent payments can help tenants in many other ways – including Rent Reporting, which is the process of reporting on-time rent payments to credit bureaus in order to build valuable credit history.

Don’t be intimidated by going digital. You’ll discover it will help you further streamline the rental process and reach a larger renter demographic. Here are some of the most popular ways to collect rent online:

#1: Direct Deposit Via ACH

Setting up a direct deposit between your tenant’s bank account and your own via ACH (bank transfer) can be a great option. This is usually a free service for both parties, requiring you and your tenant to work together to set it up. You can also use ACH through most property management platforms. If you have multiple bank accounts you’d like to set up, our Premium Plan might be right for you.

- Pros: Once set up, direct deposit via ACH is a seamless method. You won’t have to do any work to receive payments, and you can set automatic direct payments so rent is never late.

- TurboTenant rent payment benefits include automatic reminders, AutoPay, Late Fees, Rent Reporting, extensive records, notifications, and partial payments.

- Cons: Setting up a direct deposit via ACH requires participation from your tenant. Depending on your bank, the process can also take a few days before the money reaches your account.

#2: Venmo, Paypal, & Zelle

Applications like Venmo, Paypal, and Zelle all provide extremely convenient online payment methods. In 2023, these online services are some of the most popular ways to transfer money electronically, but this doesn’t mean they don’t come with their fair share of downsides, especially for business owners like landlords.

- Pros: These apps are easy to use, funds transfer quickly, and the process does not require bank visits or shared account information.

- Cons: Venmo charges a 1.9% business fee for every transaction. Zelle limits payments to $1,000 per day and $5,000 per month. There’s a potential for misdirected payments (your tenant could pay the wrong person), difficulty tracking payments, and since partial payments go through instantly, tenants could pay you as little as a dollar to halt an eviction for nonpayment.

#3: Credit & Debit Cards

Credit and debit cards are often requested payment methods by tenants. Using credit cards or debit cards is simple and can be done through a variety of services, but tenants are typically charged a processing fee when paying through a service. That’s because most credit card companies enforce it.

- Pros: Credit and debit cards are easy to use, extremely secure, and do not require bank visits or shared account information.

- Cons: Most credit and debit card services charge a 2% to 4% fee, and tenants can easily reverse/dispute charges 120 to 180 days down the road.

Traditional Rent Payment Methods

These tried-and-true rent collection methods are probably ones you’ve used before, or maybe are currently using for your rental properties – but they’re fading out fast. With the pandemiccame a need for contactless rent payment methods, which pushed landlords and tenants to leverage digital payment methods. According to a 2020 report by the National Landlord Association , online payments doubled from 17% in Q4 2019 to 33% in Q4 2020. Despite this trend, traditional rent payment options can be great for older renters or if you prefer not to use technology – but there are also disadvantages you should consider.

#1: Cash

One of the oldest methods of payment – cash is a secure payment method in the sense that cash can never bounce. If you are handed cash from a tenant, you know you can deposit it into your bank account with no problem. But if you are using cash, you need to keep detailed records for yourself.

- Pros: Cash can’t bounce, you know exactly what you’re getting, and it can be kept or deposited.

- Cons: With cash, you’ll usually have to physically pick it up, which is time consuming. It’s easy to lose, difficult to document, harder to keep track of payments, and can be easily disputed (the payment is $20 short, but the tenant swears they paid you in full).

#2: Personal Checks

One of the most widely used methods of payment, personal checks are even simpler than cash; a check isn’t bulky and can be put in the mail. Checks can be a good option for long-distance landlords.

- Pros: Checks are easy to collect without being physically present and can usually be deposited using your bank’s mobile app.

- Cons: Checks can bounce, which will cost you extra money and time. They can also be canceled by the tenants, and who hasn’t heard the “My check got lost in the mail.” line?

#3: Money Orders/Cashier’s Check

Money orders and cashier’s checks are considered safer than personal checks because you need to use verified funds to purchase them. However, although it’s harder, they can still be canceled before you deposit them.

- Pros: Money orders and cashier’s checks are simple to acquire, require verified funds, and are fairly secure.

