These days, it’s easier than ever for unscrupulous renters to fake important information on their rental applications. There are dozens of online companies that make creating fake pay stubs a breeze. Why fake a pay stub? If someone’s interested in your property but they don’t meet your income requirements, they can quickly print off a few fake pay stubs to forge a higher wage. These types of scams put you and your rental property at risk; if the potential tenant is actually less financially stable than they claim, they may be unable to pay monthly rent in the future, which could ultimately lead to a costly and time-consuming eviction.

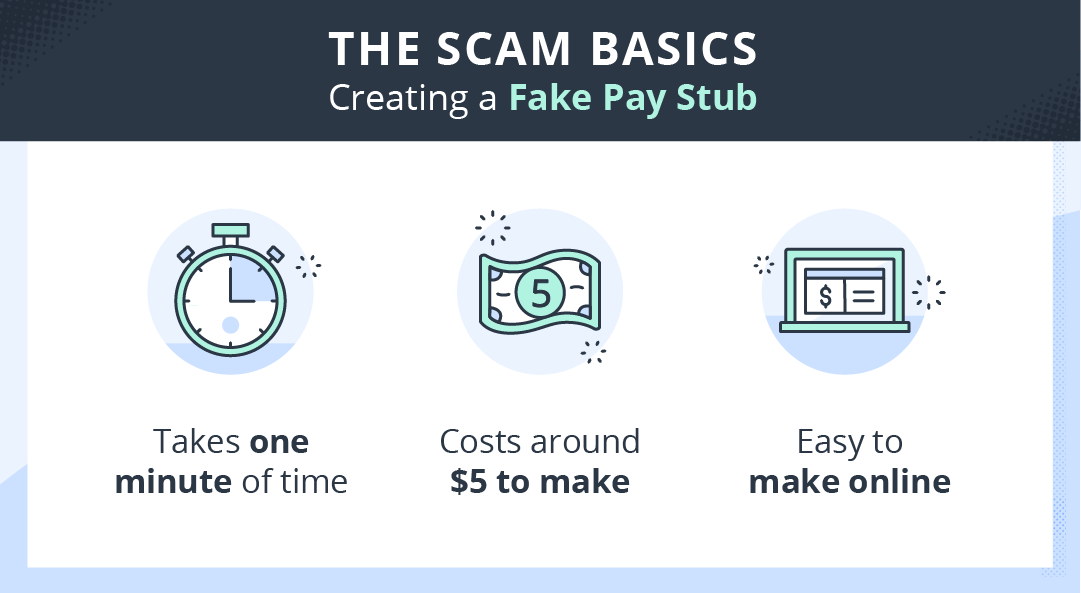

Unfortunately, creating a fake pay stub takes about one minute and costs around five dollars. These pay stubs look legitimate and are nearly indistinguishable from a real pay stub – but there are red flags all landlords and property managers should know.

We’ll give you all the details you need below to spot fake pay stubs, but here’s a round-up of the most important pay stub discrepancies:

Perfectly rounded numbers

Documentation that looks less-than professional

0s and Os used interchangeably

Inconsistent basic information across the document

Pro Tip:

Leverage TurboTenant's Premium membership to unlock Income Insights, a new way to verify your applicants' income and thwart would-be scammers.

How to Spot a Fake Pay Stub Like a Pro

To avoid this situation at all costs, below are our expert tips on how to spot fake pay stubs and employment verification.

