A security deposit is money the renter pays to cover any potential lease violations during their tenancy, such as damage to the apartment, unpaid rent, or breaking the lease. It’s not unusual to hear a new tenant asking, “What’s a security deposit?” as they sign their lease.

Some landlords may not require a security deposit if they feel they’ve done a thorough job screening their tenants. However, ensuring you and your tenant have a clear understanding of the term is essential to avoid any potential issues down the road. It’ll help keep your tenant happy after they’ve moved out, making them more likely to recommend your property to someone in need of a rental.

Protect yourself from security deposit disputes

With TurboTenant’s online condition reports, you can customize your report and send it to tenants for signatures. Then, store it in your account for re-use and easy reference.

What Is a Security Deposit for Renters?

The security deposit is one of the fees a renter pays when signing their lease. Generally, most landlords require the following fees to be paid when signing the lease: the security deposit, first and last month’s rent, and, if they have a pet, a separate pet deposit.

Don’t confuse the security deposit with the apartment deposit to reserve the apartment before the move-in date. You can have the apartment deposit transition into a security deposit once the tenant has moved in, but generally they are different.

Most landlords choose to make the security deposit refundable, provided the tenant doesn’t cause any damages. Money is a powerful motivator, so tenants are more likely to abide by the lease agreement to get back the full amount, protecting your property.

Some landlords, though, may opt to have the security deposit also serve as the last month’s rent, in which case it would not be refundable at the end of the lease. While this lowers the amount of savings the potential renter needs to bring to the table, it does leave you on the line for repairs that may be needed when they move out.

The terms of the security deposit should be carefully documented in the lease, and it’s worth going over verbally when your tenant signs their lease, just to make sure everyone is on the same page.

Learn everything you need to know about security deposits in this free webinar:

How Much Is a Security Deposit?

