Finding a great tenant is the number one priority for most landlords. Tenant screening is an integral part of that process; learning how to read a tenant screening report arms you with the knowledge to find a great renter. To kick off the process, you’ll need to set your tenant screening criteria.

Once you’ve decided how to qualify applicants, reading their tenant screening reports will be much easier.

Before we dive into how to read this crucial document, let’s define the phrase “tenant screening report.”

What is a Tenant Screening Report?

A tenant screening report uses an applicant’s social security number to pull their credit history, criminal history, bankruptcies, and eviction history (as permitted by state law). This thorough tenant background check also relays the applicant’s employment history, which helps landlords spot potential red flags as part of the screening process.

TurboTenant’s tenant screening reports give you a brief overview of the applicant as well as the option to read sections that dive into more detailed information about your prospective tenant, including their full credit check from TransUnion, one of the three credit bureaus.

How to Read a Tenant Screening Report

Below is our step-by-step guide to reading and understanding your tenant screening report.

1. Understand Key Terms

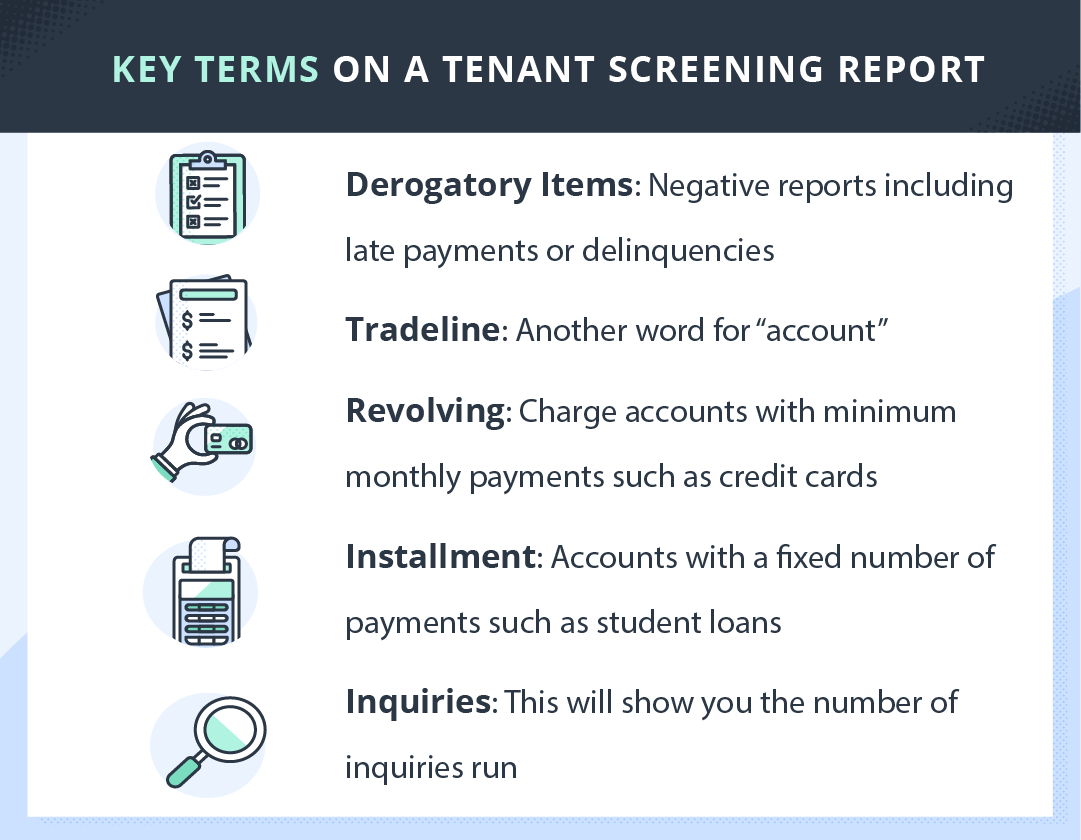

To understand your applicant’s tenant screening report, you need to know some specific vocabulary – specifically:

- Derogatory Items: Negative reports including late payments or delinquencies

- Tradeline: Another word for “account”

- Revolving: Charge accounts with minimum monthly payments, such as credit cards

- Installment: Accounts with a fixed number of payments, such as student loans

- Inquiries: The number of credit checks the applicant has had run

2. Review the Snapshot

Now that you can talk the talk, it’s time to start walking. Let’s get familiar with the tenant screening report snapshot.