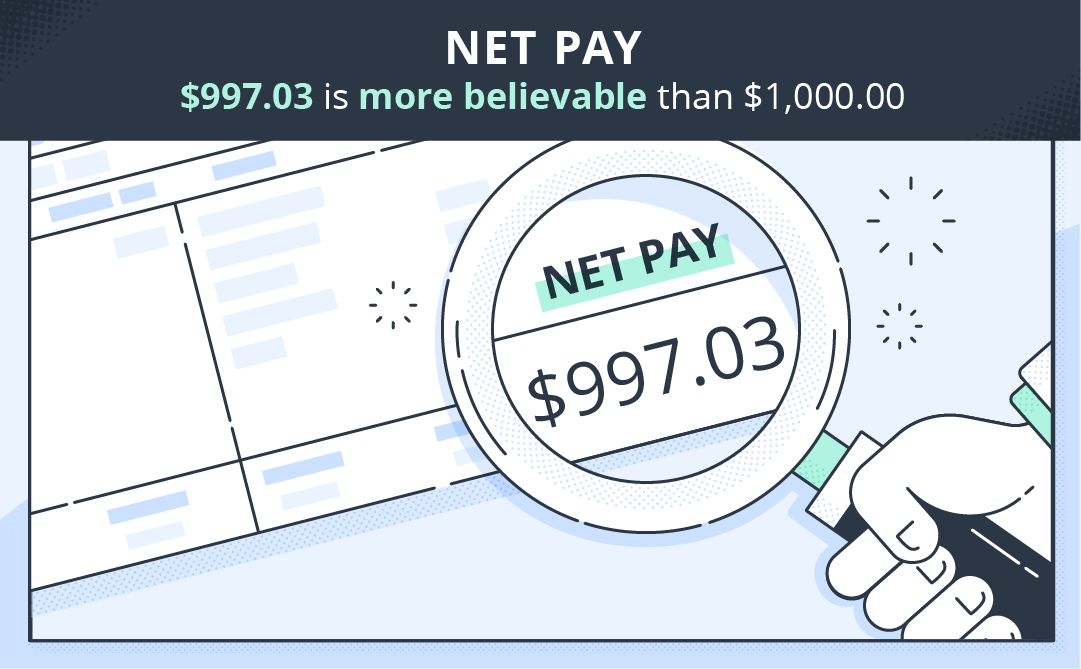

1. Is everything perfectly rounded?

When is the last time your paycheck came out to a perfectly rounded number with no extra dollars or cents? Chances are, probably never. One of the first things to check for when reviewing an applicant’s pay stub is to make sure that their monthly earnings are not perfectly rounded to the nearest hundred or thousand. If it is, this is a sure sign that the person filled out a fake pay stub template (and lazily, at that!) because paychecks are almost never a rounded number.