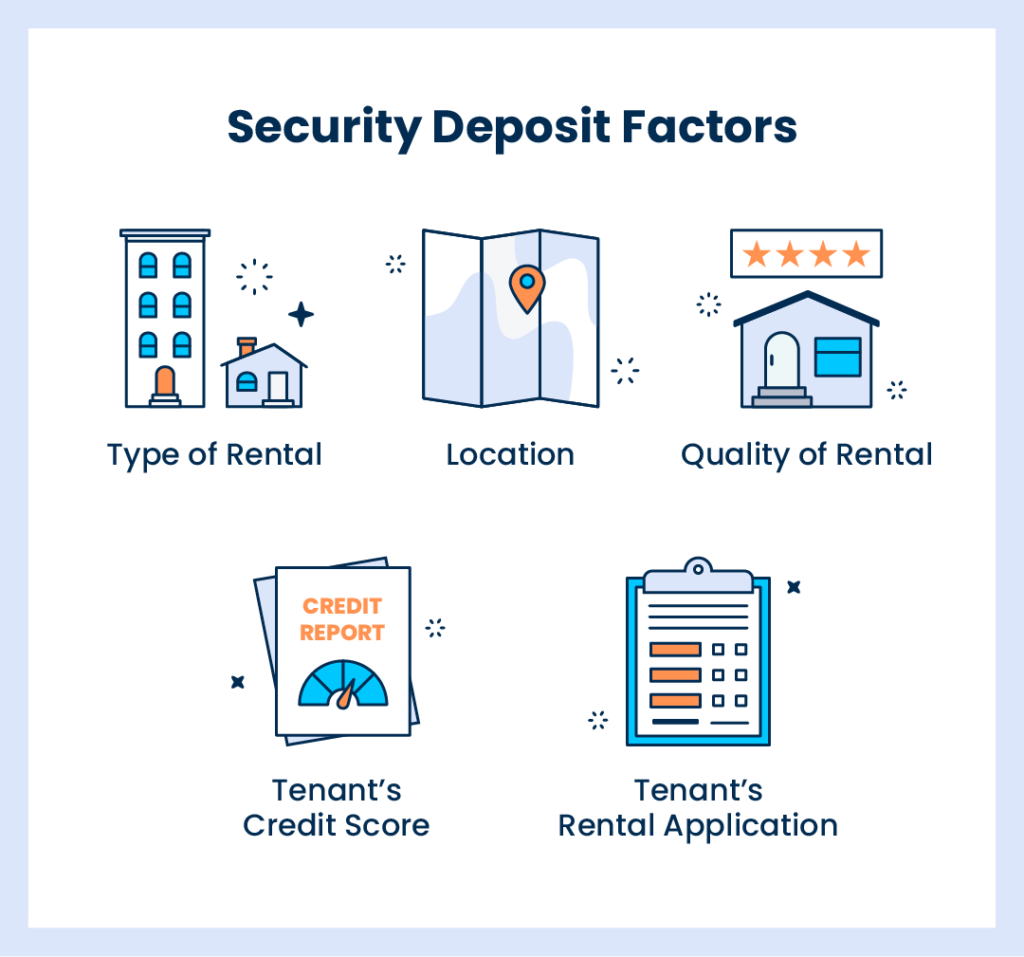

Unfortunately, there’s no easy answer to this question. The amount you set for your tenant depends on several factors.

1. Your Location

Before setting your tenant’s security deposit amount, you need to consider your state’s laws governing how much you are allowed to charge.

Some states, like California, require security deposits to cover two months’ rent for an unfurnished apartment, and three months’ rent for a furnished one. Other states, like Florida, have no limit on what you can charge.

Once you know if your state has set security deposit parameters, you can take other factors into account.

2. Your Tenant’s Credit Score

Because a person’s credit reflects how responsibly they behave when it comes to money, it is reasonable to assume it also reflects their level of responsibility in other areas of their life.

Since you want a tenant who is responsible, and therefore someone who will take care of your rental, someone with a lower or no credit score may trigger a red flag for you. If that’s the case, and your state allows it, you can charge someone with a lower credit score a higher security deposit.

3. Your Tenant’s Rental Application

If your tenant’s rental application includes a spotty employment history or a criminal record, it’s reasonable to conclude there is more of a risk in renting to them. For that reason, you can elect to raise the security deposit to reflect the higher risk.

4. Type and Quality of Your Rental

If your state allows you to set your own security deposit amount, you can charge more if the unit is new. The same is true if it is a larger unit.

5. What Your Competition Is Charging

Finally, you can explore what your local competition is doing so you can price your security deposit competitively. Savvy renters will be looking for not only the best deal on rent but also the lowest fees, especially if they don’t have a lot of cash on hand.

When Do Tenants Pay the Security Deposit?

Most landlords prefer to collect the security deposit when the tenant signs the lease paperwork. At that time, you are already collecting other payments and fees so it naturally makes sense.

Other landlords prefer to collect it as part of the lease deposit to hold the apartment, while some states require you to collect it in stages over the first few months of a lease’s term. For example, if you charge a security deposit equivalent to two months’ rent, the tenant would pay it in two installments over the first two months of the lease in addition to their regular rent. Visit Nolo for state-specific security deposit laws.

Regardless of when you collect it, make sure that you are collecting the security deposit as a separate check or payment since you’ll need to deposit it in a separate account from the rest of your business transactions.

To protect yourself from any security deposit disputes, make sure you’re keeping record of the state of your property with a condition report. The easiest way to do this is to build a report tailored to your rental, take pictures for each room, and then store the report in a secure place that’s easy to reference (P.S. you can do that all with TurboTenant – sign up today).

What Do I Do With a Security Deposit?

While tenants can still pay their security deposit with a check when they sign the lease, they can also pay them online just as they pay rent. However they choose to pay, once your tenant has paid their security deposit, it’s your responsibility to protect it until they move out, at which point you inspect the property, deduct for any damages or missed rent, and then return it to the tenant. (More about that here.)

Check your state’s laws carefully about what type of account to use; several states require landlords to deposit security deposits in an interest-bearing account. If that’s the case, the tenant is owed the interest once the deposit is returned when the lease expires. You may also be required to share a deposit receipt or interest statements with the tenant.

Once it’s deposited, don’t touch the balance until the tenant moves out.

What Is a Security Deposit Used For?