The snapshot is a quick overview of the applicant. It provides you with valuable information such as:

- The potential tenant’s credit score

- Their number of criminal records

- Evictions on record

- Employment verification,

- Accounts in collection

- Public records

This section will be valuable for landlords who are seeking applicants with a specific credit score. Depending on how high or low the credit score is, the numbers will show up in red, orange, yellow, or green.

Please note that the number of employers reported may not be 100% accurate due to the lag in employment reporting to credit agencies.

As a landlord, you need to verify current employment and check references on your own. The applicant also reports their own income, which means you need to verify their income to guarantee accuracy independently. The credit report will not pull their actual income. Be sure you follow up with employment references and confirm their income on your own. Fake paystubs can also be created, so make sure you verify their authenticity. As a landlord, if you decide to deny an applicant based on information in their credit report you’ll need to follow the Fair Credit Reporting Act rules as it relates to notifying them.

3. Review Score Factors & Criminal Records

This section gives you information about the applicant’s criminal background check, including any criminal or court records on record. If the applicant does not have a criminal background, this part will read “no available data.”

You’ll also find the case number as well as the court information for each record found. You can use this information to contact the court to learn more about the criminal records, or, when applicable, you can look up the description number to find out what specific charges are on the applicant’s record.

4. Review Tradelines, Collections, & Public Records

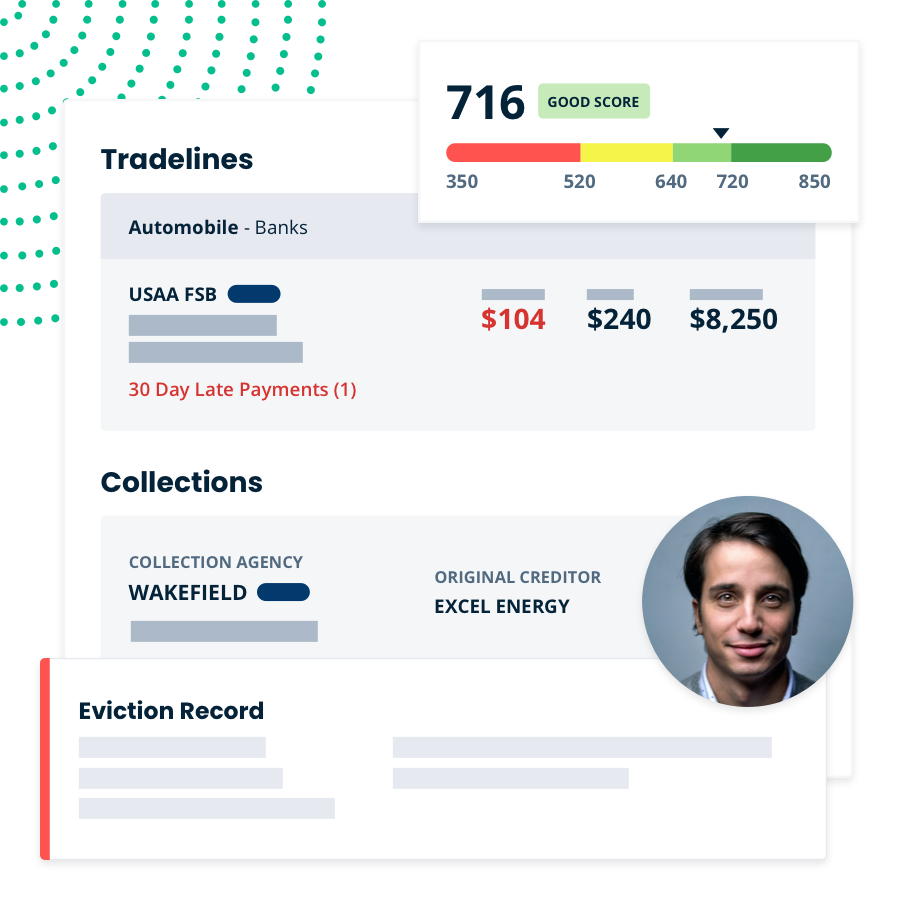

This section is where the terminology guide becomes extremely helpful. The tradelines are accounts that the applicant has opened such as car loans, credit cards, or mortgages. The collections number reflects how many accounts they currently have in collections. The public records number includes tax liens and civil judgments (with further details provided later in the report). Negative tradelines are accounts that have missed payments. The historical numbers reflect how often the applicant’s accounts have missed payments.