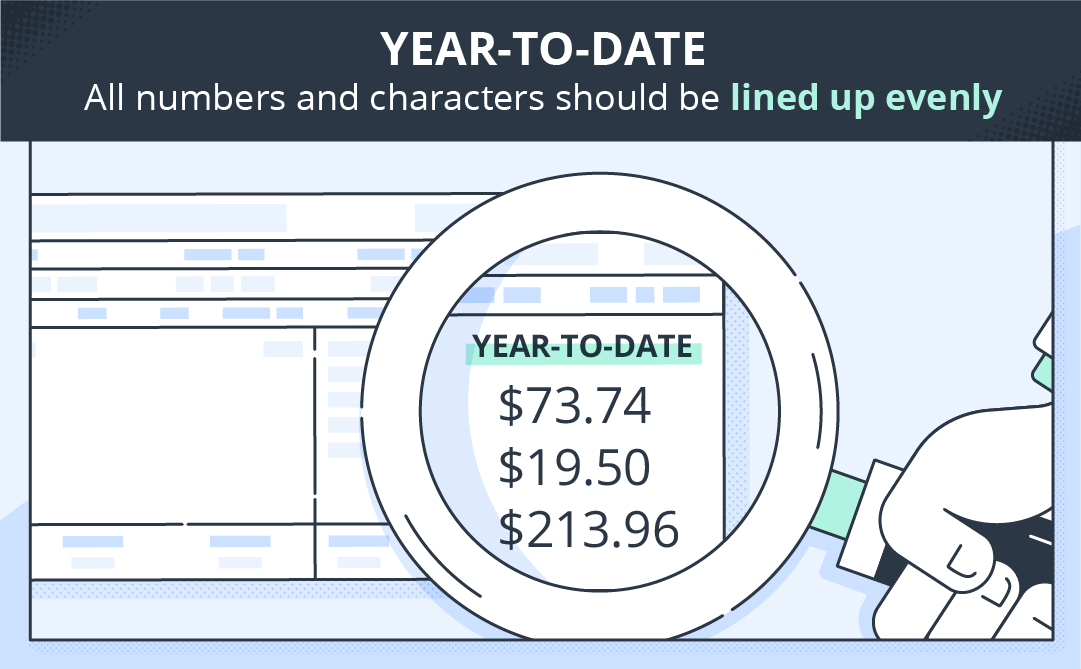

2. Does it look professional?

The people in charge of putting together pay stubs are typically accountants and HR staff. These people are not likely to make messy, confusing documents that are difficult to decipher. When reviewing your applicant’s pay stub, look over the small details. Everything should be clear and legible, not blurry, and all digits and characters should properly line up. Also, there should be no typos – that’s a telltale sign that something is amiss.

3. Is there a difference between 0's and O’s?

A very small but revealing detail to evaluate is whether or not there’s a difference between the capital letter “O” and the number “0”. Zeros should be slightly taller and oval-shaped, while capital O’s are typically much more rounded. Again, a professional accountant would never make this type of mistake, any check stubs with this error are highly suspicious.

4. Is the basic information consistent?

One of the easiest mistakes an applicant can make when submitting a fake stub is missing some personal detail sections. Pay stubs and other official documents usually have the person’s name, address, social security number, and other personal information listed in multiple places, so make sure there are no inconsistencies in these areas.

How to Spot a Fake W2 in Three Easy Steps

In addition to pay stubs, applicants will also sometimes submit other false documents as proof of income if they don’t meet certain rental application requirements. Here are our tips for how to spot a fake W2 form.

1. Dot Your I's and Cross Your T's

Run through the list above and check for the same issues. Does their W2 state they made an even $1,000,000 in gross income last year? Is it blurry with characters all over the place? Is their address listed as one thing on the pay stub but as something else on their W2? All of these inconsistencies should give you pause.