- Cons: Money orders can be difficult because tenants have to get the money and mail it to you, and then you have to physically deposit them in a bank because bank apps don’t support money orders. Scamming is easier as tenants can get a money order and receipt, but never give the landlord the money order.

Other Rent Payment Factors to Consider

Even if your current method of collecting rent payments has worked well for you, sometimes it’s important to try new methods for a variety of reasons including the following:

- Tenant Age – Every generation communicates differently, and that means collecting rent will look different depending on the tenant’s age. For example, younger generations will prefer online rent payments while older generations are more comfortable using checks.

- Contactless Payments – As the world is constantly changing, contactless ways of doing business are becoming easier and normalized. Limiting contact ensures accessible payment methods for all demographics.

- The Digital Age – Living in the 21st century means constant developments in technology. It can be intimidating, but adapting to online tools for your business will make life as a landlord easier. TurboTenant offers many simple ways to automate your rent collection such as Autopay and automatic Late Fees.

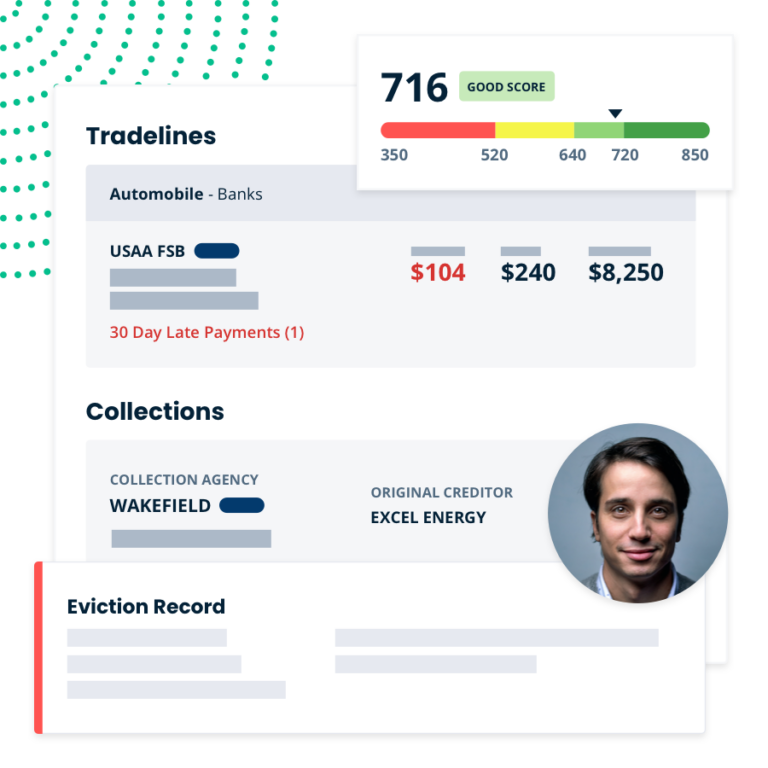

Overall, when deciding upon your rent payment method, focus on creating an easy system that tracks payments and late fees. If your current system is not working well, consider new options that provide a more efficient process. Remember, because rent payments are a property investor’s main income, starting with a solid way to screen tenants will help you know they have a good track record and credit score before ever moving them into your property.

Rent Payment FAQs

Can I collect rent through TurboTenant?

Through your TurboTenant account, landlords can collect rent online for free. It takes less than five minutes to set up in your account, easily keeps track of charges, includes reminders and automatic payments, and it’s secure. Renters have the option of paying through an ACH (bank transfer) or a credit/debit card with a fee.

Is collecting rent online safe for my tenants and me?

Collecting rent online whether it’s through TurboTenant, or other online money transfer services is very safe and convenient. We partner with leaders in the financial industry to transfer money and make sure your information is encrypted. Sensitive information for renters and landlords will not be shared with anyone else.

Is it free to collect rent online?

For landlords, most payment platforms do not charge the landlord to collect rent online.

What is the best method to collect rent?

When it comes to choosing the best way to collect rent payments from your tenants, there is no black and white answer. Ultimately, it comes down to the best process for you and your renters. Paper check payments are still a popular method among landlords, but online rent payment services are only becoming increasingly popular with the digital generations.