The section under this provides details about each type of account, whether it is something with an installment payment plan, revolving (such as credit cards), or a mortgage. This section also informs you of how much is owed and how much is past due. You can also see the total balance owed on all accounts, the total past due amount owed, and the credit limit the applicant has left. In this case, this report shows a credit limit of $475, which is extremely low. The total past due here is $10,067, which would alert you that this applicant is in financial trouble.

5. Review Accounts, Balances, & Past Dues

Here you’ll learn more details about the trade lines, or accounts, mentioned above. This area will often include information about what company is holding the account, what type of loan it is, and what amounts are still due on each account. You are also able to see how much is past due on each account and by how long. This information can help you better understand what bills your applicant will have outside of your rental cost, which is why income verification is very important.

Someone may have multiple trade lines with large monthly payments, but if they have the income to back this up, it isn’t necessarily a bad thing. However, if they have multiple accounts that are past due, you may be concerned about their ability to pay rent on time.

6. Review Calendar Of Payments

The next section of the screening report show you a calendar of payments, which acts as the applicant’s payment history. Green checkmarks signify when payments were made on time. Yellow, orange, and red numbers highlight the number of days payment has been late. This section will help you see how often they struggle with non-payment.

7. Review Collection Totals

This section provides information for applicants who have had accounts sent to collections. If they do not have anything in collections, this section will remain blank. In our example, you can see how many accounts are in collections, the details of how much is owed, and the credit grantor’s name.

8. Review Public Records

The next section will show you what public records are on file for the applicant. These include tax liens and civil judgments. This section will also give you details about the records and the dates they were reported.

9. Review Eviction Records

Landlords can request eviction reports along with the rest of the tenant screening. This section provides detailed information about any evictions on record. This is valuable information for landlords, as a history of evictions can be a significant red flag for applicants.

Screen Your Tenants Thoroughly

As a landlord, your goal is to find a responsible tenant who pays on time and treats your property with respect. Our goal at TurboTenant is to help you do that. Our tenant screening reports act as thorough background reports to help you effectively learn important details about an applicant.

Remember, always abide by Fair Housing regulations throughout the application process and ensure you use standard criteria for all applicants when determining who you will accept or reject. Also, be aware, if you deny an applicant based on information in their credit report, you’ll need to follow the Fair Credit Reporting Act rules as it relates to notifying the applicant. If you are uncertain about how to best handle the rejection and acceptance portion of the screening, consult with a local attorney for advice.

Tenant Screening Report FAQ

What is a tenant screening report?

A tenant screening report provides detailed information about a rental applicant’s criminal, credit, and eviction history. Tenant screening is important for landlords to find the right tenant while also protecting their rental investment. TurboTenant’s screening reports are completed through TransUnion, a top consumer credit reporting agency.

Is a tenant screening report free?

Typically, renters will pay for the application fee which means landlords do not have to pay for TurboTenant screening reports. The rental application fee is \$55.

What additional tenant screening information should I collect?

To be sure an applicant is suitable for your rental property, there is other information you should collect to get a well-rounded assessment of a tenant. Landlords could look at an applicant’s social media, ask for references for past landlords, and conduct in-person video interviews to get to know them better. You can also collect pay stubs to ensure a potential tenant can afford your property.

How do I pick the best tenant?

Finding the best tenant can feel like a daunting task, but going into your search with set terms can help simplify the process. Be sure to establish financial criteria like a credit score range that you’ll accept, along with setting background and eviction history criteria. After these qualities can be checked off the list, use our tips to get to know an applicant better personally to see if they would be a good fit. For more details on how to find a perfect tenant, read our full step-by-step guide.

DISCLAIMER: TurboTenant Inc. does not provide legal advice. This material has been prepared for informational purposes only. All users are advised to check all applicable local, state and federal laws and consult legal counsel should questions arise.

This blog was updated July 2023