2. Do Your Due Diligence

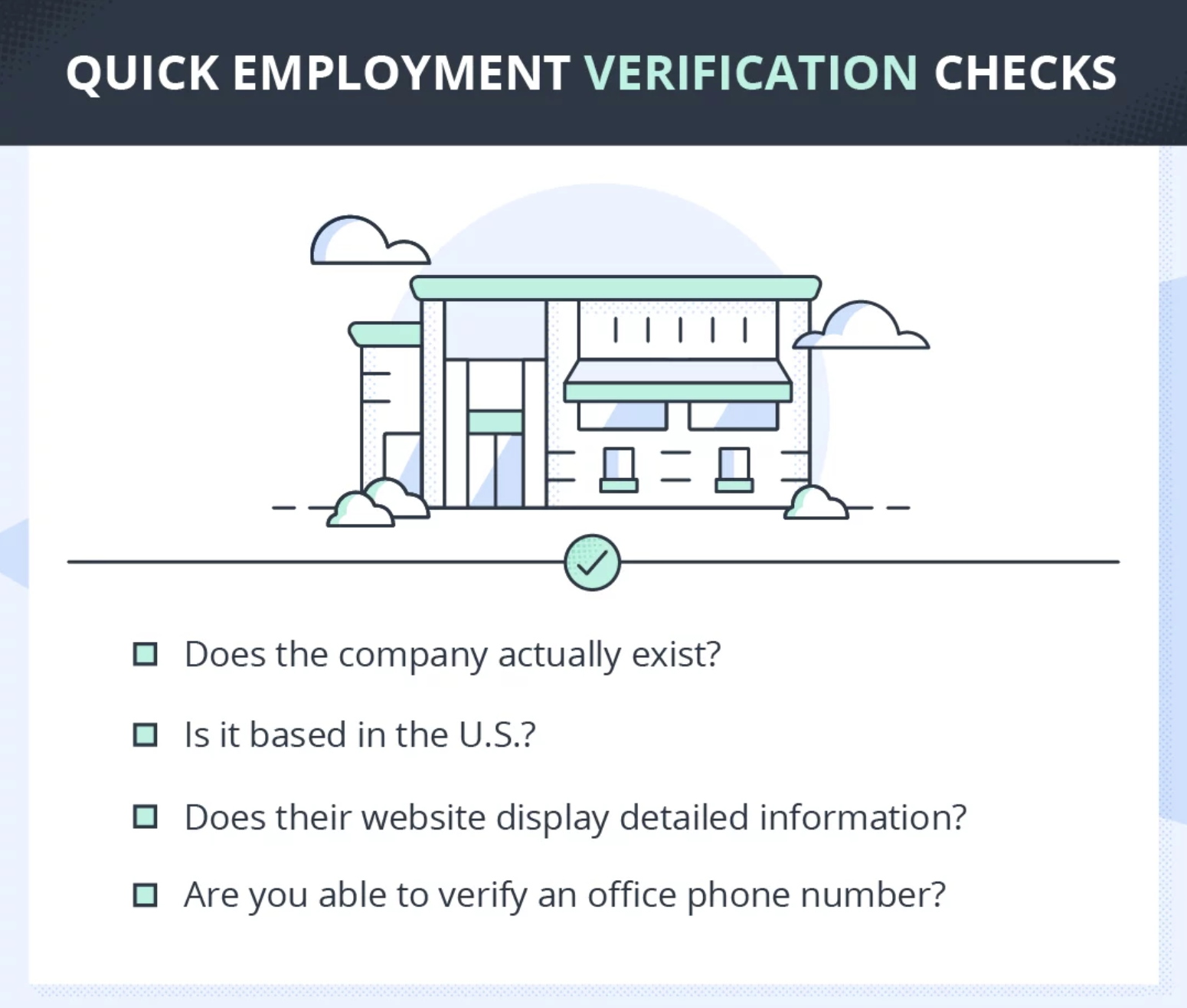

Another easy way to verify if the W2 your applicant submitted is legit is to make sure it comes from a real company. Research the company quickly; look up reviews along with their website and BBB ratings. If your search does indeed pull up a real company, do they seem genuine? Are they based in the U.S., or do you need to confirm that your applicant is a remote worker? Does their website seem credible, and display actual information about what the company does? If you can tick all these boxes, then the company checks out.

3. Verify Applicant’s Employment Status

The last thing you can do to verify a W2 is to call up the company they’ve listed. They should be able to confirm that the applicant works for them, along with their date of hire. When you ask for references during the application process, make sure to ask for a current employer reference. This step is crucial when screening tenants. If an applicant knows you have the ability to call their employer, they will be less likely to try committing pay stub or W2 fraud. If your applicant claims to be self-employed, request a previous employer as a reference.

Make sure you actually contact the references they provide. This can help you build a better character profile for the individual. Asking for an office number that you can verify through a quick Google search, rather than a cell phone number, is a good way to ensure you are not simply speaking to a scammer’s partner-in-crime.

Steps to Take If You've Received a Fake Pay Stub

Are you worried that you’ve received a fake pay stub or another false proof of income? It could happen to anyone, so it’s fair to be concerned. You may be wondering how to respond to the applicant, and how you respond is important. To avoid breaking any Fair Housing laws, always err on the side of caution and do not accuse the potential tenant of fraud.

Instead, follow these strategic steps:

-

Communicate to the renter that you are having trouble verifying their proof of income with the submitted documents.

-

Request additional income verification, such as two months of bank statements and the last two years of tax returns.

-

Set a date for when these documents are due, and hold to it.

While these steps may be an extra hassle for renters who are honest, they will most likely comply with your request if they really want to rent your place. If they’re dishonest, however, they’ll realize the jig is up and move on to the next susceptible landlord.

In the case that you believe a fake pay stub has slipped past you and you’ve already accepted the applicant as your tenant, you still have options available. Prior to addressing the issue with the tenant, we highly recommend seeking legal counsel and gathering documentation to prove your case. This situation will most likely lead to an eviction, so it’s best to be prepared.

In addition to running through the provided lists during the rental application process, you should also use a thorough tenant screening process, and inform all your applicants of it from the beginning. This means running a credit check, background check, and eviction check to get a holistic understanding of your applicant. With many tenant screening services available, it’s easy to ensure your potential tenants meet your rental criteria!