A security deposit is a good thing because it protects your rental property and your bottom line if your tenant damages the rental or skips out on rent at the end of their lease. It also benefits future tenants, because you can repair damages without raising rent for future tenants to pay for the costs.

Once your tenant has vacated the apartment, then you can determine what (if any) deductions you need to make from the security deposit.

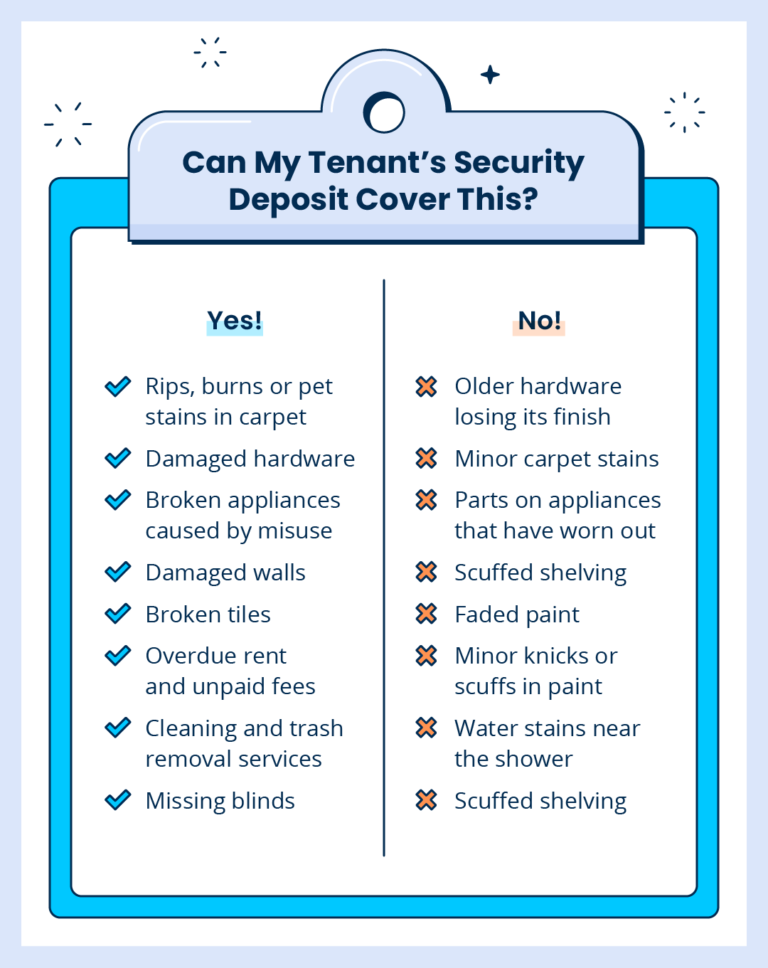

What Does a Security Deposit Cover?

In general, a security deposit covers any damage caused by the tenant, their pet(s), their guests, or their subletters (if permitted in your lease).

- You can deduct the cost of repairs for damage beyond normal wear and tear. Normal wear and tear is considered any damage that occurs during ordinary use. For example, the standard apartment carpet is expected to last about five years, so if it’s looking worn within that time frame, it’s normal wear and tear. In that case, you can’t deduct the cost of new carpet from the tenant’s security deposit. On the other hand, a large red wine stain from a party is not normal, so in that instance you could deduct the cost of replacing the carpet.

- You can deduct any overdue rent or unpaid fees. If your tenant is evicted for nonpayment of rent or just skips out on the rent at the end of their lease, you can keep the security deposit in lieu of that rent. This is why most landlords choose to set their security deposit amount in relation to monthly rent. If the tenant moves out without paying fees, such as a lost key fee or a parking pass fee, you can also deduct that from their security deposit before returning it.

- You can deduct the cost of a cleaning if your tenant left the apartment a mess when they moved out. While you should expect to do some light cleaning before the next tenant moves in, the rental shouldn’t require any deep cleaning. If you need to call in professionals, or if the tenant left a bunch of items in the apartment for you to dispose of, you can deduct that cost from their security deposit.

What Doesn’t a Security Deposit Cover?

Security deposits don’t cover everything, which is why you may want to require your tenants to have rental insurance as part of their lease requirements and why you should consider landlord’s insurance (which is usually required if you are paying a mortgage on the rental property).

- You can’t deduct the cost of repairs due to a natural disaster from a security deposit. If an apartment floods during an excessive rainstorm, you are responsible for paying for cleanup and repairs because the tenant didn’t cause the flood. In most cases, your insurance will cover this. If, however, their washing machine floods the apartment below them, their renter’s insurance should cover that. If they don’t have renter’s insurance, then you could deduct it from their security deposit.

- You can’t deduct the cost of repairs due to damage done during a break-in. A tenant’s renter’s insurance should cover the replacement of lost items, but you are responsible for repairing the broken window the thieves used to enter the apartment. In most cases, your insurance should cover this.

- You can’t deduct the cost of repairs due to a fire started in another apartment. If a unit is damaged in a fire, where it starts is key. You can only use a tenant’s security deposit if they are directly responsible for the damage. If the fire starts in the tenant’s apartment, their renter’s insurance should cover the cost of repairs; if they don’t have renter’s insurance, then you can deduct the cost of repairs from their security deposit. Otherwise, the repairs should be covered by your insurance policy.

When Is the Deadline to Return a Security Deposit?

Once the tenant vacates the rental, you have anywhere from 14 to 60 days to make any deductions and return the security deposit to the tenant. Check your state’s laws to determine your specific deadline.

Once you have assessed the apartment for damages, made repairs, and tallied any unpaid rent or fees, you must notify the tenant in writing of any deductions you make to their security deposit. Some states may also require you to provide receipts for any repairs that are made so the tenant knows you are making the deductions accurately.

If you are returning the security deposit in full or in part, it is generally returned via mail in the form of a check. Make sure you get the tenant’s new address when they move out to prevent any delays in delivery!

What If the Tenant Disagrees With Damage Charges?

Sometimes a former tenant may dispute a damage charge or seek to have their deposit returned in full. In this case, records are your friends. Provide receipts for the repairs to show your deductions were fair. If they argue that the damage was done before they moved in, refer back to rental inspection checklists from their tenancy.

In some cases, the tenant may ask to negotiate in order to get back their security deposit, either by making the repairs themselves (such as filling in holes from hanging pictures or repainting the apartment). Whether you are open to this type of negotiation is up to you.

If the situation is not resolved, the tenant may send you a formal demand letter before filing a lawsuit in small claims court, at which point it’s a good idea to consult a lawyer.

When you have a TurboTenant condition report, you can better protect yourself from these types of situations by having a record of the property’s state prior to the tenant’s move-in.

Are There Alternatives to a Security Deposit?

Recognizing that some people would be excellent tenants but can’t muster together all the upfront fees associated with renting, some landlords are exploring other options to reduce the upfront costs. Here are a few alternatives to try in lieu of requiring a security deposit.

Lease Insurance

Lease insurance covers the cost of typical security deposits for a small fee paid monthly by the tenant. Any costs associated with damage caused by the tenant would then be paid to you by the insurance company.

This helps bring new tenants to you without you taking on any additional financial risk. It also eliminates the need for you to manage multiple security deposit accounts for each unit you manage.

Surety Bond

A surety bond is an agreement between the tenant, you and a third party. The third party guarantees the tenant will uphold all their financial obligations to you without paying the deposits upfront.

If the apartment is damaged by the renter, the third party will pay the associated fees, and they will collect the money from the tenant themselves, saving you the hassle.

Pay-Per-Damage

You can opt to just send the tenant a bill (up to the established security deposit amount in your state) for any damages instead of collecting the money upfront. A third party is involved to protect the tenant. While helpful to the tenant, it can be difficult for you to recoup losses, especially if they owe rent or unpaid fees.

There’s a lot to consider when setting a security deposit for a tenant — or even whether to charge one. Start by carefully considering your state’s laws governing security deposits. Regardless of what you decide, ensure your security deposit policy is clearly stated in the lease to avoid any potential issues after the tenant moves out.